Join Our Telegram channel to stay up to date on breaking news coverage

XRP, the token issued by the American blockchain startup building cross-border money transfer network and systems, Ripple is trading 1.1% down on Monday. However, the sixth-largest crypto worth $24 billion in market share has sustained gains of roughly 8.4% in the last seven days.

Exchanging hands at $0.4616, $830 million worth of XRP tokens has been traded over the previous 24 hours. As discussed last week, the bullish outlook in XRP follows the latest development in the Ripple Vs SEC case.

In December 2020, the United States Securities and Exchange Commission (SEC) filed a case against Ripple and its top executives, alleging that the company’s sale of XRP constituted an unregistered securities offering.

More than two years later, the case is still dragging on but the scales appear to be tipping in favor of Ripple, with the help of the Hinman documents, which the judge ruled that they remain open and not sealed as the SEC had requested.

According to Judge Torres, the documents regarding the speech which William Hinman, a former SEC director gave in 2018 were relevant in the judicial process.

“Putting aside the fundraising that accompanied the creation of Ether, based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions,” Hinman stated.

The speech was significant because it suggested that cryptocurrencies could transition from securities to commodities. This could affect Ripple’s fair notice defense, and a summary judgment ruling could be issued soon. The outcome would have a significant impact on the future of cryptocurrency regulations.

XRP Did Not Outrightly Meet the Definition of a Security – SEC’s Internal Emails Suggest

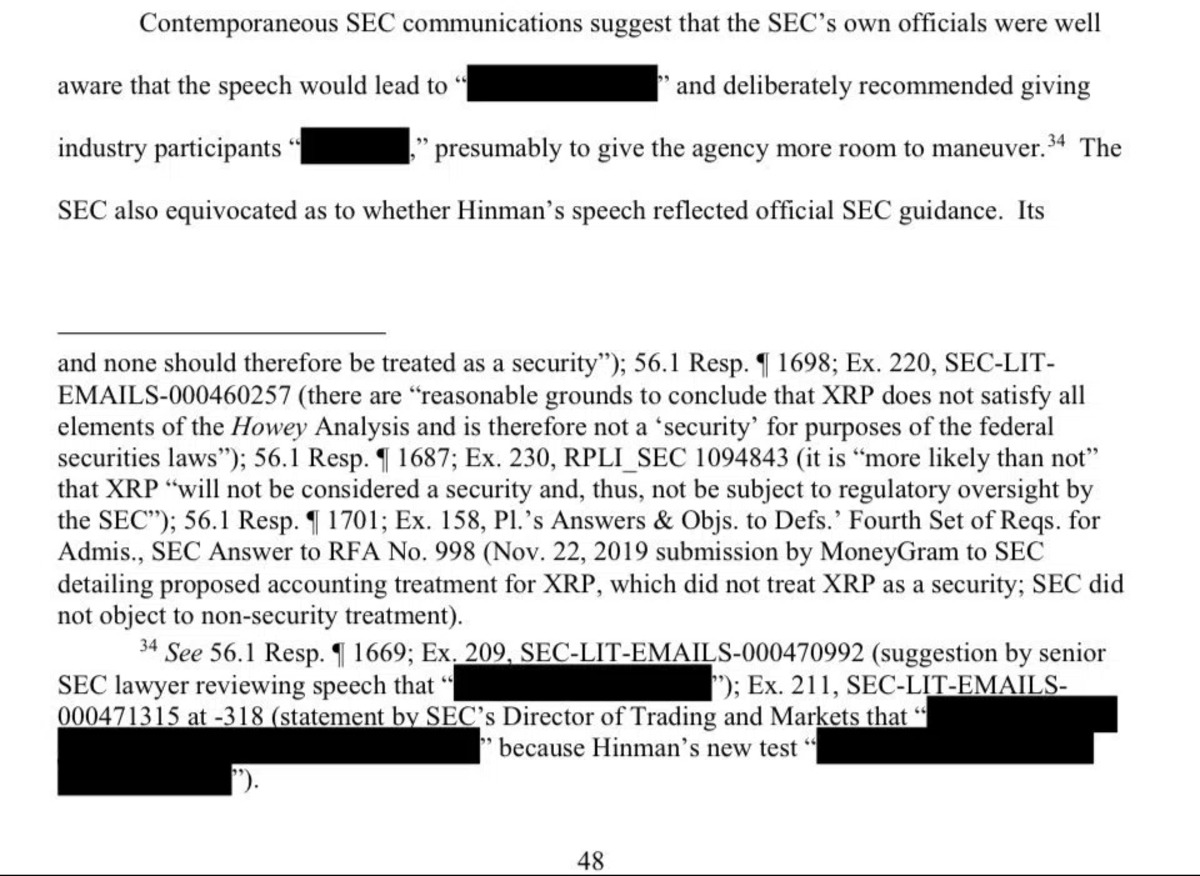

According to emails highlighted by John Deaton, a crypto lawyer known for demystifying the ongoing lawsuit and shared by BeIncrypto XRP had not met the standard definition of security, although the agency still went ahead with the lawsuit.

Deaton could not comprehend why Ripple’s legal representatives did not bring out the implication of the emails, or their relevance to the case from the beginning.

According to the emails referred to in exhibit 220, XRP did not completely pass the Howey test to be considered a security.

There are “reasonable grounds to conclude that XRP does not satisfy all elements of the Howey Analysis and is therefore not a ‘security’ for purposes of the federal securities laws,” the email reads in part.

An admission such as this from the SEC would dig a big hole in the lawsuit which seeks to classify a lot of the crypto tokens as securities, as long as they pass the Howey test.

Deaton, however, argues that Ripple lawyers might have chosen not to dwell on the emails because they were not direct quotes of the agency’s officials and as such could be an external analysis of XRP.

Another crypto-friendly lawyer, Bill Morgan said that it was “most likely a SEC attorney, given how many were involved and commented on Hinman’s speech expressing his personal opinion.”

It is worth mentioning that since the Hinman documents are yet to be released, all these remain speculations, which would soon be cleared.

XRP Price Still On The Move

XRP price appears to have doubled down on confluence support provided by the 50-day Exponential Moving Average (EMA) and 23.6% Fibonacci retracement around $0.4535.

Bulls have managed to keep the breakout from the falling wedge pattern discussed last week intact, allowing investors time to make up their minds ahead of the final ruling in the Ripple vs SEC case possibly in June.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator reinforced the bullish outlook. Traders looking forward to activating their buy orders would be watching out for the momentum indicator’s likely move into the positive region above the mean line at 0.00 in the coming sessions.

On the upside, despite the support at $0.4535, bulls are required to push XRP to the upside by first weakening the immediate seller congestion at $0.47. A break and hold above this level imply that buyers have the upper hand and the cross-border money remittance token has the momentum to close the gap to $0.5.

On the other side of the fence, not holding onto support at $0.4535 could be detrimental to XRP’s position in the market, with a trend reversal likely to take place in favor of declines to $0.43 and $0.4, respectively. If push comes to shove, XRP could retest support at $0.36 before rebounding after collecting enough liquidity for gains targeting $1.

XRP Alternative To Buy – yPredict

Investors have been rushing to get a piece of YPRED, the token powering the newest innovative AI market intelligence ecosystem, yPredict.

Participants in the crypto market do not need a reminder of why price prediction is an uphill battle that often leads to more losses than gains even for the most experienced traders.

However, this is about to change with the introduction of yPredict’s AI-enabled crypto price prediction dashboard.

The platform’s AI models have been trained to analyze huge amounts of price data which helps with identifying trends that would have otherwise gone unnoticed even to an experienced human eye.

🎉Announcing Our 2nd AI Ambassador: Tuffy! 🎉#yPredict takes immense pride in introducing @meastuffy as our second distinguished AI Ambassador! 🏆

Tuffy's unmatched passion and unwavering dedication to promoting #YPRED have earned him exceptional privileges, including admin… pic.twitter.com/YEMiXAemtb

— yPredict.ai (@yPredict_ai) May 18, 2023

Investors are particularly interested in this new ecosystem; whose platform is currently in development for real-time trading signals.

Using state-of-art predictive models and data insights built by top 1% AI developers and quants, yPredict’s in-development platform plans to hand market participants an “unbeatable edge.”

In addition to this the team is “building a cutting-edge crypto research and trading platform that provides traders and investors access to dozens of AI-powered signals, breakouts, pattern recognition, and social/news sentiment features” the team behind the project said in their Litepaper.

With $1.45 million raised within a few weeks of the presale’s debut, potential investors must hurry to catch YPRED tokens in stage five, selling for $0.07. Investors must move quickly as stage six is around the corner with YPRED tokens expected to go for $0.09.

Recommended Articles:

- Best Crypto Winter Tokens to Invest In for High Gains

- As U.S. Budget Talks Resume, Biden Slams Rich Crypto Traders

- HuobiGlobal Ordered to Cease Operations by Malaysian Regulators

- Cardano Price Analysis: ADA Struggles With Recovery As Losses To $0.33 Linger

Join Our Telegram channel to stay up to date on breaking news coverage