Join Our Telegram channel to stay up to date on breaking news coverage

Meng Chan Shu, the head of business development at the RAK Digital Assets Oasis (RAK DAO), encouraged the crypto community to continue building despite the challenges hindering the adoption of world token.

Shu was among the World Token Summit’s panel on tokenization economics convened to ponder on issues mitigating its adoption.

Participants at the World Token Summit 2023, held in Dubai on Wednesday, July 21, discussed how to facilitate the mainstream adoption of tokenization through tracking and forensics analysis.

Benefits of Assets Tokenization

Meng Chan Shu and Ellis Wang, a member of the executive and Advisory team at The Private Office of Sheikh Saeed bin Ahmed Al Maktoum, and the Cardano Foundation’s global head of partnerships, Jeremy Firster, were part of the panel.

The panel discussed tokenization-related topics, including the benefits of asset tokenization and the roadblocks companies meet in the landscape. Speaking at the event, Firster noted that tokenization helps in utility creation.

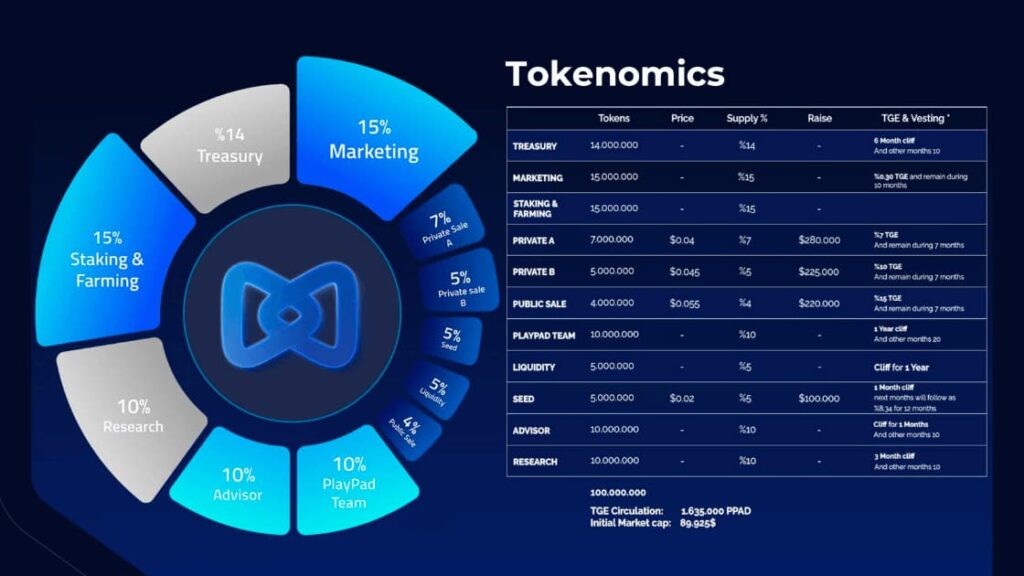

According to the Cardano executive, tokenization adds value by simplifying access to funds, funds distributions, and fragmentation of assets. He explained that tokenomics represents the ability to capture an asset’s digital identity, ownership, value, and history.

Wang also weighed in on the benefits of asset tokenization. Having worked in the banking sector, Wang highlighted the benefits of tokenizing real-world assets.

He mentioned transparency and security, inherent features of blockchain technology, as the main advantages of tokenization.

According to Wang, storing records within a blockchain and tokenizing real-world assets unlocks various advantages, including Smart Contracts-enabled flexibility.

Challenges of Tokenization And Their Solutions

In addition to the benefits, Wang acknowledged the challenges organizations face in navigating the tides of tokenomics. According to the executive, it is hard to keep up with the latest developments due to too many emerging technologies.

For instance, implementing security measures, such as Know Your Customer (KYC) and Know Your Transaction, which checks illicit fund movements, adds to the challenges most firms have to deal with.

However, Wang believes tokenization presents tremendous opportunities for many industries despite the highlighted challenges.

Adding to the highlighted points, Firster said Forensic analysis could scale tokenomics adoption by addressing the challenges Wang pointed out. He noted that the tokenization landscape has reached where address tracking to large entities is possible.

“It is about the rules of how many previous transactions they need to look into to ensure that these funds are clean and clear for use within a trade finance model,” Firster added.

The executive said the question is what information needs to be embedded into tokenized assets to facilitate compliance with KYC and Know Your Transaction rules.

Citing examples, the panelist highlighted real estate tokenization, noting that there must be a way to determine on-chain if an asset share a genuine connection with another outside the blockchain.

Firster emphasized the need for an embedded identity solution for challenges associated with digital signatures. The embedded identity solution can also address KYC issues, he noted.

RAK DAO’s Shu concurred with the other panelists’ opinions, urging the community to focus on what purposes tokens serve. He encouraged the community to continue building despite the challenges sprouting as the world moves towards tokenization.

Join Our Telegram channel to stay up to date on breaking news coverage