Join Our Telegram channel to stay up to date on breaking news coverage

Ripple is enjoying a new victory in its legal tussle against the United States Securities and Exchange Commission (SEC). It happened that Judge Analisa Torres denied a motion filed by the regulator in December 2022, to seal the Hinman documents.

Hinman Speech docs will not be sealed; p.5. Judge makes clear they should be open regardless of their impact in a decision. States it neither stifles SEC deliberation nor is the SEC's "prophylactic" concern it could be priveleged in the future convince.https://t.co/tCS5cpgsQO pic.twitter.com/73YXhZszNY

— WrathofKahneman (@WKahneman) May 16, 2023

Noteworthy, the Hinman Speech Documents refer to a speech given by William Hinman, the former SEC Corporation Finance Division Director during the June 2018 Yahoo Finance All Markets Summit. In his speech, Hinman said that Ethereum (ETH) is not a security.

Ripple vs. SEC Lawsuit: Court To Consider Hinman Speech Documents As Supporting Argument

The US SEC filed a motion late last year, asking the Court to seal the controversial Hinman Speech documents. The application was founded upon the regulator’s argument that “its mission outweighed the public’s right to access documents that have no relevance to the Court’s summary judgment decision,” among other reasons.

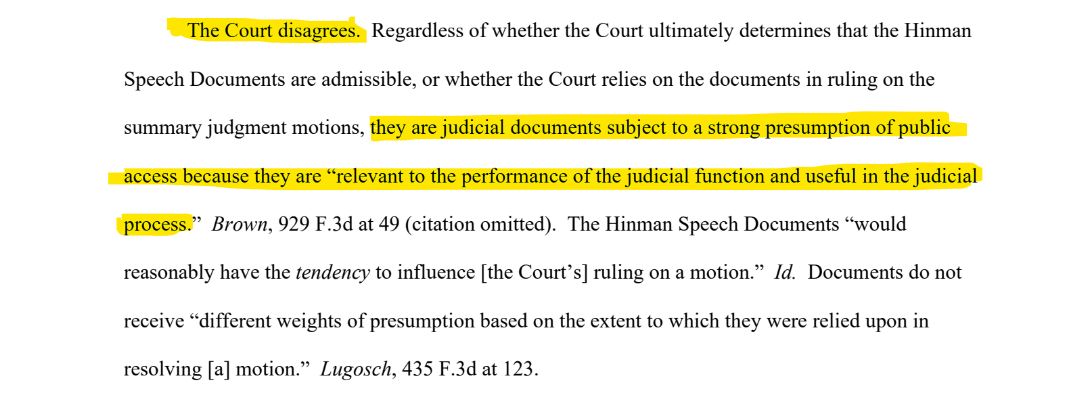

In a recent court order, however, District Court Judge Analisa Torres has ruled otherwise, in favor of Ripple. The Judge said, “The documents are judicial documents subject to a strong presumption of public access.” The decision tips the odds in favor of Ripple and the entire XRP community in the ongoing legal battle against the SEC.

The following is a snapshot of Judge Torres’ ruling, determining why the Hinman Speech Documents must be considered in evidence.

Based on the above excerpt, the judge was very clear that reasonably, the Hinman Speech Documents would have a bearing in the Court’s ruling on a motion.

It is worth mentioning that this was not the only motion that the court denied as filed by the SEC. Several other applications were dismissed, including the regulator’s claims that sealing the documents is necessary to preserve “openness and condor within the agency.” To support this position, Judge Torres articulated:

The deliberative process privilege does not protect Hinman Speech Documents because they do not relate to an agency position, decision or policy.

Even so, other applications from the SEC passed. Among them, when the agency asked the Court to redact the names and identities of the regulator’s pundits and the XRP investor declarants. The agency also asked for the personal and financial data of the defendants concealed.

Similarly, some of Ripple’s motions were turned down. Among them, are references linking the payments company’s revenues with XRP sales and the level of reimbursement offered to trading platforms, among others.

Ripple Price Reacts With a 10% Uptick

The speech was an important piece of evidence in the ongoing legal battle between Ripple and the SEC on allegations of securities laws violation. Accordingly, the Court admitting the Hinman Speech into evidence tips the balance in favor of the defendant.

Accordingly, Ripple (XRP) price reacted to the positive development, recording a 10% uptick. This came alongside a 40% increase in 24-hour trading volume, indicating a return of investor enthusiasm. It is also worth mentioning that the news catapulted the remittance token past key hurdles, to mount a recovery rally above the $0.431 and $0.438 resistance levels and record an intra-day high of $0.449.

If the bullish momentum among investors is sustained, Ripple price could soar higher past the current market value of $0.445. This could see XRP shatter the psychological $0.450 hurdle thereby reclaiming early May highs.

Several important indicators, starting with the Parabolic SAR, which had flipped below Ripple price, adding credence to the bullish outlook, support the bullish outlook. Additionally, the Relative Strength Index (RSI) and the Awesome Oscillator (AO) were also both in the positive zone. These added credence to the bullish thesis.

On the flip side, if profit takers pull the trigger, a selling spree would ensue. This could lead Ripple price southward to shed most of the recent gains. One of the possible reasons would be investors trying to book profits after breaking even.

Take note of the RSI, which was high in the overbought zone at 81, hinting at a looming pullback. Accordingly, XRP traders should prepare for a correction in Ripple price. A trend reversal could see XRP resume the May 16 lows around $0.420.

Also Read:

- XRP Price Rallies 10% As Ripple Enjoys A New Win Against the SEC

- Senate Democrats Push SEC to Expedite New Private Investing Rules

- Where and How to Buy XRP – Invest with Low Fees Today

Join Our Telegram channel to stay up to date on breaking news coverage