Join Our Telegram channel to stay up to date on breaking news coverage

Ahead of its hard fork, Bitcoin Cash surged as high as 29 percent during the weekend trading session. All the eyes are now on whether the altcoin can swell any further, especially when it promises to offer holders free tokens after its blockchain splits.

Trading Sentiment around Coin Forks

Traders tend to behave bullishly whenever a forking event is nearby. To them, a fork signifies free coins on the top of what they already hold. For instance, when the main Bitcoin blockchain forked and conceived Bitcoin Cash, the same chain, Bitcoin holders received an equivalent amount of BCH tokens. Traders could claim the free BCH tokens by creating new Bitcoin Cash wallets. And when the crypto exchanges added BCH to their list of tradeable crypto assets, the free coins suddenly had a value of $555.

A fork is a reason to earn free rewards – at least for speculators.

Bitcoin SV vs Bitcoin ABC

In the case of the upcoming Bitcoin Cash fork, known as Bitcoin ABC, a blockchain split will result in the formation of Bitcoin SV. The new blockchain, though not well-supported by the community, is still led by people with big pockets. Many big mining pools have extended support to the forked chain, reportedly because of their owners’ close relationship with the chain’s mastermind Craig Wright. Also known as the fake Satoshi, Wright has support from Coingeek, BMG Pool, and his own SV Pool.

In addition to the above, Squire Mining, a crypto mining firm with a $49.5 million market cap, is also backing the Bitcoin SV chain. It means that Wright’s new version of Bitcoin could gain adequate hash support despite the lack of community support. There is this explicit institutional support which could be the reason why traders went on a BCH buying spree during the weekend and might continue to do so before November 15, 2018, the day of the BCH fork.

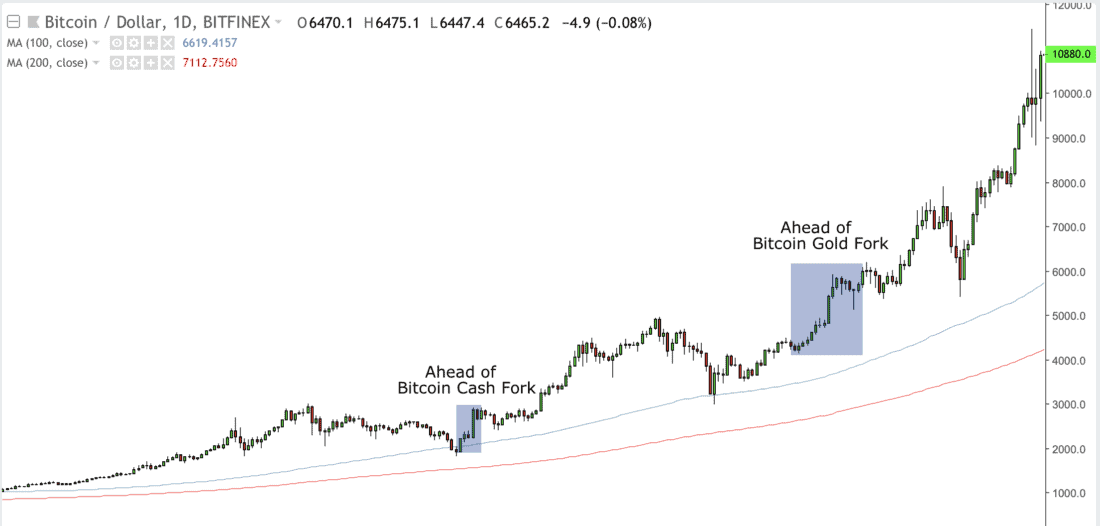

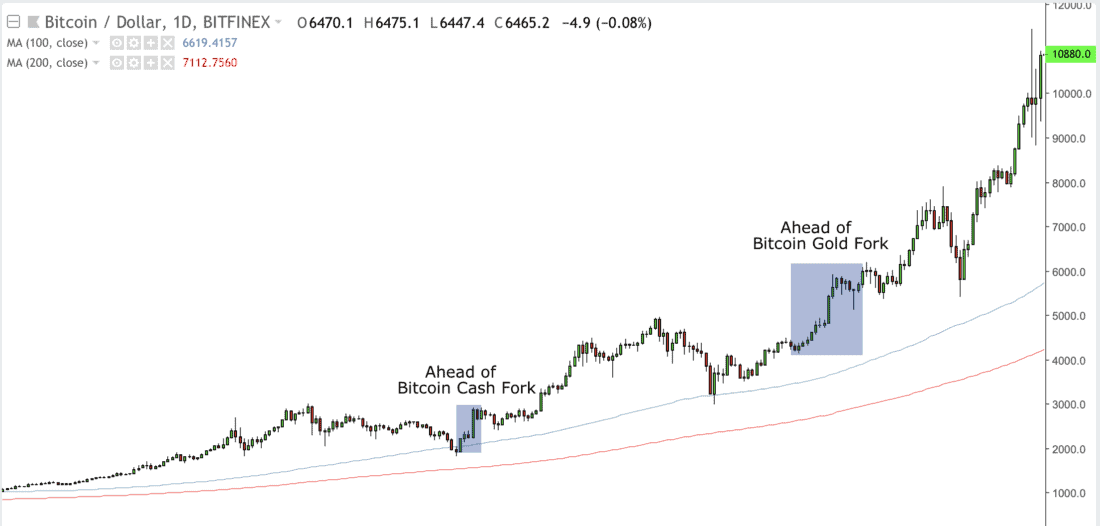

There is historical evidence available to prove traders’ behavior around coin forks. In October 2017, the original Bitcoin had reached a new all-time high, hitting $6,200, five days before the Bitcoin Gold fork. It also happened when the main bitcoin blockchain split into two to create Bitcoin Cash. At that time, the Bitcoin price against the dollar increased as much as $1,200.

The Next BCH Price Action

In reality, the potential adoption rate of Bitcoin SV could attest to the price action of BCH/USD post the fork.

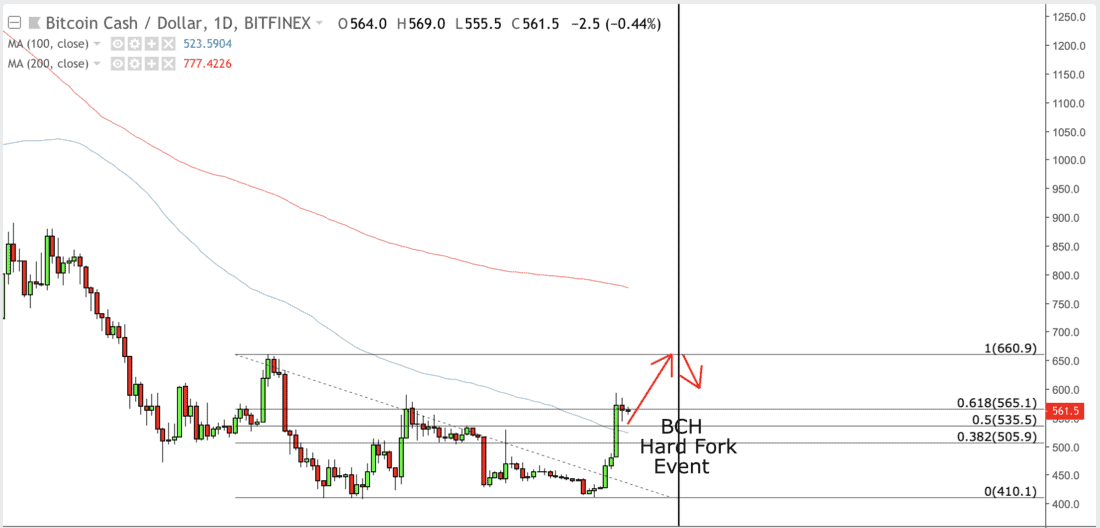

The BCH/USD price could witness a surge towards its September 2 high at $660 – or less – if traders find potential in SV. According to the Fibonacci retracement swing from 661-high to 410-low, the price is now testing $565 as its range resistance. A clear breakout signal will bring $661 in view as the next potential upside target.

Meanwhile, a sharp pullback could take place around or after the BCH hard fork event (represented via a vertical line in the chart above). Again, $660 only represents a potential target – the price can reverse anytime before hitting the said level. The market nevertheless is bullish near-term, providing adequate upside opportunities to traders looking to go long on BCH/USD.

Image from Shutterstock

The post Will Bitcoin Cash (BCH) Price Surge as Hark Fork Approaches? appeared first on NewsBTC.

Join Our Telegram channel to stay up to date on breaking news coverage