Join Our Telegram channel to stay up to date on breaking news coverage

The great Merge has taken the market and miners from their feet. It is predicted that the Merge will force Ethereum’s 19 billion USD mining industry to find a new home.

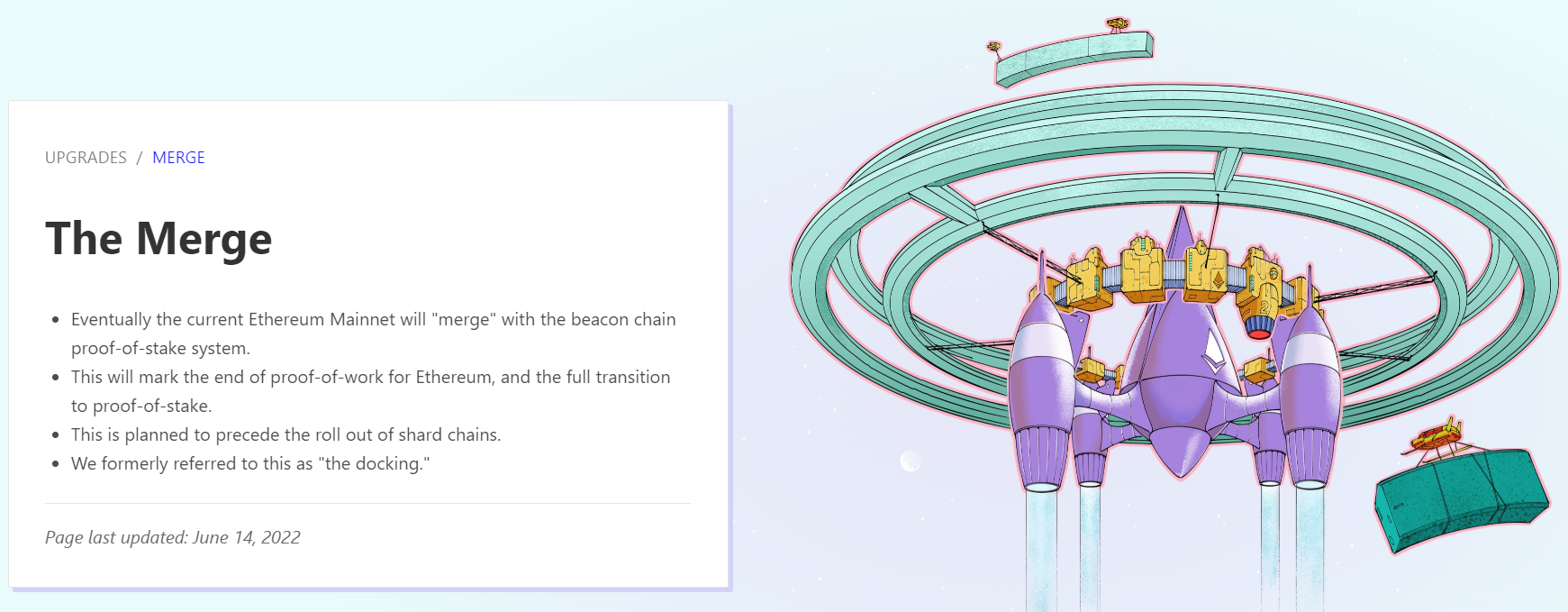

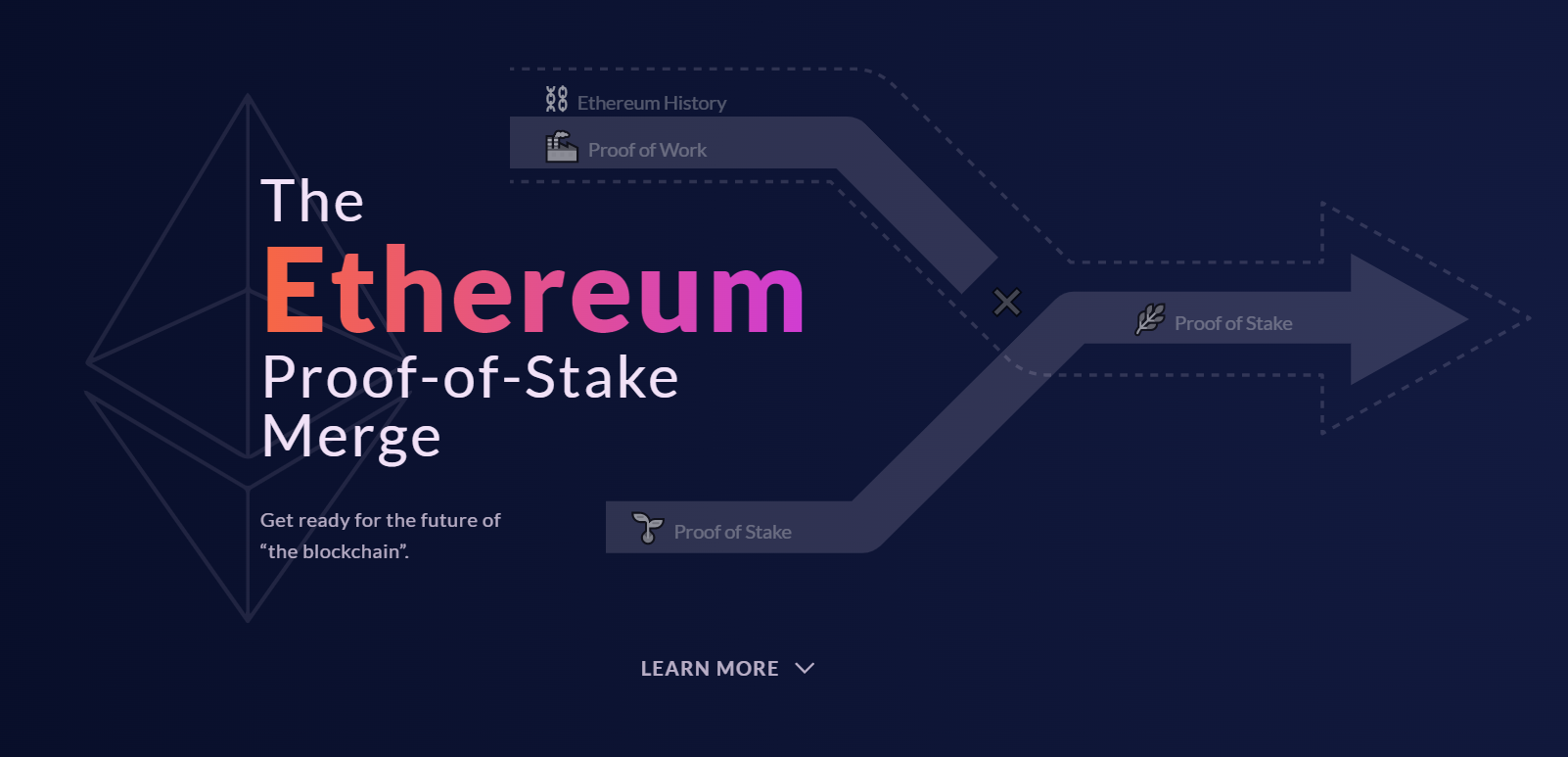

Vitalik Buterin, Ethereum’s co-founder in his statement at the ETH Shanghai Web 3.0 Developer Summit said that “the merging” will be concluded by this summer. According to the Ethereum official page, the Ethereum will eventually “merge” with the beacon chain proof-of-stake system. This will be the final step in converting Ethereum from a proof-of-work (POW) to a proof-of-stake (POS) consensus paradigm.

Ethereum is shifting from a POW to POS, which is a less energy-intensive technology after years of being the most popular smart contract blockchain. The proposed changes were previously known as Ethereum 2.0, however, the Ethereum foundation now refers to them as Ethereum Merge.

In this article, we will understand what the Ethereum Merge is, what the shift from the proof-of-work to proof-of-stake means, why the Merge is happening and what investors minors can expect from it?

Buy Ethereum via eToro Platform Now

Your capital is at risk.

The Talk about Ethereum 2.0 and Merge

Ethereum 2.0 is an improved and advanced version of the Ethereum blockchain that will rely on staking to authenticate transactions as part of a proof-of-stake consensus procedure.

Image Sourced via Ethmerge.com

Ethereum 2.0’s staking method will replace the proof of work standard, in which cryptocurrency miners use high-performance power computers to complete hard mathematical computations also called hashes. The mining procedure requires an ever-increasing amount of electricity to substantiate Ethereum transactions before they are posted on the open public blockchain.

Proof of Work Explained:

Bitcoin and Ethereum, the two most valuable cryptocurrency networks by market capitalization, use a proof-of-work system to record transactions. Cryptocurrencies lack centralized gatekeepers to ensure that new transactions and data added to the blockchain are accurate. Instead, they rely on a network of participants to confirm incoming transactions and add them to the chain as new blocks.

Proof of work is a consensus technique that allows miners/network participants who are authorized to perform the lucrative chore to determine and confirm new data. It’s profitable because miners are compensated with new crypto for correctly validating new data and not cheating the system in which miners devote computer resources to solving tricky math problems in order to add blocks of transactions to a public ledger.

Bitcoin mining, which often requires specialist equipment, has become industrialized, and as mining has moved to data centres, ordinary people’s participation has vanished. However, Ethereum mining requires graphics cards similar to those found in standard gaming PCs, and many regular people can still do it.

Proof-of-work is nothing more than a competition to make computers work hard, which means it consumes a lot of energy. One of the most common complaints about cryptocurrencies is the environmental toll it takes.

And therefore, to change the face of the whole mining process of Ethereum, the founders are coming up with Ethereum 2.0, which works on a Proof of Stake consensus mechanism.

Proof of Stake Explained:

Since the beginning of Ethereum, its creators have been planning a transition to a proof-of-stake mechanism. People would set aside, or “stake,” a fixed amount of Ether, the Ethereum blockchain’s cryptocurrency, in order to gain incentives for running software that properly groups transactions into new blocks and verifies the work of other validators under such a system.

Proof-of-stake could reduce the Ethereum network’s power consumption by a considerate percentage. It would also throw miners out of work, which would be a huge blow given the significant initial investment required to set up operations.

According to the statements reorded from Bitpro Consulting, ETH miners have spent around 15 billion USD on graphics processing units, which does not include ancillary costs like transformers and wiring.

Although the Ethereum founders have set no official date, the Merge is scheduled to take place in August.

Invest in Ethereum via eToro Platform Now

Your capital is at risk.

Update – As of 2025, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

The Merge Explained: Ethereum and Ethereum 2.0

Since April, Ethereum has been up and running, with two blockchains running concurrently, one using proof of work and the other using proof of stake. The Ethereum Mainnet, or ETH1, and the new Beacon Chain, or ETH2, will be combined into a single blockchain.

The Ethereum and Ethereum 2.0 were released by Ethereum developers for the convenience of the general public due to uncertainty that they might confuse consumers ahead of the unification.

Some investors may have been confused by the two varieties of Ether, the Ethereum Network’s innate cryptocurrency on popular cryptocurrency exchanges. The investor’s Ether is renewed when staked to ETH2 at the Coinbase platform, the values of ETH and ETH2 are similar.

These two variations of Ether will be “merged” into one sole token once the merging process is complete.

Staking Process in Ethereum 2.0

Once the Merge is concluded successfully, staking will be used to authenticate ETH transactions instead of mining.

Users shall stake a certain amount of cryptocurrency to take part in the transaction authentication process. In a proof of stake pattern, an algorithm will choose which validator gets to add the following block to the blockchain depending upon the calculation of how much cryptocurrency the validator has risked.

To become an ETH validator, investors must invest a minimum of 32 ETH. Currently, as we write, there are over 300K ETH validators. The more the amount of Ethereum each validator invests, the more the blocks that validator is likely to produce. A validator earns incentives in ETH each time they produce blocks for addressing validation duties.

The returns on staking on ETH’s Beacon Chain currently range from approximately 4 per cent to 5 per cent each year.

It is to be kept in mind that this staking may come out to be expensive for the regular investor, with the ETH selling at around 1,164.94 USD per (ETH / USD) and with a minimum prerequisite of 32 ETH, which amounts to more than fifty thousand USD.

Investors can join staking groups called “staking pools”- groups of Ethereum stakers who combine their resources and split the profits. Most major cryptocurrency exchanges and platforms such as eToro already offer staking services to investors who are unable to contribute 32 ETH from their own finance.

Stake Ethereum on eToro Platform Now

Your capital is at risk.

Why is the Merge Needed?

As mentioned above, the “Merge” aims to move the Ethereum blockchain away from the existing proof-of-work (PoW) consensus process and toward a proof-of-stake (PoS) model, which is faster and more energy-efficient.

The co-founder of Ethereum has long advocated for the proof-of-stake consensus mechanism. PoS is expected to reduce the network’s energy consumption by at least 99.95% when compared to Ethereum’s existing resource-intensive PoW governance scheme.

Systems that use proof of work consume a lot of electricity. Bitcoin mining, for instance, requires approximately 125 terawatt-hours of electricity annually (TWh). That is more than the entire country of Norway’s power consumption (yeah, right!).

Another reason for the Merge is that there is no demand for advanced and costly technology like mining rigs, and shifting to proof of stake will reduce the risk of network centralization, which is a security barrier.

What Does Will Ethereum Merge Mean for Investors?

Crash in GPU Prices

GPU prices have fallen below the manufacturer’s suggested retail price as supply recovers and Ethereum’s transition to proof of stake approaches. Some GPUs are still far more expensive, but overall we see a downward trend.

GPU prices have dropped by more than half, increasing sales. Ethereum’s hash rate, a measure of how much mining power is sustaining the network—has roughly doubled in the preceding year.

Most existing Ethereum miners will not be able to afford to mine other Proof-of-Work currency. Without ETH, the total market cap of GPU-mineable currencies is $4.1 billion, or about 2% of ETH’s market value. ETH also accounts for 97 per cent of all GPU-mineable coin daily miner earnings. Web3 protocols like the Render Network, Livepeer, and Akash allow miners to contribute their GPUs.

Ethereum May Witness a Bull Run

There are reasons to be hopeful about Ethereum’s possibilities of successfully merging with Bitcoin, there are also reasons to be apprehensive. A “block rearrangement” event was also marked by the Beacon chain, in which its blockchain forked about 7 times in a row.

Such a situation hasn’t happened in years. While the cause appears unknown, it sparked a momentary loss of trust by the investors, as the development of any additional competing Ethereum chains following the merger would be catastrophic.

The stakes for the merger, not just for Ethereum but for the whole crypto sector, could not be higher. Further delays or a botched execution will cause a price crash and a fresh and harsh Crypto Winter, while success will restore faith in Web3’s future.

The upgrade will undoubtedly result in a reduction in fresh ETH production, and demand in the Ethereum blockchain may rise due to the quantity of ETH available to stake. For most Ethereum investors, the fall in supply is good.

Ethereum Price Chart on eToro Platform

Investors in DeFi appear to be eager for the merger to be completed. At least 31 billion USD in ETH has apparently been deposited in the new Ethereum Consensus Model staking mechanism, ready to validate recent transactions as soon as the green light is given.

High-profile cryptocurrency experts are anticipating a 10,000 USD Ethereum bull run in 2022.

Visit eToro to Buy Ethereum Now

Your capital is at risk.

Staked Ethereum, will finally persuade governments to stop complaining about how unsustainable blue-chip cryptocurrencies are and how they will never be embraced. You now have access to the world’s first and most secure smart contract platform, which has just become about ninety-nine per cent more energy efficient.

When it comes to cryptocurrency paradigm shifts, the Ethereum Merge is second to none, and it is time we talk more about this merge, and create more awareness about it. Every crypto believer will be irreversibly impacted by the merger, which will have far-reaching consequences that we won’t even be aware of at the outset.

Read More:

- These are the Best Bitcoin Alternatives

- These are the Best Metaverse Coins to Buy in 2025

- Can Miners Stop Bitcoin’s Free Fall?

Join Our Telegram channel to stay up to date on breaking news coverage