Join Our Telegram channel to stay up to date on breaking news coverage

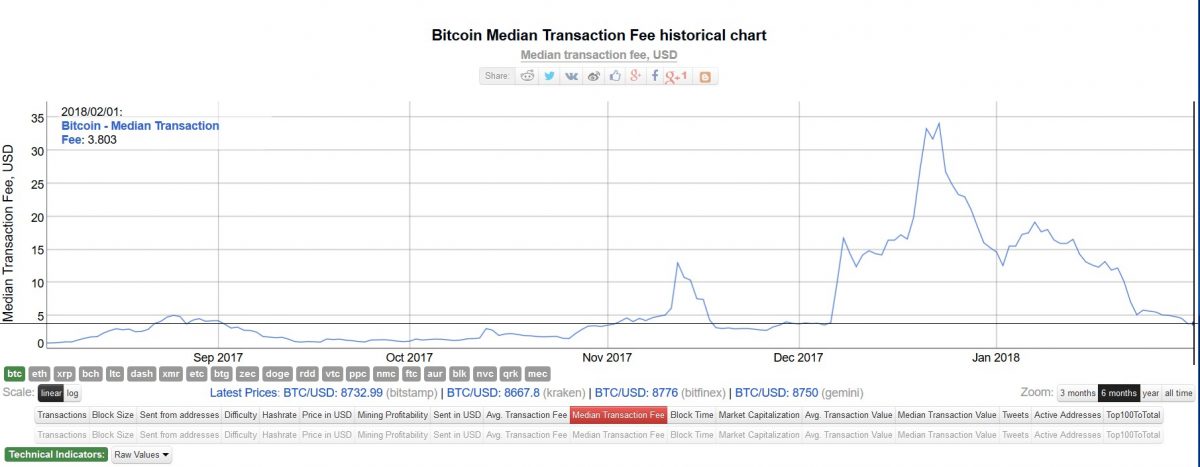

Bitcoin’s transactions fees, which became astronomically expensive during the later parts of 2017, has started tumbling down to its barest minimums. Here are the reasons why.

Back in 2017 when the price of bitcoin was on its journey to the moon, transaction fees also packed its luggage and followed suit. At that time, costs for even small transactions went as high as $28, and this proved to be a pain in the nether regions of bitcoiners.

Fast forward to February 2018 and bitcoin miners are now charging less than a third of what they collected in fees in December 2017. Now let’s take a look at some key factors responsible for the decline in the cost of Bitcoin transactions.

Source: Bitinfocharts

Key Factors Lowering Transaction Fees

The pent-up demand for bitcoin in 2017 led to massive network congestion which in turn resulted in a bidding war over block space. As observed by CoinMetrics, in early 2017, fees were at an average of $0.30, but by December, they had peaked at over $40. Median transaction fees spiked above $30 in December 2017 but have since fallen to around $4.00 in February.

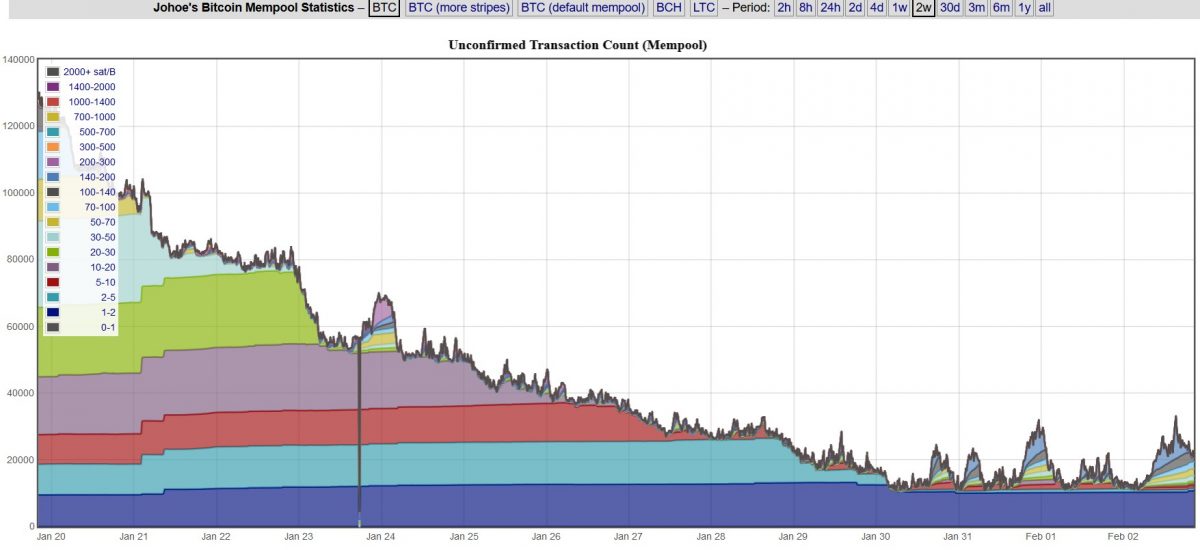

2018 started on a bearish note, with a significant decline in the number of transactions broadcast to the Bitcoin network as a result of the calmed speculative frenzy around the world’s pioneer cryptocurrency. According to data from Blockchain, the number of operations added to the mempool every second has reduced by roughly 50 percent compared to what it was back in December 2017.

Market analysts believe the bitcoin fees have tumbled just because people are no longer anxiously buying the cryptocurrency in anticipation of the journey to the moon and this has drastically slashed demand for block space.

Source: Johoe’s Bitcoin Mempool Statistics

The bitcoin bloodbath has also contributed to a reduction in U.S dollar-denominated transactions fees since the transaction fees are denominated in bitcoin.

Other Possible Factors

Some social media users have hinted that a significant amount of new hashing power has been added to the Bitcoin network, increasing the capacity of the system and mining frequency.

Although some experts like BitGo engineer Mark Erhardt have said recently on Twitter that it is not a new occurrence at all, around 164 blocks were mined daily in January 2018 as compared to the average number of 144 blocks based on the 10-minute block timeframe.

Apart from the increase in block space by the mining of more blocks on a daily basis, the efficiency of the Bitcoin blockchain has also been improved, regarding how transactions are carried out. Bitcoin Writer and researcher, David Harding has written comprehensive notes about this topic on Bitcoin Wiki. Some of the methods of lowering transaction fees as highlighted by Harding are transaction batching, Segregated Witness (SegWit) and more.

Although some wallets and exchanges have not started using the transaction fee lowering methods, the transaction fees on the blockchain have gone back to a fraction of the dollar for regular transactions and just above $2 for prioritized transactions.

The post Why have Bitcoin Transaction Fees Fallen so Sharply? appeared first on BTCMANAGER.

Join Our Telegram channel to stay up to date on breaking news coverage