Join Our Telegram channel to stay up to date on breaking news coverage

While the general crypto market is recovering from months of bear assaults, Bitcoin has stood out especially because it’s the market leader. In fact, it’s Bitcoin’s positive price action that kicked off the current surge across the market. However, there’s now a question lingering in the minds of many: Which other crypto looks well-set to surge next? Looking around, the answer could be Binance Coin (BNB).

Focus: Binance Coin (BNB)

First off, Binance Coin is currently the best performing among the top 10 cryptos on the charts and has just kicked off a price action that saw it reach a new ATH at $32.80 before drawing back a little to settle at the current $31.82.

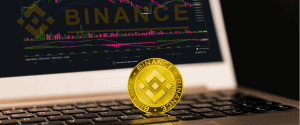

Although some argue that Binance Coin could still go down to test the $28 level, there’s a general consensus that it still has a strong bullish momentum that would eventually take it back up above $30 and possibly make it surpass the current ATH. Below is BNB’s market standings as of now.

According to data from CoinMarketCap, BNB’s ROI (Return On Investment) currently stands at 9000%. Since the beginning of 2019, the crypto has surged by over 380%. Also of note is the news that triggered the current surge. Binance, the crypto exchange, sent out a tweet implying that the exchange is now ready to launch the DEX 2.0. Still, there are a number of other important factors that put Binance Coin in a prime position as the next crypto to mount a serious spike. The first one is the base support and adoption that it enjoys.

Base Support And Adoption

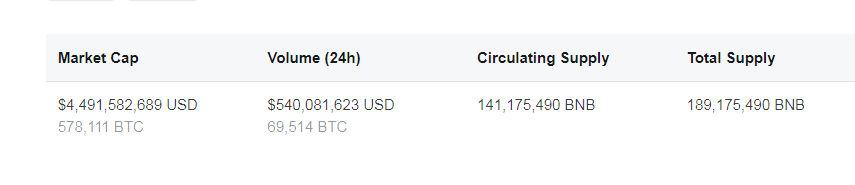

Binance Exchange has been in the forefront in bolstering BNB’s market position to cement a good support base for the now number 7 largest crypto in the market. Besides launching a DEX (Decentralized Exchange) for crypto trading, Binance has also scored partnerships with Cipher Trace, Coinomi, and CoinFlip. Coinflip gives BNB and its users exposure and access to over 200 crypto ATMs in the United States, meaning that people can use BNB more effectively and easily boost its mainstream adoption. As is evident in the current market trend, Binance’s support for BNB is responding more positively than others like XRP and TRX that also have major support from their creators. In effect, more people are now interested in knowing about BNB or buying it.

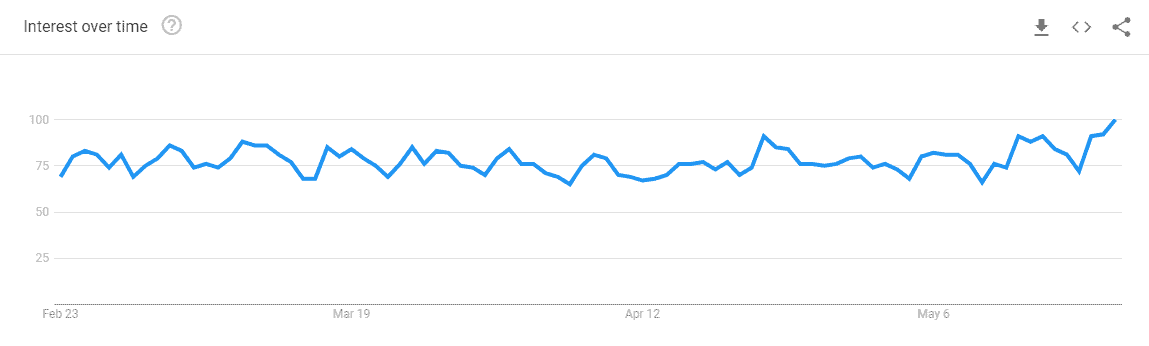

A look at Google Trend’s “Binance Coin” search chart shows that a lot of people have been keen on the crypto over the last 90 days.

Below is another one for the term “BNB.” As indicated in the chart, the number of people interested in BNB has been rising.

Also, the exchange works to support Binance Coin by extending trading discounts for BNB users. When issuing IEOs (Initial Exchange Offerings), Binance requires participants to use the purchases using BNB. These efforts have further extended the crypto’s base support and created demand for it, hence the price surge. If the trend continues, of which it’s likely to, Binance Coin could see a significant price action.

Historical Trend

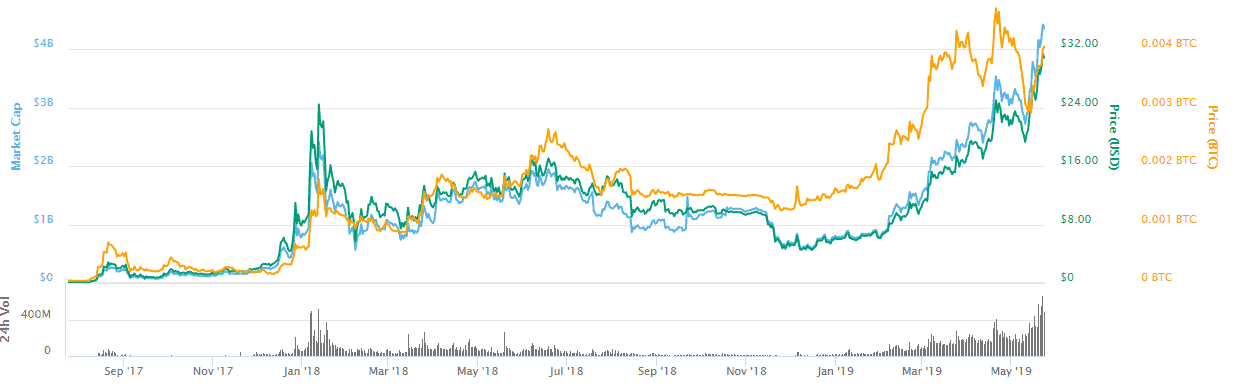

Looking at BNB’s historical data, the crypto presents a compelling outlook of a highly dynamic asset that has been continuously rising in value overtime. As such, the established trend indicates that Binance Coin will continue spiking in price.

Below is a chart representing BNB’s market dynamics for the last 3 years – as presented on CoinMarketCap.

Technical Indicators

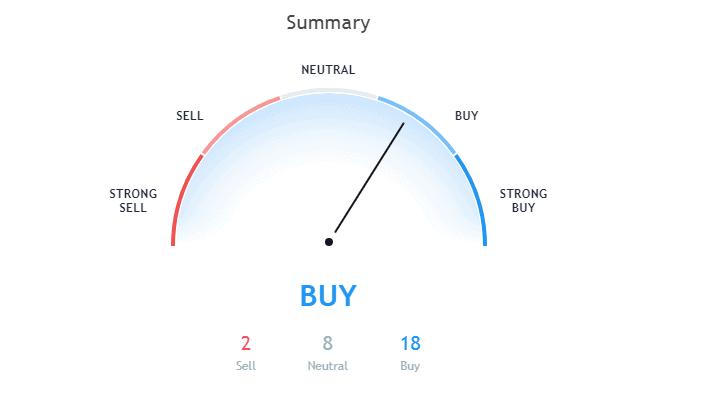

Binance Coin’s RSI (Relative Strength Index) indicates a strong bullish push driven by increasing buying pressure.

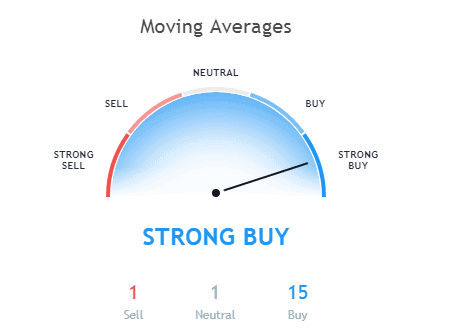

Further examination of BNB’s data in regard to its Moving Averages relative to the sell and buy pressure shows strong buy intent with negligible sell pressure.

Coin Burn

Market forces have been known to influence the price of various asset classes, and Binance Coin is no exception. Initially, the total number of BNB coins created was 200 million, but the current circulating supply adds up to about 141,175,490 coins. Binance plans to burn 20% of its BNB quarterly earnings with a goal to eventually have just around 100 million coins in total supply. As that happens, Binance Coin’s demand will rise sharply and send its price skyrocketing. Just recently, Binance announced BNB’s 7th coin burn.

Final Take

Given the facts above, it’s pretty easy to opine that indeed BNB looks every bit ready for a surge in the near future as well as in the long-term. However, it should be noted that the crypto market has been known to be a volatile space with no real guarantees of price surges or drawbacks.

Join Our Telegram channel to stay up to date on breaking news coverage