Join Our Telegram channel to stay up to date on breaking news coverage

Known YouTuber Steve Courtney has released a new video talking about the enigmatic Bitcoin trend known as the “Wave Trend”. Titled “Wave Trend Rejection – This Happens Next,” the video delves into the critical moment that Bitcoin is currently facing, questioning whether it will break through the current barriers or face a stark rejection.

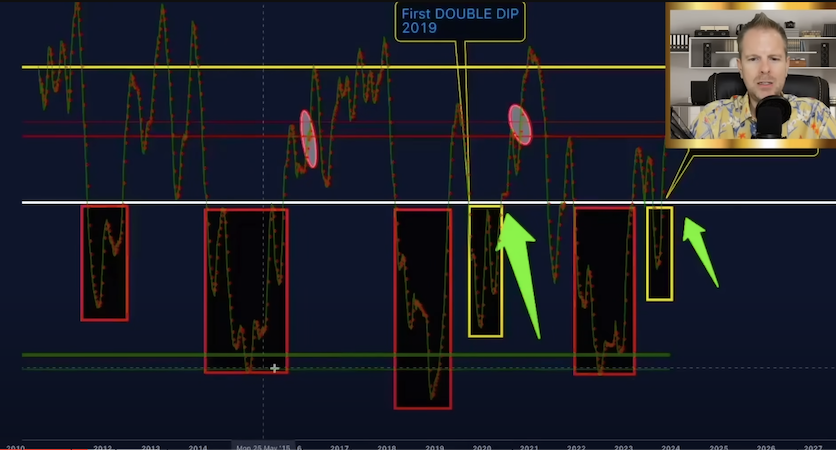

A key focus of the video is the detailed analysis of the Bitcoin weekly chart against the US dollar. The Wave Trend indicator, a tool used to decipher market movements, is thoroughly explained, including its settings and significance. Steve highlights the green channel within the Wave Trend, a critical zone historically associated with bear market bottoms in 2011, 2015, 2019, and 2022. This insight offers a strategic view of market lows, reinforcing the tool’s predictive power.

Further, the concept of a “double dip” is introduced, marked by yellow boxes on the chart. This phenomenon, observed in past Bitcoin cycles, indicates significant buying opportunities, as seen when Bitcoin dipped to around $23,000. The Wave Trend not only helps identify market bottoms but also aids in spotting market peaks. A yellow line, set at around 86 in the Wave Trend settings, serves as an alert for potential profit-taking opportunities, demonstrated in various instances over the years.

The video emphasizes the importance of human psychology in market movements, asserting that the predictability of Bitcoin’s behavior is rooted in the consistent nature of human emotions, particularly in financial contexts. This psychological aspect, coupled with the rhythmic cycles of Bitcoin, forms the basis of the analysis presented.

As for the current market scenario, the video discusses the significance of phase one rejections and the role of the red channel in the Wave Trend. Drawing parallels with past cycles, particularly those of 2012, 2016, and 2019, Steve suggests a potential pattern in the current cycle, with a focus on the pivotal yellow line during phase two of the bull market.

Other Points to Note Regarding Crypto

It’s good to take broader view at the overall trend of the markets, including the stock market.

A point not discussed by Steve, that we think it’s worth mentioning, is the correlation between the stock market and cryptocurrencies. Despite recurring fears of a recession, the market has consistently risen after each downturn, suggesting a pattern of resilience. It is good to be cautious about falling for media sensationalism about market crashes and focus on concrete data.

Fed Rate Hikes and Market Response

We also note that it’s important to pay attention Federal Reserve’s rate hikes and their impact on the market. Historically, whether rates go up, down, or pause, the market has shown an upward trend. We argue that this pattern is likely to continue, and to not fall prey to the notion that “this time may be different.”

Related News

- Microsoft Hires Sam Altman after Weekend-Long OpenAI Drama That Sent Worldcoin Price On a Wild Ride

- Bitcoin Price Prediction: VanEck Sees BTC Hitting ATH In November, But This Bitcoin ETF-Themed Coin Is Primed To Explode Next Month

- Bitcoin Breaks $30K Amid Rising Optimism Over Imminent ETF Approvals After SEC’s Ripple “Capitulation’’ – And That Indicates Boom Times For Bitcoin Minetrix

- Galaxy Digital Founder Says Bitcoin ETF ‘Essential’

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage