Join Our Telegram channel to stay up to date on breaking news coverage

USDCAD Price Analysis – June 13

The pullback has been carried out and the Bears are getting ready to continue its bearish movement which may break down the $1.3207 level.

USD/CAD Market

Key levels:

Supply levels: $1.3367, $1.3493, $1.3648

Demand levels: $1.3207, $1.3111, $1.2977

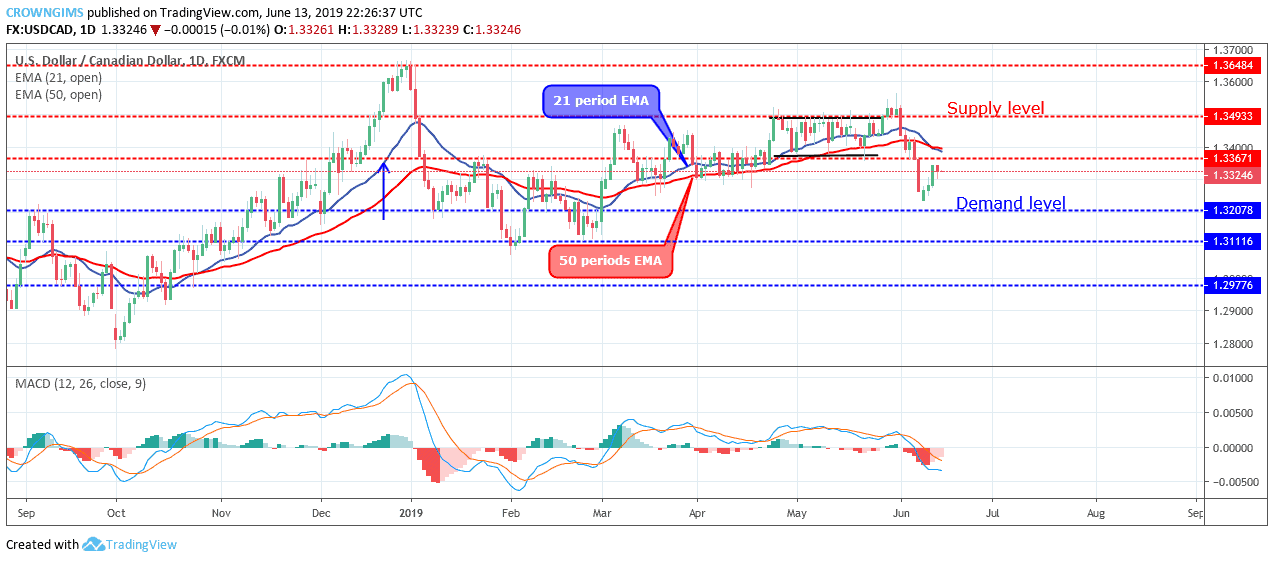

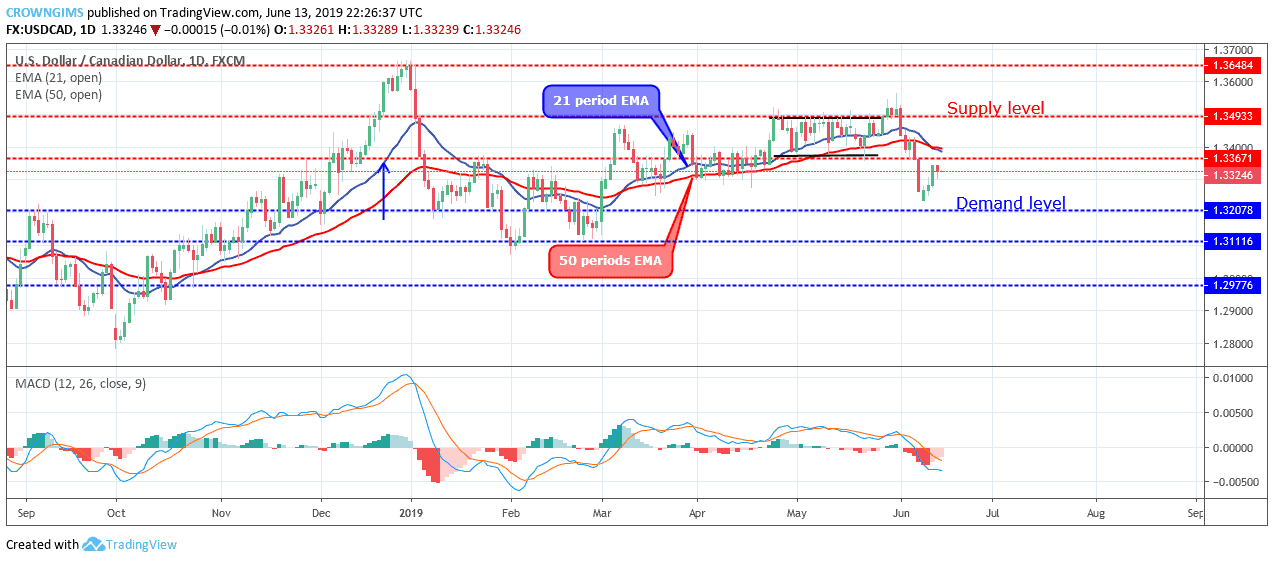

USDCAD Long-term trend: Bearish

USDCAD is bearish movement on the long-term outlook. The currency pair was range-bound last week within the supply level of $1.3493 and the demand level of $1.3367. As it was predicted, the Bears gained more momentum than that of the Bulls and the price dropped to the low of $1.3207 demand level. The price reversed and retesting the $1.39.

The currency pair keep a distance from the two EMAs The pair is trading below the 21 periods EMA and 50 periods EMA in which the later want to cross down the former. The Moving Average Convergence Divergence period 12 with its histogram is below zero levels and the signal lines pointing down to indicate sell signal.

The pullback has been carried out and the Bears are getting ready to continue its bearish movement which may break down the $1.3207 level.

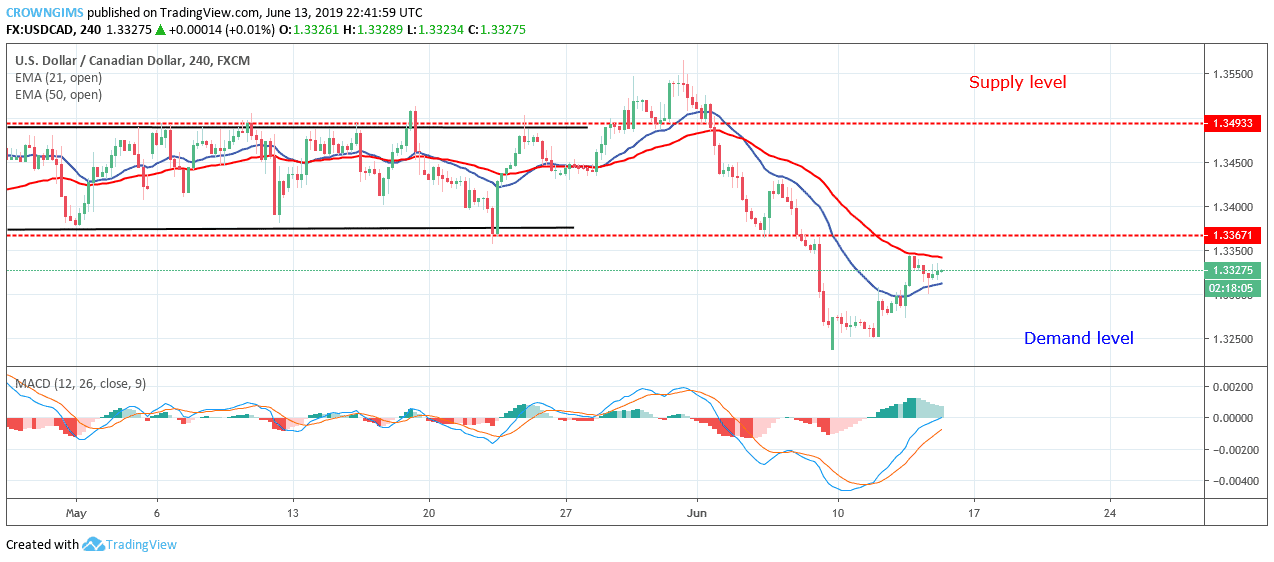

USDCAD medium-term Trend: Bearish

USDCAD is bearish in the medium-term outlook. The Bearish momentum continues in the USDCAD market on the 4-hour chart. The price found support at the demand level of $1.3207. The price retracement is ongoing as at the moment. The USDCAD price is trading in between the 21 period EMA and 50 periods EMA trying to cross over the dynamic resistance level.

The MACD period 12 with its histogram is above zero levels and the signal lines pointing up to indicate a buy signal.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage