Join Our Telegram channel to stay up to date on breaking news coverage

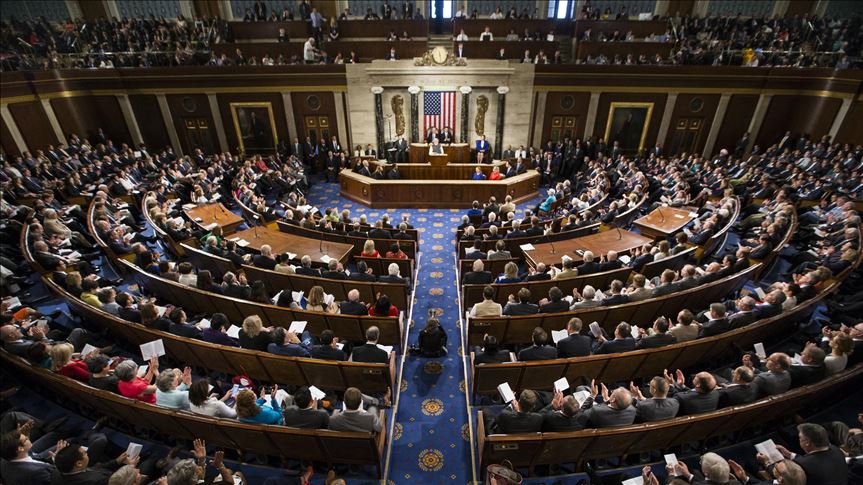

The regulatory situation in the crypto industry continues to stagnate as lawmakers still struggle to come up with a set of laws and rules that would ensure regulatory clarity. More than that, their time is running short, as New Jersey Representative Josh Gottheimer recently noted.

Crypto industry needs regulatory clarity as soon as possible

After the recent discussion with the chair of the Commodity Futures Trading Commission (CFTC), Rostin Behnam, Rep. Gottheimer noted that there were several proposed crypto bills that could serve as building blocks for achieving regulatory clarity. The bills were proposed by the members of the US House of Representatives, but Representative Gottheimer admitted to being bullish on the bill proposed by the House Financial Services Committee.

Of course, this is not the only possible way forward, as he said, only the one he personally prefers. He added that he is open to any solution, assuming that it provides some of the regulatory certainty that the regulators need currently in order to be able to offer at least something to the space.

At this point, the US is losing businesses, startups, and entrepreneurs, who are either losing interest in the field due to the lack of regulations or are losing interest in launching their businesses in the US. With that said, he is open to almost any proposal that will do the trick and regulate digital assets adequately.

He concluded by saying that the time is not on the regulators’ side and that it is imperative to make a move, pick a regulatory body that will handle the sector, and give the market the certainty and guardrails it deserves. Right now, the greatest risk comes from doing nothing, as he sees it.

The biggest issue remains: Who gets to regulate crypto?

Gottheimer, as a member of the House Financial Services Committee, introduced one of the legislations himself, although this was back in February of this year. He proposed the Stablecoin Innovation and Protection Act at the time, which was legislation that proposed that the US Federal Deposit Insurance Corporation bank should back stablecoins in a similar way as it backs fiat deposits.

This would mean that issuers have to prove that they have sufficient cash reserves to back each stablecoin with the appropriate amount of fiat currency, which is typically $1 per token. However, there was a larger question of whether cryptos and stablecoins themselves fall under the CFTC’s regulatory purview or the SEC’s. The lawmakers have quite opposing views on the matter, and they failed to reach an agreement on which regulatory body should be in charge here.

Following that, additional bills were introduced seeking to clarify the CFTC’s and SEC’s roles over crypto, as well as who should regulate stablecoins, banking, taxation, digital assets, and other aspects. The SEC also received quite a bit of criticism due to the fact that it has adopted a “regulation by enforcement” approach to digital currencies.

Related

- US Lawmaker introduces a draft bill focused on stablecoins management

- US lawmakers urge Meta CEO to address the rise in crypto scams

- US lawmakers request information on crypto mining

Join Our Telegram channel to stay up to date on breaking news coverage