Join Our Telegram channel to stay up to date on breaking news coverage

Financial watchdogs around the world have been making great efforts to identify loopholes in the crypto market, with the aim of developing a robust regulatory framework. The US authorities have also been brainstorming on the best strategies that can be adopted to protect investors and make the crypto sector safe for everyone.

The US Federal Reserve Chief, Jerome Powell, recently made remarks about how cryptocurrencies were posing a risk to financial stability. To curb this, more regulations needed to be implemented especially in the light of this year’s frenzied popularity of cryptocurrencies.

In addition, the US Treasury also expressed concerns about wealthy individuals turning to cryptocurrencies to avoid taxation. To address this, the Treasury has proposed that crypto exchange firms in the US report large transfers to the relevant regulators.

Speaking to the Financial Times this week Michael Hsu, the acting comptroller of the currency, said that he was hopefully expecting US officials from the various regulatory bodies to come together to create what he described as a “regulatory perimeter” for crypto.

Critical Time for Regulations

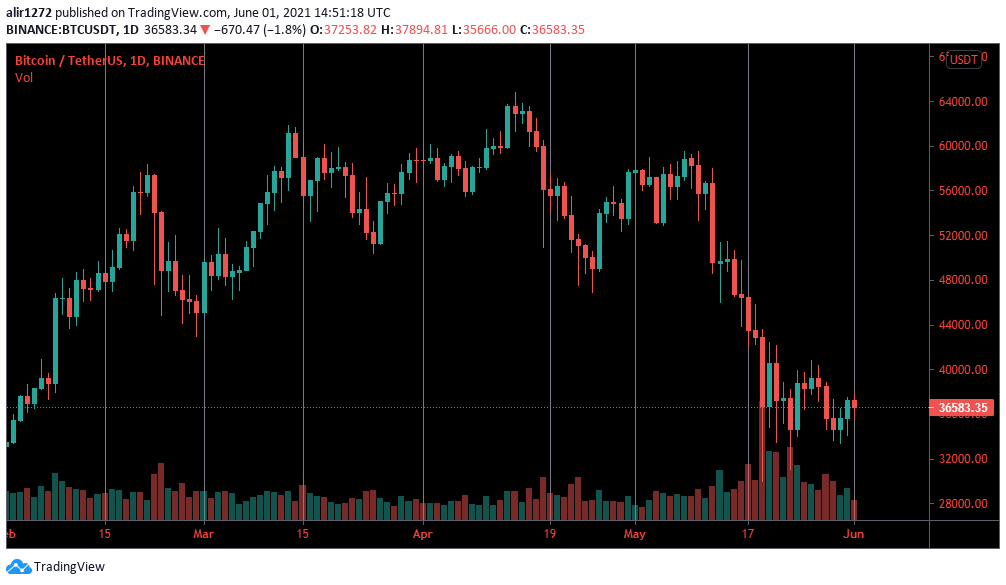

The regulatory proposals come at a time when Bitcoin is experiencing wild price movements. The currency lost nearly 50% of its value in May when the token crashed to almost $30,000 after hitting an ATH of $63,500 in April.

Jerome Powell relayed his concerns about cryptocurrencies and the threat they posed to financial stability. He also expressed guarded support in the Federal Reserve exploring the launch of its own digital fiat, that might mark a significant step in the US creating a central bank digital currency. Powell also expressed worry about how crypto innovations were risky to both investors and the entire financial sector.

The remarks by Powell show that the Federal Reserve has been looking at ways they can deal with the popularity of cryptocurrencies and their affect on traditional financial models. Creating a comprehensive framework for the crypto industry would lay the ground for launching the CBDC.

Not Actual Assets

The Federal Reserve and the Treasury have been considering how to regulate crypto for some time but have been moving slowly. Now they appear to be worrying that the industry could get too big for them to regulate properly unless they start to get serious.

The question of whether to regulate crypto is a different one to whether crypto has intrinsic value. However, even after the market cap of cryptocurrencies reached $2.6 trillion in May, the two agencies remain unconvinced that cryptocurrencies have a great value. The authorities still view the tokens as art, gold, and other assets solely used for speculation.

However, the Federal Reserve believes that a CBDC is a safer tool as a holder has a claim to the central bank, which is similar to paper currencies. Powell also stated that regulators would release a discussion paper within the summer talking about digital currencies as well as the benefits and risks that these tokens have. The relevant stakeholders would also seek public participation in the matter.

With the tough regulatory framework looming in the US crypto sector, it means that cryptocurrencies should be ready for substantial change, although there may be lengthy deliberations before the rules are definitively put in place. While the change may be difficult at first, it will ultimately be beneficial for the market in ending uncertainty and setting up clear rules of the road for all market and ecosystem participants.

Get Free Crypto Signals – 82% Win Rate!

3 Free Crypto Signals Every Week – Full Technical Analysis

Join Our Telegram channel to stay up to date on breaking news coverage