Join Our Telegram channel to stay up to date on breaking news coverage

The decentralized finance (DeFi) sector has been one of the most affected by the ongoing bearish market. Uniswap is one of the best DeFi platforms, and its native token, UNI, has been experiencing growing volatility in tandem with the wider crypto market.

At the time of writing, the global crypto market cap was down by almost 1%, staying below the $1 trillion mark. Buyers are trying to hold on to the recent gains in the market, and most cryptos, including UNI, are flashing green.

Uniswap Labs Eyes Fundraising At $1 Billion Valuation

Uniswap Labs, the company behind decentralized exchange (DEX) Uniswap, is planning to raise $100-$200 million over the next funding round with $1 billion in valuation. This will be the initial phase of a new fundraising round to increase its offerings.

During the Series A funding round in August 2020, Uniswap raised $11 million with venture capital companies like a16z and Paradigm as the major investors.

Sevel investors have already lined up in support of Uniswap for the next phase of fundraising, including Polychain and Singapore’s sovereign fund. The remaining investors have requested to remain anonymous until the fundraising round is over. Notably, given that the plan is still in the initial phase, the terms of agreement could change.

During an interview with TechCrunch, Uniswap Labs COO Mary-Catherine Lader said:

“Our mission is to unlock universal ownership and exchange. Suppose you can embed the ability to swap value and have people join the community and exchange value with your project, company, or organization. In that case, that’s a powerful way to allow more people to engage in this ownership.”

More importantly, the Uniswap community is looking to develop the Uniswap Foundation. Members Devin Walsh and Ken Ng presented the proposal to support the Uniswap ecosystem’s growth. In an earlier statement by Uniswap, the Ethereum chain’s transition to PoS will help the exchange and scale Web3.

According to a tweet by Uniswap Labs, the platform achieved a $1 trillion volume in May 2022. This was a stunning achievement in less than half a decade, as most of the platform’s trade volume of approximately 80% was seen in 2021 amid a hefty interest rate fueled by the bull market.

1/ It’s been one hell of a ride 🚀

As of today, the Uniswap Protocol has passed a lifetime cumulative trading volume of $1 Trillion. pic.twitter.com/stFdMDgJPZ

— Uniswap Labs 🦄 (@Uniswap) May 24, 2022

The news has positively impacted UNI price since it first came out, jumping more than 5% immediately after the fundraising news reached investors. While Uniswap has not announced details on the fundraising, the company’s earlier hints pointed to an ambitious plan to expand its offerings, like support for NFT trading on Uniswap from various marketplaces.

UNI Climbs 13% To $5.50

UNI dropped to a multi-year low of around $4.78 before rallying almost 30%. It corrected to $4.95 after a rejection by the $6.50 psychological level. A slight recovery bolstered the token to the current price of $5.37.

UNI has been following an uptrend, while the price records a slight downtrend over the last several days. On the other hand, the market has been pushing for a correction after a strong rally to record higher highs and higher lows, indicating a bullish trend.

The volatility is increasing on the eight-hour chart (below), with the moving average (MA) suggesting a growing bullish momentum in the market. The recovery completed a double-bottom pattern formation, ushering in the long-awaited rally. Traders waiting for long positions anticipate that UNI will print another bullish candle above the neckline resistance at around $5.50 before executing their buy orders.

The 50-eight-hour simple moving average (SMA) is at $5.68, the 100 SMA (blue line) is at $6.30, and the 200 SMA (purple) is sitting at $6.26. The DEX token now trades above relatively strong support while considering a 17.24% breakout to $6.3.

The odds appear to favor the bulls, particularly with a buy signal from the Moving Average Convergence Divergence indicator influencing the price positively. The simple moving average (SMA) on the 50-eight-hour chart is present at $5.68 due to the bullish trend. The 100 SMA (blue line) is at $6.30, and the 200 SMA (purple) is sitting at $6.26, showing that while bulls work to overpower the bears, instability is also increasing.

Traders are likely to consider the 50-day SMA (yellow) as the first point to cash in profits. On the other hand, the more ambitious traders could hold on until UNI price tags the 200-day SMA (purple) to cash in some money.

UNI/USD Eight-hour chart

UNI’s eight-hour chart reveals the increasing possibility of a price upturn. The bullish momentum had gained stability over the past 24 hours. However, the market attempted a correction, but the bulls remained strong, holding the UNI price above the $5.30 psychological level, evidence of market volatility and growing stability.

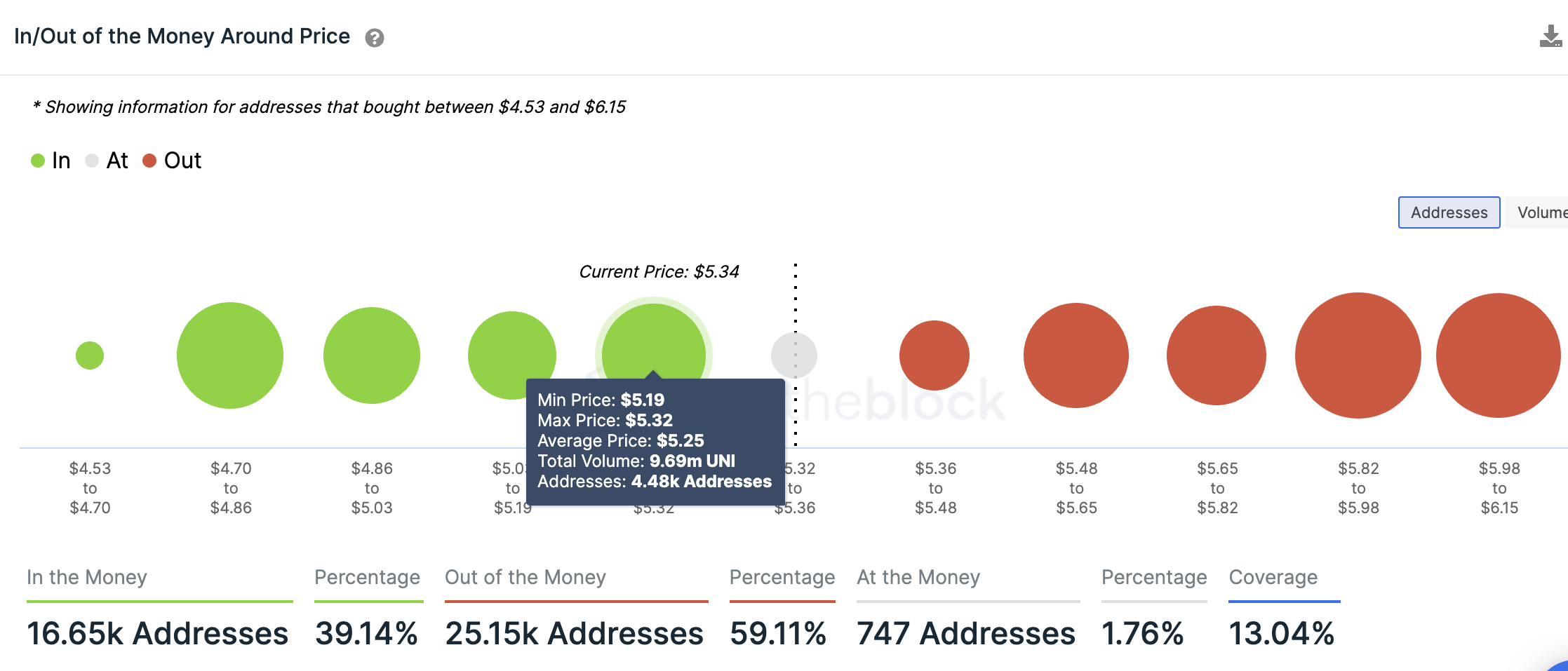

Nevertheless, the longer lower wick on today’s candlestick shows that buyers are rejecting lower levels, an indication that a possible upward trend may be in the offing. However, the bullish outlook should be taken with a pinch of salt because of a major resistance between $5.32 and $5.36, as seen in The Block’s IOMP on-chain model.

The IOMP model shows relatively formidable support around the $5.30 area, adding credence to the bullish outlook. Approximately 4,480 addresses previously purchased 9.69 million UNI in that range. As UNI recovers, this demand zone will provide the required hind winds to propel the DEX token forward.

Uniswap IOMAP Chart

On the flip side, UNiswap faces relatively weak barriers ahead. Therefore, burring activities could escalate if the price storms and holds past $5.30. Long positions placed marginally above the aforementioned level will turn profitable on the upside.

The overall market trends have been in bearish support for the past few weeks. Still, circumstances seem to be transforming, and further recovery is possible if buyers’ efforts remain persistent. Bears showed strong performance during the day, but eventually, bulls are managing to hold the price.

Uniswap market cap is $4.099 billion, and the trading volume is down only 7.86%, according to data on CoinMarketCap.

Other Projects With Potential For Investor Growth

The prolonged crypto winter, made worse by the FTX debacle, has left investors jittery about the safety of their investments. As you look for ways to diversify your portfolio with safer alternatives, here are some tokens to consider for your portfolio diversification. Notably, most of them are in the presale phase and have already demonstrated solid underlying fundamentals to earn themselves initial listings on sturdy exchanges.

IMPT

Promising holders the chance to offset their carbon footprint while earning NFTs at the same time, IMPT is an Ethereum-based network designed to link in with carbon trading.

It is a carbon credit marketplace wherein users earn and trade non-fungible tokens (NFTs) based on carbon offsets. The carbon offsets are also obtainable through shopping at select eco-friendly retail outlets.

The carbon credits are minted into NFTs, helping in the prevention of any fraudulent activities. Using the blockchain ensures stability and transparency in the ecosystem, which addresses environmental challenges, according to an official Twitter post.

#IMPT is an easy solution for everyone who wants to contribute to sustainable development ♻️

🔥Get involved!

Take part in the $IMPT presale now! ⬇️https://t.co/8KSvC4Hf9d pic.twitter.com/LxqsTgkLdH

— IMPT.io (@IMPT_token) November 24, 2022

So far, the presale has raised more than $13 million and sold over 700 million tokens, each for $0.023.

Dash 2 Trade (D2T)

Dash 2 Trade is one of the most promising crypto projects, presenting a system that works as a social media platform for crypto traders.

In its working, Dash 2 Trade helps people discover what cryptocurrency they could be trading at a time before it potentially becomes overly fashionable and expensive. According to the project’s whitepaper: “Signals can come in many different forms, and Dash 2 Trade caters to those signals that can have the most actionable impact: listing alerts, presales, technical indicators, social metrics, and more.”

D2T is the platform’s native token that went on its initial presale on October 27, 2022. As of November 25, the project had raised almost $7m out of its $8.757m target, according to an official Twitter post.

📣 Attention #D2T Crew! 📣

💰 We have just reached another milestone – $7,000,000 💰

⏰ Stage 3 of our presale is selling out fast and the price will increase soon ⏰

Don't waste time and buy $D2T now! ⬇️https://t.co/ExvBBjKIU6 pic.twitter.com/QNVLL0ZT98

— Dash 2 Trade (@dash2_trade) November 25, 2022

The initial presale price was 0.0513 USDT for each D2T token. Once the token’s presale target is attained, D2T will go for 0.0533 USDT over the next stages.

Once the presale is over, D2T’s dashboard will go live for its beta phase, scheduled for early 2023. When this happens, Dash 2 Trade (D2T) should have a listing on centralized (CEX) as well as decentralized (DEXs) exchanges.

Related News:

Join Our Telegram channel to stay up to date on breaking news coverage