Join Our Telegram channel to stay up to date on breaking news coverage

TRON (TRX) Price Analysis – June 3

TRON reached the highest level in 2019 once again when trading at $ 0.0356 earlier this year. TRX beat the first resistance level at $ 0.033 to $ 0.0409 yesterday and closed at $ 0.038. The return on investment is 1637.50%, which classifies the coin as number 11.

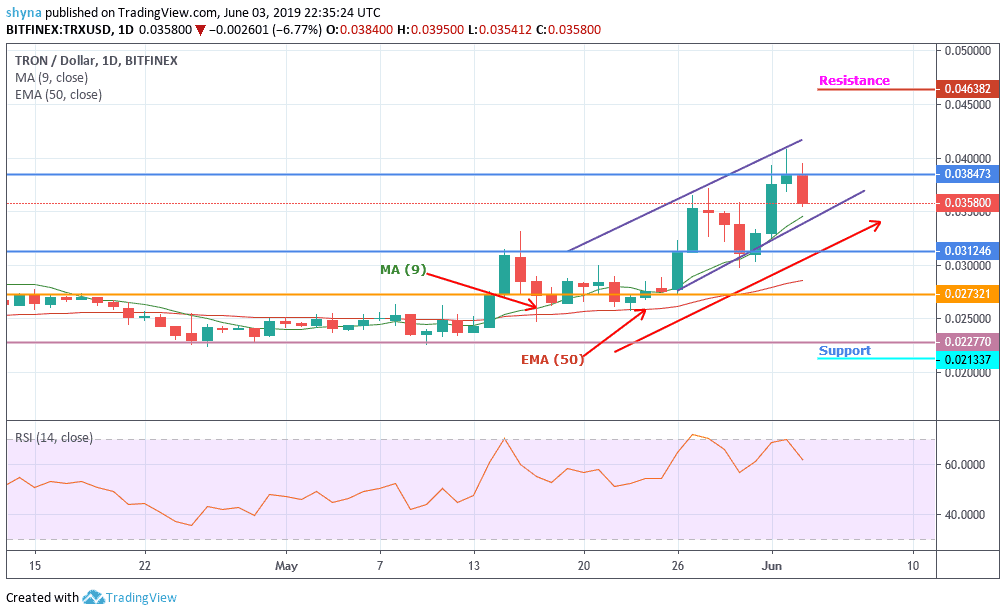

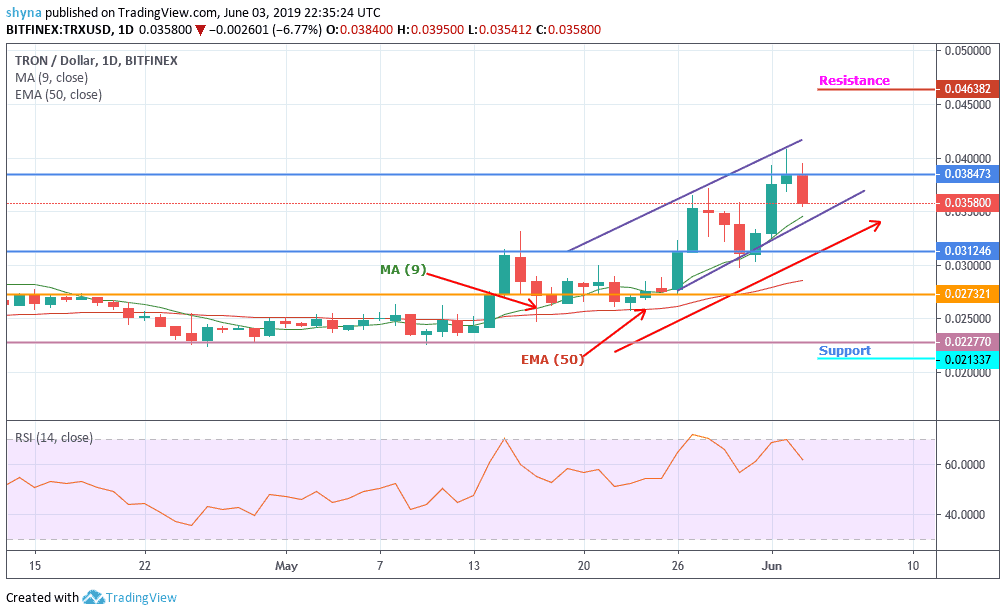

TRX/USD Market

Key Levels:

Resistance levels: $0.046, $0.055, 0.065

Support levels: $0.021, $0.01, $0.005

According to the daily chart, TRXUSD will then move from the resistance level of $0.038 to $0.036 at the time of writing, but the crypto may be gaining ground to rise higher, making it a great time to buy Bitcoin with PayPal. The formation of the uptrend is very visible because the price is still trading above the values of 9-day MA and 50-day EMA respectively.

In addition, the market return to a support level of $0.021 which may not become a reality until the end of 2019, as there is no turning back for TRX. The beginning of the year opened the value at $0.0196 and the value has already increased to 80%. It seems that even before this great revelation, this escalation is likely to destabilize other coins and allow TRX to be charming with an uptrend.

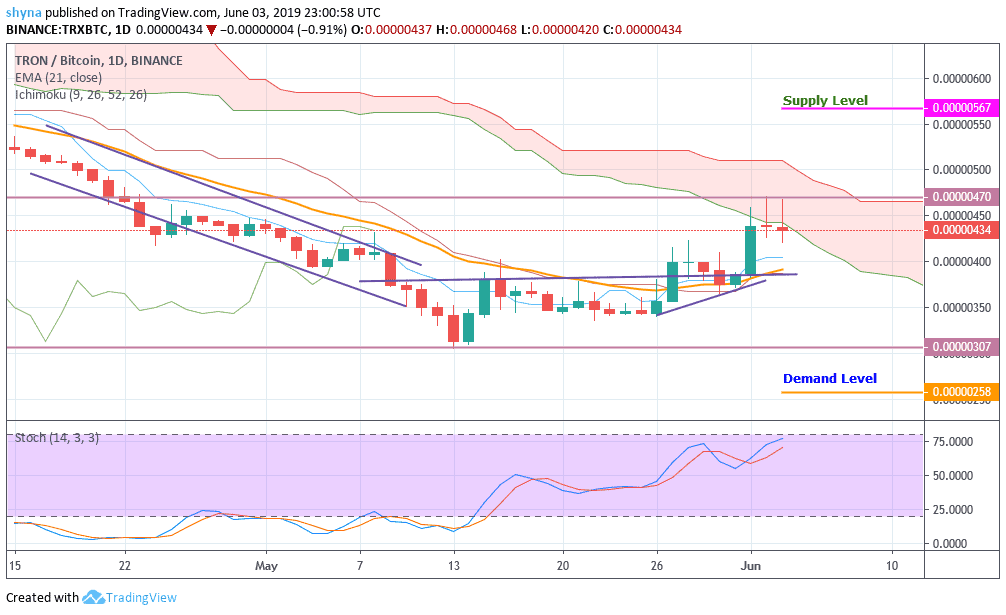

TRX/BTC Market

After reviewing the performance of TRX/USD yesterday, one can clearly see that the TRX/BTC pair has increased from the bearish territory as cryptocurrency exchanges move away from the demand level of 0.0000025BTC, which is trying to cross the indicator from the Ichimoku cloud. While this is happening, the upward trend will resume.

If the TRX gains more momentum and is trading above the Ichimoku indicator, the uptrend can reach the supply level at 0.000005BTC. For the time being, the two signal lines of the stochastic indicator are heading towards the overbought territory. If this movement continues, the price will increasingly destroy supply levels.

Please note: Insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage