Join Our Telegram channel to stay up to date on breaking news coverage

The trend based Fib extension tool on Tradingview can be useful for predicting how high an altcoin or other financial asset can rally.

Fibonacci analysis works best when the market is trending strongly either in a bullish uptrend or bearish downtrend, and is less accurate in chop or sideways consolidation price movements. Crypto markets do tend to trend strongly.

In this tutorial we’ll analyse Lucky Block’s recent price action (PA) to predict how high Lucky Block can go in 2022 and what potential price targets for traders to take profit (TP) may be.

How to use the Trend Based Fib Extension tool

Find the crypto price chart you want to do technical analysis (TA) on by entering its ticker symbol on TradingView.com or on Geckoterminal.com, the charting tool of Coingecko.

Click the magnet button in the left menu to turn on magnet mode. Then your mouse cursor will automatically snap to the top and bottom of candle wicks to make plotting Fib levels accurate.

Expand the ‘Gann and Fibonacci tools’ button in between the trend line and paint brush symbol. Select Fib retracement from the dropdown menu.

A-B-C pattern in trading, and Fib extension targets

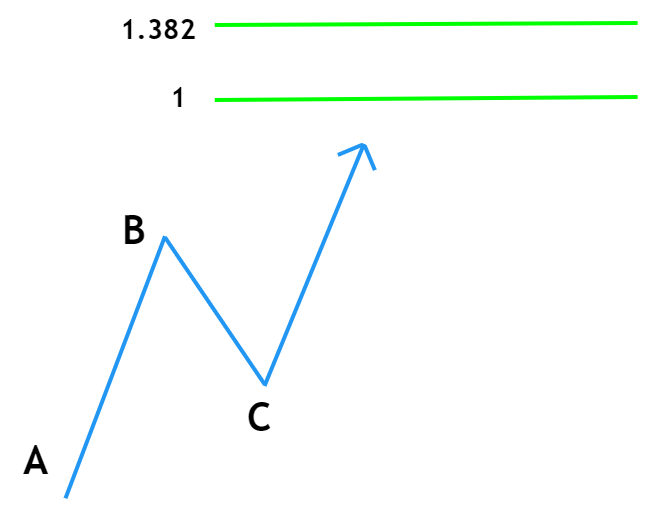

The trend based Fib extension tool requires plotting three points on the graph in an ABC pattern – in the chart above we clicked the bottom of the first daily candle, then the previous ATH, then the bottom from which the current upward move, or ‘impulse’ began.

LBLOCK is a new crypto token so the first point is the price it opened trading at, but you can also use the trend based Fib extension tool on an asset with more price history. Find any ABC move you want to predict price targets for, then start by clicking the local bottom that was formed before that moved, then the most recent swing high, then the point the impulse started from.

Then open the settings by clicking the gear button (click the end of the diagonal trend line to bring this up if you lose it) where you can adjust the color scheme and add or remove Fib levels of your choice.

Trend-based Fib extension settings

For the graph above we unchecked all the Fibs below 1 – the 0 Fib, 0.236 Fib, 0.382 Fib, 0.5 Fib, and 0.786 Fib.

These are useful for predicting Fibonacci retracement levels and where to ‘buy the dip’ on a pullback in the price, but for our chart we are predicting how high the price can rise. We left Fib levels higher than 1 checked and added the 1.382 Fib, then scrolled down to select ‘use one color’ and unticked ‘background’.

Some traders will wait for price to breakout above the recent swing high – point B – before buying or entering a long position, if it hasn’t already. In the case of our LBLOCK chart, it already has broken out above $0.003. If it failed to do so, and instead only moved up part of the way then broke down, that’s termed an ABC failure.

Two of the most important Fibonacci levels are said to be 61.8% and 161.8% – i.e. the 0.618 Fib (when looking to buy a pullback) and the 1.618 Fib (when looking to take profit). All Fib levels act as support and resistance but those two can be particularly important. 1.618 is the Golden ratio in mathematics, one divided by 1.618 is 0.618.

For strong trending assets, traders also plot higher Fib levels as targets if price goes parabolic – 2, 2.618, 3, 3,618, 4.236 are commonly used as Fib extension targets.

Lucky Block Fibonacci Targets

On the Lucky Block chart above the first daily candle to approach the 1.618 Fib closed below it, then the next wicked above it and back below it, then stalled forming a small candle body – a Doji candlestick pattern.

Doji candles represent indecision and no real control over the price action by bulls or bears. Some sellers will have chosen to exit and take profit around the 1.618 Fib as it is a resistance area when tested from below. Some buyers will have entered when price closed a 4h candle above the 1.618 Fib.

If the daily candle manages to close above the 1.618, retest it and flip it as support, that would be a sign of bullish continuation. A trader who had a limit sell order at the 2 Fib and sold some of their position there (at a price of $0.0067) would then be able to re-enter and compound their position on that retest.

Fib levels can indicate price reversal areas, so if price closes a daily candle under the 1.618 Fib a good spot to buy the dip would then be the 1.382 Fib at $0.0048, as that will now be a support area when tested from above.

Investors and traders also look for confluence with other technical indicators when using Fibonacci levels, such as exponential moving averages, e.g. the 4h 200 EMA.

Cryptocurrency markets are highly volatile and your investments are at risk.

Join Our Telegram channel to stay up to date on breaking news coverage