Join Our Telegram channel to stay up to date on breaking news coverage

The new non-fungible token lending innovation continues gaining significant adoption among crypto collectors and non-fungible token marketplaces; with a recent study from CoinGecko showcasing that the total NFT lending volume surpassed $2.1 billion in the first quarter of 2024.

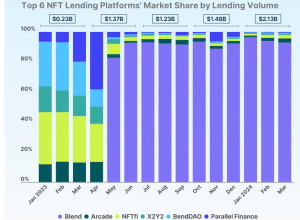

Total NFT lending volume surged to a quarterly high of $2.13B in Q1 2024, with 5 out of the top 6 NFT lending platforms seeing increased volumes.

In today's article, we'll look at the most popular platforms and their performance in the last quarter. ⬇️ https://t.co/BIOprtwhfz

— CoinGecko (@coingecko) April 30, 2024

What Is NFT Lending?

Launched sometime in 2022, NFT-backed financing, also known as “NFT lending,” is a form of decentralized finance that allows individuals to use their non-fungible tokens as collateral to acquire more crypto liquidity. The loan can be later utilized to purchase more non-fungible tokens.

NFT lending came into the spotlight last year after Blur’s NFT marketplace launched Blend, a peer-to-peer perpetual NFT lending protocol on the Blur ecosystem that allows users to borrow Ethereum liquidity using their NFTs as collateral. Since then, the NFT lending landscape has gained massive traction among NFT marketplaces and traders.

Total NFT Lending Volume Hits $2.13B In Q1 2024

The recent non-fungible token market research conducted by CoinGecko, an on-chain crypto market aggregator and a multi-chain non-fungible token market explorer, shows that the total NFT lending volume surged to a quarterly high of $2.13 billion in Q1 2024, with five out of the top six NFT lending platforms seeing increased lending volumes.

Top Six NFT Lending Platforms:

Source: coingecko.com, Top 6 NFT Lending Platform in Q1 2024

1. Blend

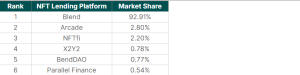

Blend, the lending protocol offered by the leading Ethereum NFT marketplace Blur, was the top NFT lending platform in Q1 2024, dominating the market with a 92.9% share. In January, Blend amassed a monthly lending volume of $869 million, $587 million in February, and $562.33 million in March 2024.

Source: coingecko.com, Top 6 NFT Lending Platforms by Market Share

Blend was launched in May 2023 and immediately captured a majority 82.7% market share in the same month. Since then, Blend’s monthly market share has remained in the lead, ranging from 88.8% to 96.5%. In Q1 2024, Blend saw its NFT lending volume jump 49.2% quarter-on-quarter (QoQ) to reach a new high of $2.02 billion.

2. Arcade NFT Lending Platform

Arcade is the second leading NFT lending platform in Q1, 2024. Built on Ethereum, Arcade is a protocol and platform combo that facilitates NFT-based peer-to-peer lending and borrowing. Arcade empowers its users to secure fixed-rate term loans by leveraging the value of their NFTs as collateral. The NFT lending platform recorded a lending volume of $9 million in January, $12 million in February and $16 million in March 2024.

3. NFTfi NFT Lending Platform

NFTfi was the third-ranking NFT platform by volume in Q1 2024. NFTfi is a peer-to-peer platform connecting NFT holders and liquidity providers directly via permissionless smart contract infrastructure. According to the CoinGecko report, NFTfi recorded a lending volume of $10 million in January, $12 million in February and $13 million in March 2024.

4. X2Y2fi NFT Lending Platform

X2Y2 Fi, an NFT lending market platform from the NFT marketplace X2Y2 designed to offer specialized financialization services for NFTs, was the fourth-ranking NFT lending platform in Q1, 2024. In January, the X2Y2 Fi recorded a non-fungible token lending volume of $5.3 million, $6.6 million in February and $4.7 million in March 2024.

5. BenDAO NFT Lending platform

BenDAO, an NFT lending service renowned for allowing users to take loans of up to 40% of their collateral, was the fifth leading NFT lending platform in Q1,2024. The lending platform recorded a lending volume of 2.8 million in January, $3.2 million in February and $4.6 million in March 2024.

6. Parallel Finance NFT Lending Platform

Parallel Finance, the DeFi Super App renowned for encompassing lending, staking, trading, buy now, pay later, and more within a single platform, was the sixth leading NFT lending platform in Q1, 2024. The NFT lending platform recorded a lending volume of $3.1 million in January, $2.5 million in February and $3.2 million in March, closing the top six NFT lending platforms in Q1 2024.

The total NFT lending volume across the six NFT lending platforms reached a quarterly high of $2.13 billion last quarter, representing a growth of 43.6% QoQ as 5 of the six biggest NFT lending platforms experienced higher volumes. In particular, January 2024 saw a record $0.90 billion in total monthly NFT lending volume, surpassing the previous high of $0.85 billion in June 2023.

1/ Our study shows that the total NFT lending volume reached a quarterly high of $2.13 billion last quarter, representing a growth of 43.6% QoQ as 5 of the 6 biggest NFT lending platforms experienced higher volumes.

Read the full study: https://t.co/PYsCz8ke9l pic.twitter.com/eOXubBI4Vf

— CoinGecko (@coingecko) April 25, 2024

To deliver a factual and actual report, the CoinGecko study team examined the top NFT lending platforms by monthly lending volume from January 2023 to March 2024, based on reliable sources, including Dune Analytics, NFTfi Foundation, Beetle and Arcade XYZ.

Related NFT News:

- CoinGecko NFT Market Report For Q1 2024

- Magic Eden Joins APhone To Bring DePIN Experience To The Solana NFT Community

- Snoop Dogg Partners With Footwear Brand Skechers To Launch NFT-Branded Sneakers

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage