Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market is gaining momentum, with many analysts predicting a strong February for altcoins. This potential surge could signal the beginning of the next phase of the broader crypto bull run. Historically, such periods of growth have often led to an “altcoin season,” where altcoins outperform Bitcoin in terms of gains.

Institutional interest in digital assets continues to rise, further fueling market optimism. The approval of Bitcoin ETFs provided a significant boost, and anticipation surrounding Ethereum ETFs has added to the enthusiasm. These developments will likely attract more investors, increasing liquidity and increasing altcoin prices. With a potentially exciting month ahead, market participants are looking for the top cryptocurrencies to buy now.

Top Cryptocurrencies to Buy Now

THORChain is exchanging hands at $1.32, experiencing a 12.90% rise over the past 24 hours. Meanwhile, Solaxy has successfully raised over $17 million during its presale, signifying a significant achievement in funding. Additionally, Uniswap has introduced its V4 upgrade, enhancing the functionality of its decentralized exchange.

1. THORChain (RUNE)

THORChain is a decentralized liquidity protocol enabling users to swap cryptocurrencies across blockchains, such as Bitcoin and Ethereum, without giving up control of their assets. It is a cross-chain solution for wallets and exchanges, including Trust Wallet and Ledger Live.

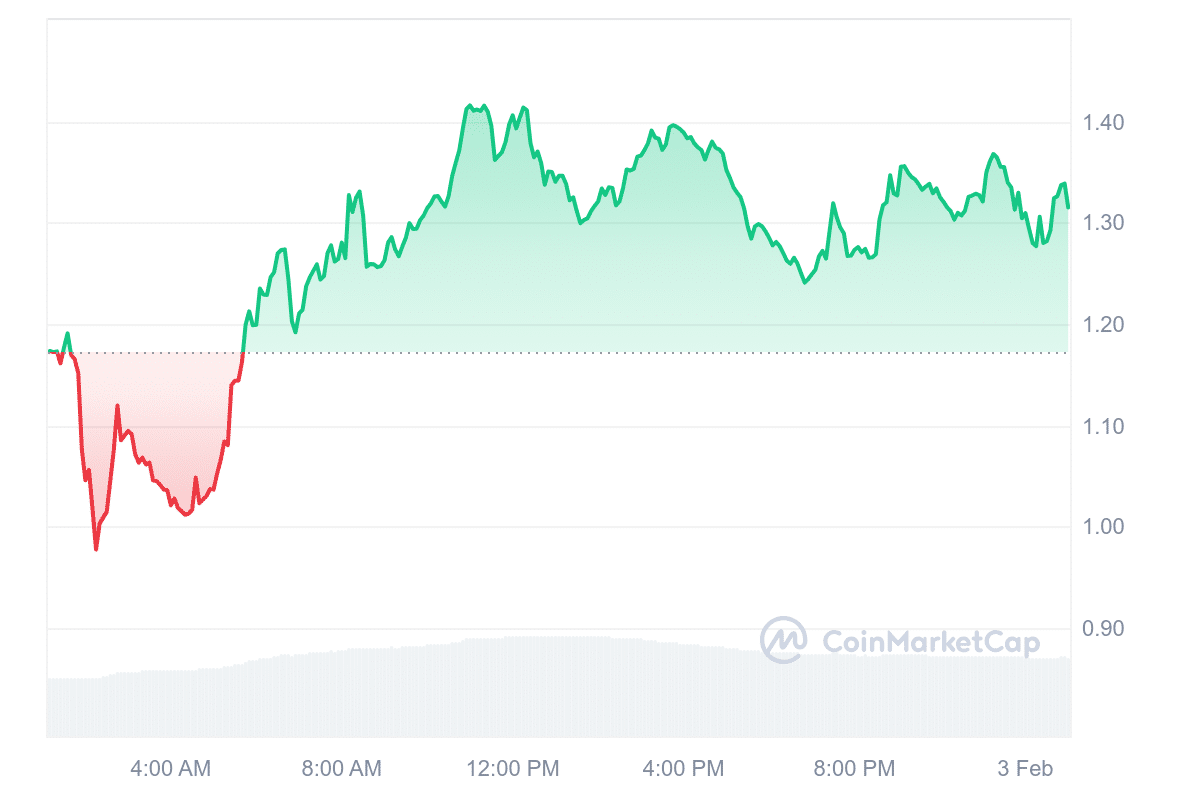

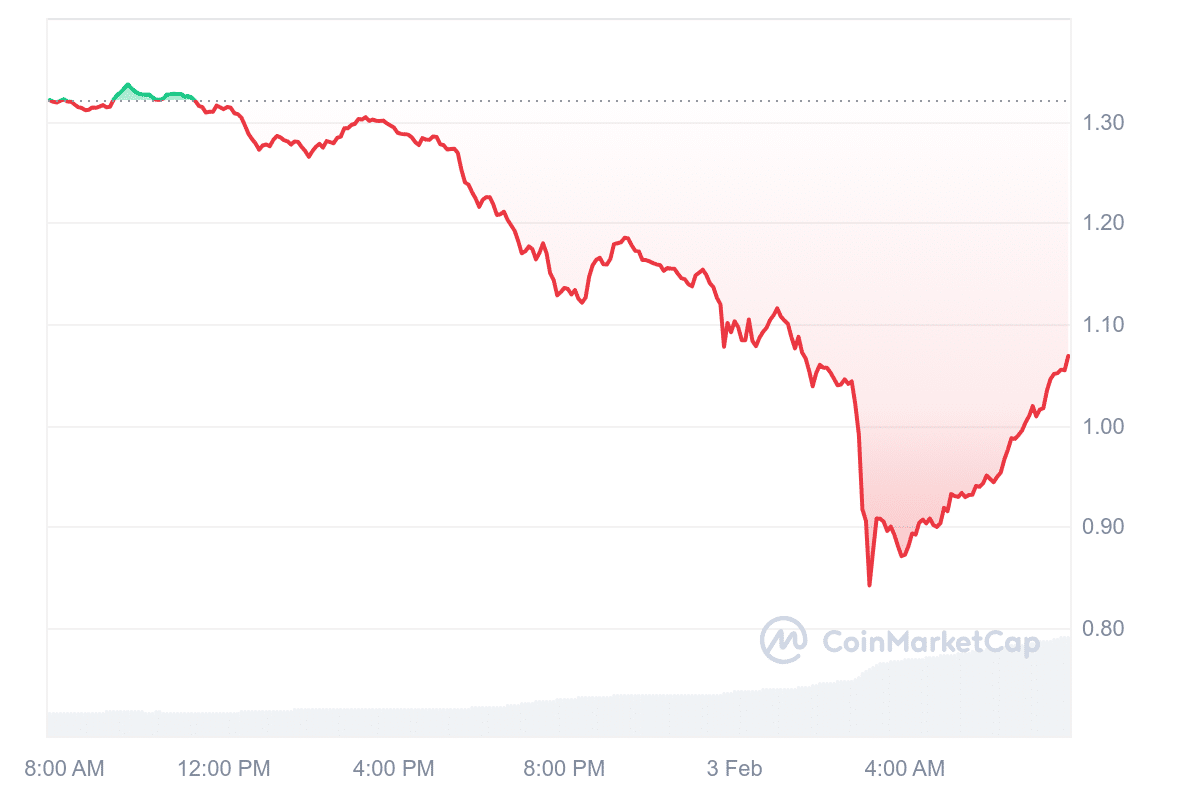

Furthermore, THORChain maintains market prices through liquidity pools, adjusting prices based on the ratio of assets in each pool. At the time of writing, THORChain is priced at $1.32, reflecting a 12.90% increase in the last 24 hours. Despite this growth, market sentiment remains bearish. The Fear & Greed Index, which measures market emotions, sits at 60, indicating a level of greed among investors.

The token has a relatively high trading volume compared to its market cap, suggesting good liquidity. The 14-day Relative Strength Index (RSI) stands at 59.67, placing THORChain in a neutral zone, meaning it is neither overbought nor oversold. This suggests the price may move sideways rather than experience significant swings in the short term.

THORChain’s price has shown moderate volatility, with a 30-day volatility of 28%, staying below the 30% threshold. Based on current trends, predictions estimate a potential 12.28% price increase, reaching approximately $1.44853 by March.

2. Render (RENDER)

Render (RNDR) is a decentralized platform that allows users to rent out unused GPU power for tasks like AI processing, 3D rendering, and metaverse applications. The platform distributes computing workloads across a network of participants, offering an alternative to traditional cloud-based services. It further supports industries requiring high-performance computing while making GPU resources more accessible.

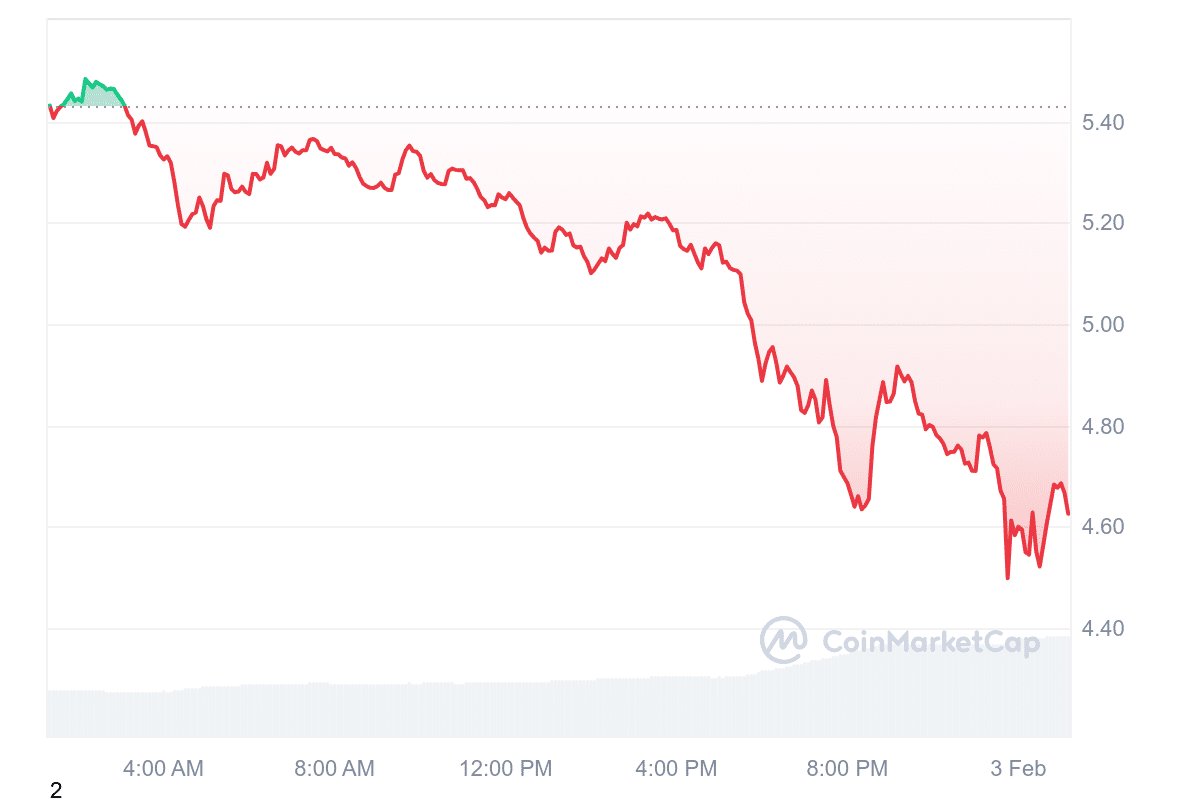

Currently, RNDR is trading at around $4.63, with its price fluctuating between $4.49 and $5.49 over the past 24 hours. The token has a high trading volume relative to its market cap, suggesting strong liquidity. The 14-day Relative Strength Index (RSI) sits at 44.62, indicating neutral momentum and a potential for sideways movement in the short term.

The increasing demand for AI and cloud-based rendering contributes to Render’s relevance. It addresses a growing need for distributed computing power, especially as AI-driven applications and virtual environments expand. Render’s role in decentralized GPU computing makes it one of the top cryptocurrencies to buy now.

3. Solaxy (SOLX)

Solaxy has raised over $17 million in its presale, marking a notable funding milestone. It introduces Solana’s first Layer-2 scaling solution, aiming to address ongoing network congestion and performance issues. Solana is known for fast transactions and low fees, but increased activity has exposed its limitations.

Furthermore, Solaxy seeks to resolve these by offloading transactions while securing them on Solana’s main blockchain. This approach improves efficiency without altering the network’s core structure.

Unlike other Layer-2 solutions primarily focusing on scaling, Solaxy also supports cross-chain compatibility. This feature allows users to interact with different blockchain ecosystems, expanding functionality beyond Solana. The platform also offers stability for decentralized applications (dApps) and smart contracts, making it easier for developers to build reliable projects without network slowdowns.

One of Solaxy‘s key advantages is its ability to maintain fast transactions during peak usage. The platform ensures smoother trade execution and enhances the overall user experience by reducing processing loads.

This is particularly relevant for traders and decentralized finance (DeFi) applications that rely on speed. The project positions itself as a long-term solution rather than a temporary fix. As network activity continues to rise, solutions like Solaxy could help maintain Solana’s efficiency.

4. Uniswap (UNI)

Uniswap recently launched its V4 upgrade, improving its decentralized exchange. The update focuses on reducing gas fees, speeding up transactions, and providing developers with more tools to customize trading strategies. One of the main features is “hooks,” which allow developers to add custom code directly to Uniswap.

This flexibility could encourage innovation within the platform rather than push developers to create competing exchanges. Another change is the “singleton” contract architecture, which consolidates all liquidity pools into a single contract. This structure reduces transaction costs by optimizing gas usage.

Additionally, Uniswap has reintroduced native Ether support, removing the need for wrapped Ether (WETH) in trades. These changes aim to make transactions more efficient and cost-effective for users.

Uniswap v4 is here🦄

Users can LP on v4 through the Uniswap web app and swapping is rolling out over the coming days on web and wallet as liquidity migrates to v4

Live on Ethereum, Polygon, Arbitrum, OP Mainnet, Base, BNB Chain, Blast, World Chain, Avalanche, and Zora Network pic.twitter.com/fXC9GHEsaL

— Uniswap Labs 🦄 (@Uniswap) January 31, 2025

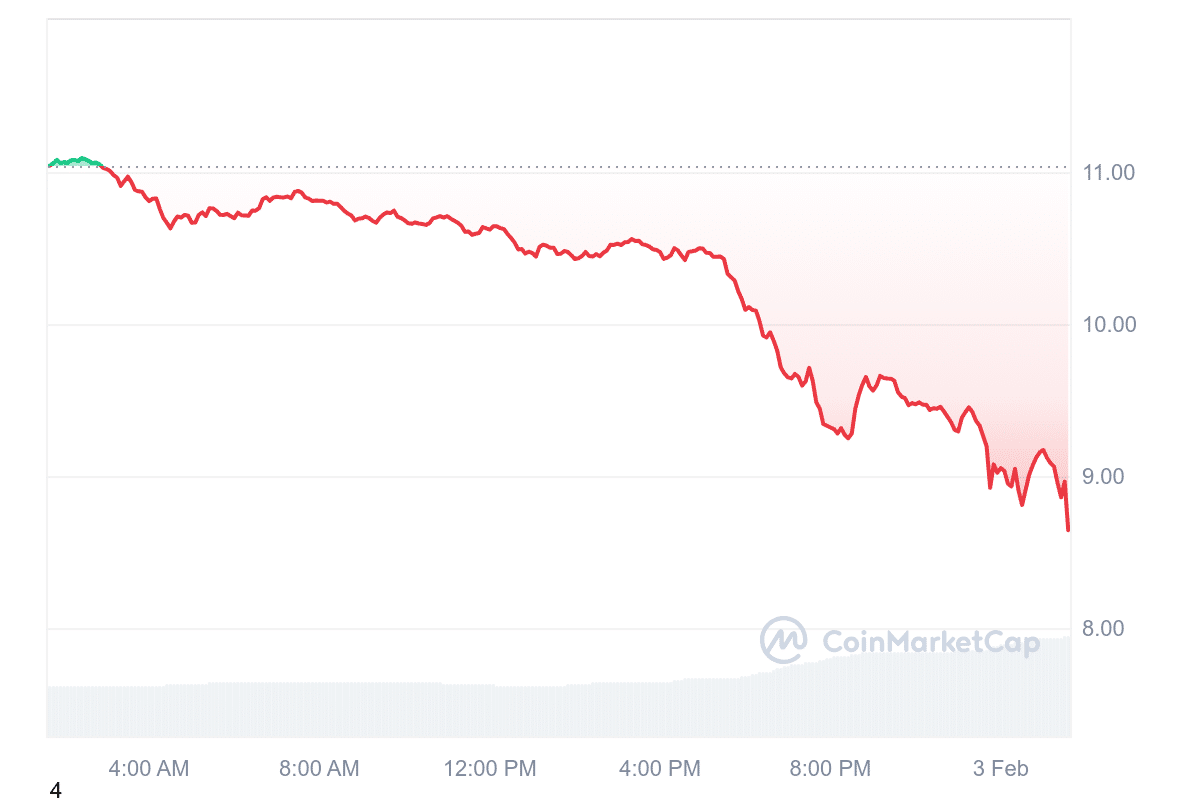

Despite the technical improvements, UNI, Uniswap’s native token, has not shown a strong price surge following the upgrade. It is trading at $8.78, up 20.63% in the past day. However, market sentiment remains bearish. The Fear & Greed Index shows a reading of 60, indicating market participants lean toward greed.

The 24-hour volume-to-market cap ratio stands at 0.1330, reflecting moderate liquidity. Uniswap’s yearly inflation rate is low at 0.39%. The upgrade provides a more efficient and flexible trading experience, but its long-term impact on adoption and token performance remains uncertain.

5. Optimism (OP)

Optimism (OP) is focused on improving transaction speed and reducing costs. It achieves this through optimistic rollups, which bundle multiple transactions and process them off-chain. While the transactions occur on Optimism, their security relies on the Ethereum mainnet, offering users efficiency and safety.

The project prioritizes sustainability and refrains from quick fixes for scaling. Instead, it uses Ethereum’s existing consensus mechanism to enhance performance. By leveraging optimistic rollups, Optimism can manage more transactions without compromising Ethereum’s integrity.

Early teams like @flaunchgg, @CreateMyToken, @inkyswap and @_proxystudio (Clanker), have already integrated the SuperchainERC20 token standard.

This means that tokens deployed from their launchpads can be interoperable across the Superchain on day one.

Who is next? pic.twitter.com/pcpPcd3Ouw

— Optimism.eth (@Optimism) January 31, 2025

Currently, the price of Optimism stands at $1.07, reflecting a recent drop of 19.12% within the last 24 hours. Despite this decline, the token trades close to its recent high of $1.07676. Its 24-hour trading volume to market cap ratio is 0.8285, suggesting active trading relative to its size.

Moreover, the asset appears neutral with a 14-day Relative Strength Index (RSI) of 48.63, indicating no strong trend in either direction. The 30-day volatility rate is 11%, suggesting relatively stable price movements over the past month. Price predictions for Optimism suggest potential growth, with estimates indicating a possible rise to $3.62 by March.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage