Join Our Telegram channel to stay up to date on breaking news coverage

In the crypto market, what often distinguishes a winning investor from a losing one is access to strategic information. As the digital space evolves, staying ahead of trends and understanding emerging assets becomes crucial. Today, we spotlight the top crypto gainers, showcasing Brickken, Axelar, Stacks, and Centrifuge. These tokens have recently captured attention due to their impressive price movements and innovative solutions. Join us as we analyze the data that could help you navigate this dynamic market and seize opportunities for growth.

Biggest Crypto Gainers Today – Top List

As we explore today’s top crypto gainers, understanding the market context is crucial. The global cryptocurrency market cap is currently $2.18 trillion, with a -3.44% change in the last 24 hours. Additionally, the market sentiment is bearish, reflected by a Fear & Greed Index at 37 (Fear). This shows caution among investors, as only 17% of cryptocurrencies have gained value recently.

Thus, identifying tokens with strong momentum is key to maximizing returns. Here, we’ll also highlight essential metrics like price movements, liquidity, and trading volume to show what makes these assets stand out.

1. Brickken (BKN)

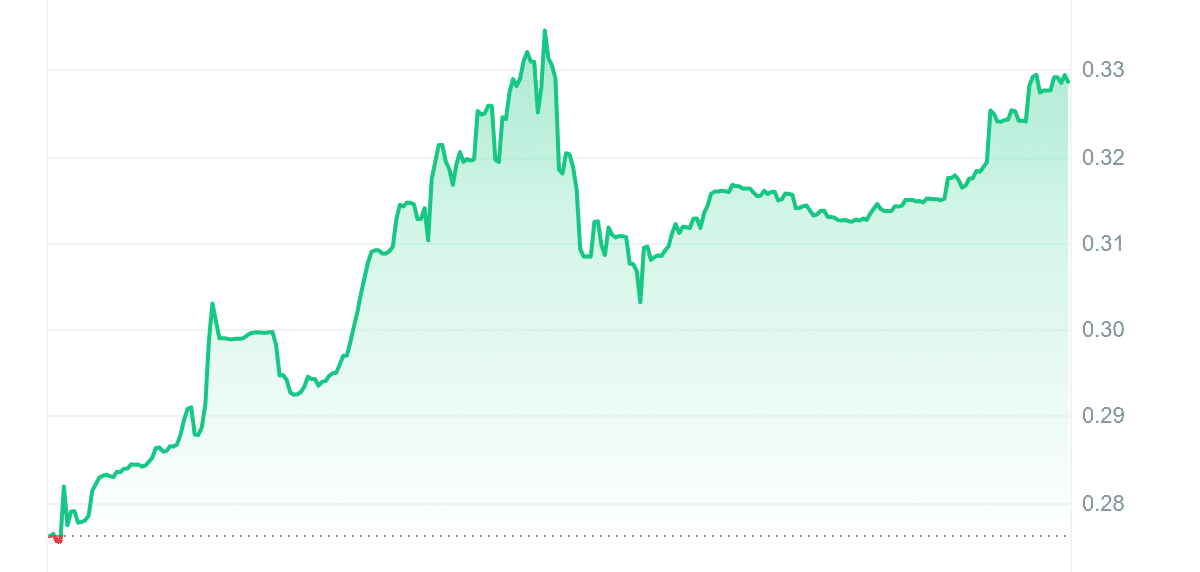

Brickken has taken the spotlight today with an impressive 19.21% surge, bringing its price to $0.329973. This sharp rise highlights the growing interest in the token, especially as it reaches a crucial milestone in its Total Value Locked (TVL), which now exceeds $12M. With this achievement, Brickken has solidified its position in the RWA category, ranking #28 overall and #2 on the Binance Smart Chain (BSC).

Liquidity isn’t an issue for Brickken, boasting a volume-to-market-cap ratio of 0.0471, indicating ample room for transactions without major price swings. However, the 14-day RSI of 65.72 suggests the token isn’t overbought, hinting at potential sideways movement in the short term. Over the past 30 days, Brickken had 17 green days, marking a positive trend with relatively low volatility at 27%.

🏆 TVL Milestone Unlocked! 🏆

Brickken's Total Value Locked (TVL) has surged past $12M, showcasing the trust and momentum behind our Digital Asset Platform.

🌐 BKN TVL Rankings by Chain:

🔹Overall RWA Category: #28

🔹Binance Smart Chain (BSC): #2

🔹Base: #5

🔹Ethereum: #20… pic.twitter.com/rE4XGRYP7E— Brickken (@Brickken) October 2, 2024

With such strong short-term performance, it’s worth taking a closer look at what the project is all about. Brickken is transforming the tokenization of Real World Assets (RWA) through its cutting-edge platform. Its plug-and-play solution allows businesses to tokenize assets with ease. Moreover, it offers advanced tools for on-chain asset management, investor portals, and real-time campaign tracking.

Analysing its price movement deeper, its long-term performance also looks promising. In the past year, Brickken has soared by 280%, outperforming 84% of the top 100 crypto assets. As it continues to push boundaries, especially as part of the European Blockchain Sandbox, Brickken is well-positioned to revolutionize asset digitization on a global scale.

2. Axelar (AXL)

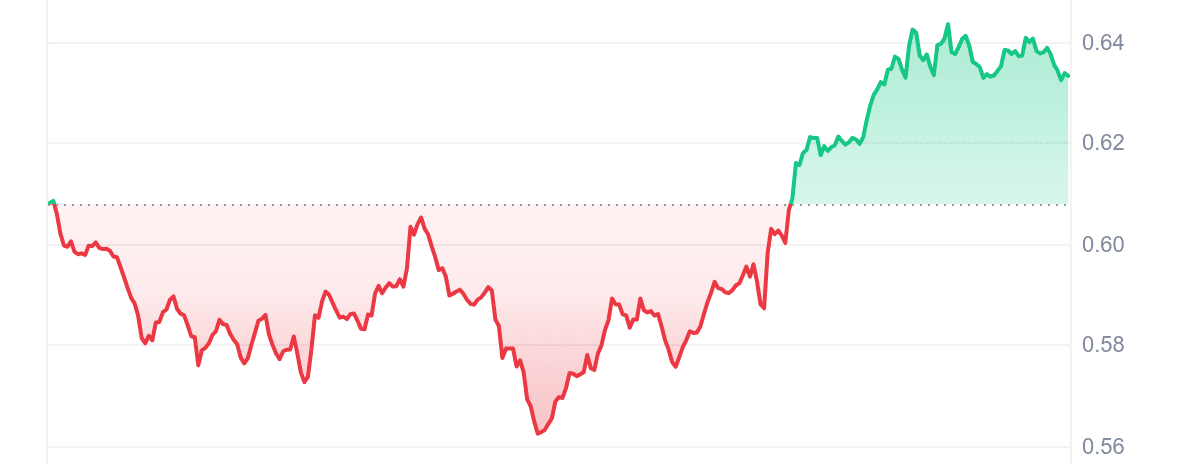

Axelar is truly making waves in the crypto space today! With a current price of $0.634713, it has experienced an impressive 5.31% increase in the last 24 hours. This surge is particularly noteworthy, especially considering its high liquidity, reflected in a solid volume-to-market cap ratio of 0.1580.

Moreover, the 14-day Relative Strength Index (RSI) sits at 54.13, indicating a neutral position. This suggests that the cryptocurrency may trade sideways for the time being. Notably, the last 30 days have seen 57% of the trading days in the green, indicating positive momentum and investor confidence.

When we look at long-term performance, Axelar shines even brighter. Currently, it is trading a remarkable 32.82% above its 200-day Simple Moving Average of $0.477891. Over the past year, its price has skyrocketed by 88%, besting 59% of the top 100 crypto assets. These metrics clearly demonstrate a robust upward trend.

1/ When we set out to build our node sale contract, we had a choice: take the easy route or do what’s right.

We chose the trustless path. Sale contract is designed to run on any EVM chain and sync with our NFT contract on @0xMantle, powered by @axelar.https://t.co/8wrwTyBIOO

— Chasm (@ChasmNetwork) September 28, 2024

This project aims to provide secure cross-chain communication for Web3, offering a decentralized network and tools that simplify interactions for developers. With its proof-of-stake consensus, Axelar ensures robust network security while enhancing accessibility.

What truly sets Axelar apart is its commitment to secure communication through a dynamic validator network. Unlike many competitors using optimistic setups, it builds its capabilities on Proof-of-Stake. This approach enables developers to create applications effortlessly, improving access to the decentralized web. Backed by major investors like Binance and Coinbase Ventures, Axelar is set for significant future growth.

3. Flockerz (FLOCK)

Flockerz is shaking up the meme coin world with a new approach. Unlike most meme coins that burn out quickly, Flockerz focuses on building a loyal community through true decentralization and long-term growth. It’s giving investors real power and profit, starting with its innovative vote-to-earn model.

It’s time to make your voice heard 🗳️🐦 pic.twitter.com/FsM5ekPq5g

— Flockerz (@FlockerzToken) October 1, 2024

The presale has already raised an impressive $375,000, attracting a growing base of investors. Early buyers not only get discounted tokens but also access to generous staking rewards. The staking model offers a huge APY of over 6,074%, making it one of the most rewarding opportunities in the market right now. However, the APY decreases as more investors join, so getting in early is crucial.

Security is a top priority for Flockerz. The project has undergone rigorous audits by Coinsult and SolidProof, ensuring that everything is transparent and secure. This level of protection is essential for building trust, especially in the meme coin space where risks are high.

Flockerz is also backed by a clear roadmap designed for long-term growth. Global marketing campaigns are already underway, and the full launch of the vote-to-earn model is on the horizon. With the presale still live and the price set to rise, now is the best time to jump in and grab your $FLOCK tokens.

4. Stacks (STX)

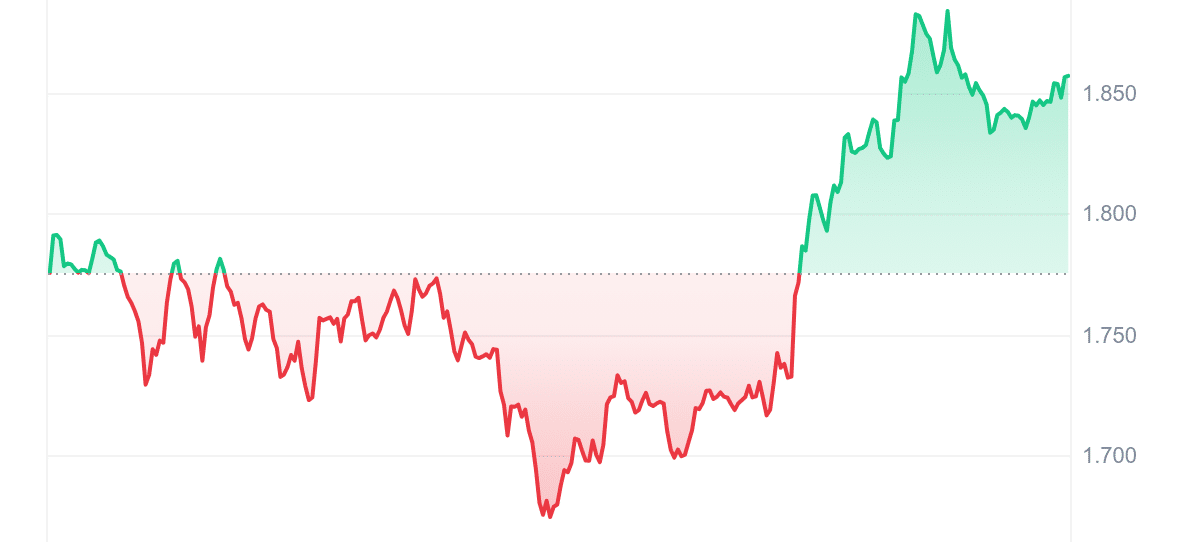

Stacks is also turning heads today with a 4.17% surge, bringing its price to $1.858736. As transaction costs on the Bitcoin chain rise, the Nakamoto upgrade makes Stacks a more efficient and cost-effective alternative. Plus, with a strong 0.1351 volume-to-market-cap ratio, liquidity is no issue.

Meanwhile, the token’s 14-day RSI is at 37.18, indicating it’s neutral and may move sideways. Yet, in the past 30 days, 57% of them were green, reflecting solid momentum. On top of that, volatility is low, sitting at just 12%, ensuring a stable short-term outlook.

What makes Stacks special? It’s a Bitcoin Layer for smart contracts, unlocking over $500B in BTC capital for decentralized applications. Thanks to its Proof of Transfer and Clarity language, it seamlessly interacts with Bitcoin while securing transactions with 100% Bitcoin hash power.

Taking a broader analysis of its performance in the long term, Stacks is even more remarkable. It’s trading 91.41% above its 200-day SMA, showing significant strength. In fact, its price has soared by 287% over the last year, outperforming 84% of the top 100 crypto assets.

GM to every Stacks community member for whom "Nakamoto" means more than just the creator of the hardest money 🟧 pic.twitter.com/W5iuxc10AY

— stacks.btc (@Stacks) October 1, 2024

Beyond price, Stacks is also reshaping decentralized finance (DeFi) on Bitcoin. Developers and businesses can leverage its platform to create secure, scalable, Bitcoin-based decentralized applications. All of this makes it one of today’s top gainers worth watching.

5. Centrifuge (CFG)

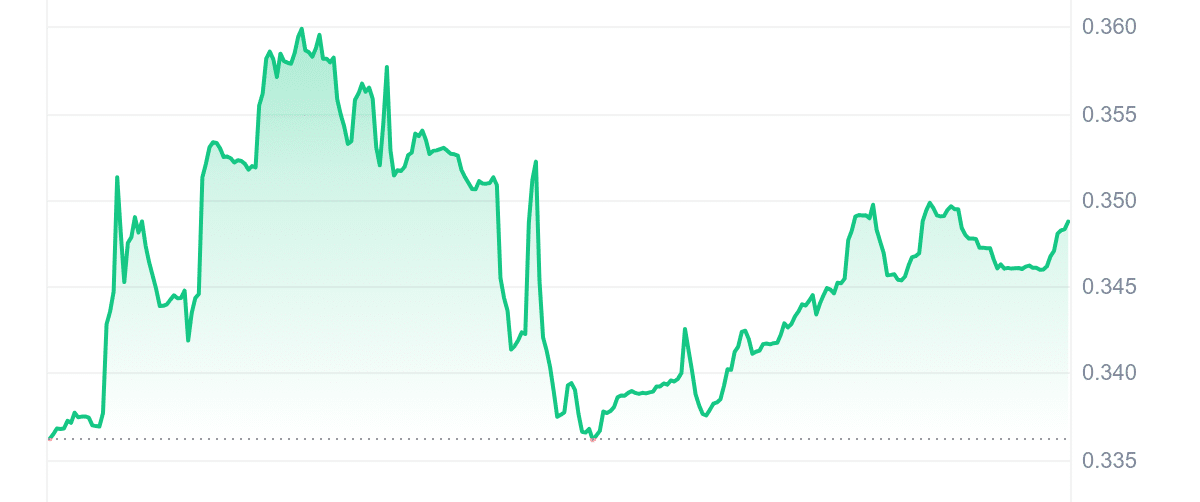

Centrifuge proudly claims its position as the final gainer among today’s top crypto assets. Currently, the price of CFG is $0.348629, showcasing a notable increase of 3.46% in just the last 24 hours. However, while the price movement is promising, it’s essential to recognize that liquidity remains low, with a volume-to-market cap ratio of only 0.0044.

Transitioning to market behavior, the 14-day RSI stands at 55.18, suggesting a neutral trend without signs of overbought conditions. Moreover, in the last 30 days, the cryptocurrency experienced 14 positive trading days, which accounts for 47% of the time. Importantly, the 30-day volatility remains low at just 6%, indicating a stable price environment.

Shifting the focus to long-term performance, Centrifuge currently trades 10.34% below its 200-day SMA of $0.38884. Despite this, the price has appreciated by 24% over the past year. Remarkably, Centrifuge has outperformed 38% of the top 100 crypto assets, showing its resilience in a competitive market.

The number of Tokenized T-Bills in the @centrifuge Liquid Treasury Fund continues to grow…

So what?

T-Bills are backed by the government. Now, they’re on-chain.

No banks, no brokers. Just direct access through the decentralized blockchain.

Centrifuge, secured by Polkadot. pic.twitter.com/EGzxcWgv5z

— Polkadot (@Polkadot) September 27, 2024

Nevertheless, what truly distinguishes Centrifuge is its role as a decentralized asset financing protocol. It bridges DeFi with real-world assets, aiming to lower capital costs for small and mid-sized enterprises. By tokenizing real assets as collateral, Centrifuge provides liquidity through its lending DApp, Tinlake.

Moreover, converting real-world assets into non-fungible tokens (NFTs) opens new financing opportunities. Borrowers can fund their assets without traditional banks, offering a fresh approach to asset management. Ultimately, Centrifuge is redefining asset financing and enhancing financial inclusivity in the DeFi space.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage