Join Our Telegram channel to stay up to date on breaking news coverage

The recent US regulatory shift toward approving exchange-traded funds for Ether has sparked increased optimism about its potential gains. This development spurred a 26% surge in Ether’s value over the past week, its most significant weekly gain since the 2021 crypto bull market. This surge reflects increasing confidence in Ether’s outlook, especially given the success of US spot-bitcoin ETFs, accumulating $59 billion in assets.

However, uncertainties persist regarding investor appetite for Ether compared to Bitcoin, given its lesser-known status. Spot-Ether ETFs may face limited appeal due to their exclusion from staking, dampening interest versus direct token ownership. As with the volatile crypto market, only time will tell if these developments will sustain Ether’s upward trajectory.

Biggest Crypto Gainers Today – Top List

Starting the week with bullish sentiment, only 36% of cryptocurrencies experienced value gains in the last 24 hours amidst a total trading volume of $ 334.05B. Today’s top crypto gainers—Flux, Decred, SafePal, and WOO Network—distinguish themselves through unique project features and significant price growth.

Flux leads with its Proof of Useful Work initiative, fostering Web3 innovation. Decred’s hybrid consensus approach ensures active network governance participation. SafePal excels in providing secure asset management solutions. WOO Network is a beacon for fostering liquidity and security in centralized and decentralized finance. Let’s investigate their utility and innovative approaches driving crypto adoption and growth.

1. Flux (FLUX)

With around 15,000 decentralized nodes globally, Flux is the largest decentralized network to foster the Web3 decentralized Internet. It boasts robust computational resources and a commitment to innovation. Flux’s unique Proof of Useful Work (PoUW) initiative transforms traditional PoW chains.

It redirects GPU-mined computational power to solve real-world challenges, thus enhancing blockchain sustainability and utility. FLUX fuels the ecosystem, enabling resource purchases and node collateralization on FluxOS. Additionally, it rewards miners and FluxNode operators for computational contributions.

Flux announced the launch of its Fiat Payments OnRamp Solution integration with PayPal on May 23. This simplifies app deployment on FluxOS with fiat currency. It bridges the gap between traditional fiat currencies and the decentralized ecosystem.

You can now deploy #apps on our FluxOS using fiat currency, eliminating the need to hold cryptocurrency.

Learn more in @BusinessInsider 👇https://t.co/gQIwL44Bya

— Flux-Web3 Cloud (@RunOnFlux) May 23, 2024

Hence, it opens new possibilities for online commerce, cross-border payments, and financial inclusion. This integration allows users to transact seamlessly within the decentralized space, with standardized security measures to protect their transactions.

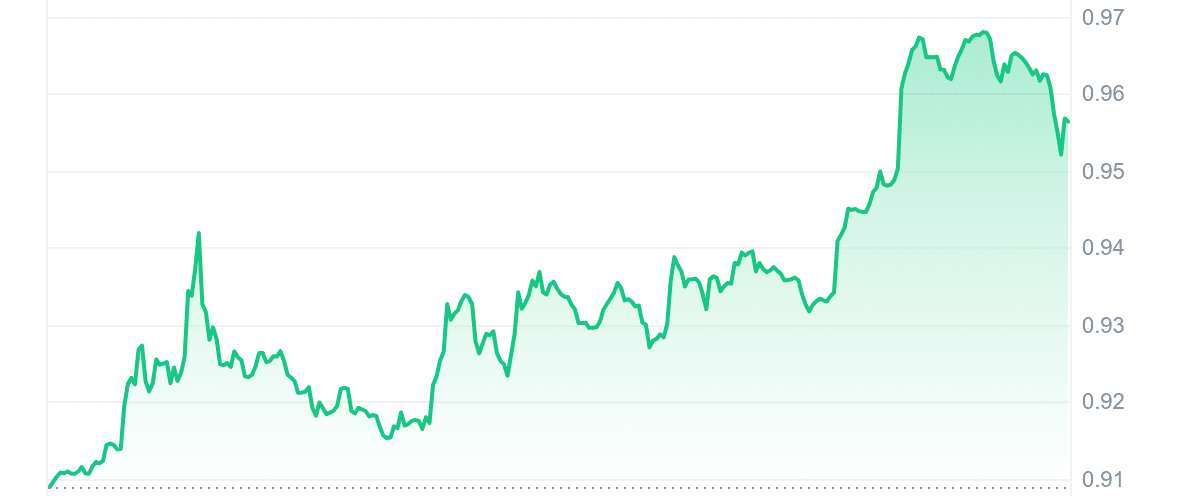

FLUX currently trades 114.49% above its 200-day SMA at $0.445299, with a 96% price surge over the past year. With a 14-day RSI of 59.63 indicating neutrality, it maintains 40% positive trading days in the last 30, alongside a 3% 30-day volatility. Although liquidity stands at a medium level, recent partnerships position Flux for continued growth and adoption within Web3.

2. Decred (DCR)

Decred represents an advanced approach to cryptocurrency. It combines Proof-of-Work (PoW) and Proof-of-Stake (PoS) mechanisms. This dual system ensures that miners and coin holders actively contribute to the network’s security and governance.

Miners validate transactions and create new blocks in the PoW component, ensuring the network’s security through computational power. In the PoS element, coin holders stake their coins to vote on proposals and validate transactions. Thus aligning stakeholder interests with the project’s success.

Block rewards are distributed among miners, stakeholders, and the Decred Treasury, ensuring a balanced incentive structure for immediate security and long-term development. The Treasury, funded by block rewards, supports project development, marketing, and initiatives decided through stakeholder voting.

Decred v2.0.0 is out!

This is a new major release of dcrd, Decred's full node.

Some of the key highlights are:

– Decentralized StakeShuffle mixing

– Higher network throughput

– Lightweight client sync time reduced by around 50%

– Improved initial peer discovery pic.twitter.com/Re4uDS1NsR— Decred (DCR) (@decredproject) May 21, 2024

Furthermore, Decred’s governance revolves around its Constitution and the Politeia proposal system. The Constitution establishes the core principles of the project, while Politeia empowers stakeholders to suggest, debate, and vote on alterations, including revisions to the Constitution itself.

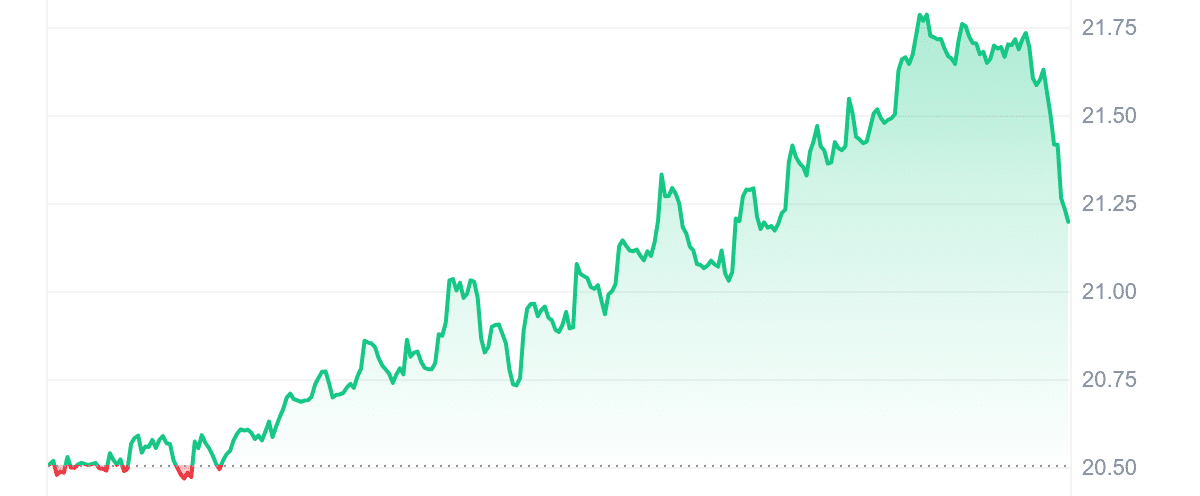

The current price of DCR is $21.23, reflecting a 3.52% increase in the last 24 hours. Also, the price has risen by 28% over the past year, now trading 19.04% above its 200-day SMA of $17.84. It shows moderate positivity, with 13 green days in the past 30 days. The 14-day RSI is 44.14, indicating a neutral market stance. The 30-day volatility is low at 5%, and the volume-to-market cap ratio is 0.0059, indicating low liquidity.

3. WienerAI (WAI)

The WienerAI project generates considerable excitement, which is evident in its successful presale, which has amassed over $3 million from eager crypto lovers. Early investors can purchase WAI tokens at a mere $0.00071 during this presale phase. This AI-centric meme coin holds promise for more substantial growth due to its focus on artificial intelligence.

3 Million raised!

As holder count grows, so does the anticipation for launch and the AI trading bot release!!

🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭 pic.twitter.com/Y19TEbKwjc

— WienerAI (@WienerDogAI) May 26, 2024

Using a multi-stage presale, WienerAI implements a timed approach to create urgency within a set conclusion timeline. This strategy ensures fair token distribution, promoting initial growth and stability.

Its roadmap unfolds in three stages. Firstly, WienerAI embarks on marketing and social media establishment. Secondly, upgrades and potential AI-driven application launches are anticipated alongside community expansion. Lastly, the project aims to list major centralized cryptocurrency exchanges, focusing on global platforms.

It designates 30% of its total token supply to the ongoing presale, offering early adopters favorable entry opportunities. This allocation also aids in project development by raising funds. Staking, accounting for 20% of the supply, incentivizes long-term holding and ecosystem stability by offering daily rewards.

Additionally, 10% is allocated to DEX/CEX liquidity to bolster token stability upon exchange listing. Another 20% is earmarked for marketing initiatives, including outreach programs and airdrops, targeting WienerAI community of followers.

4. SafePal (SFP)

SafePal offers hardware and software wallets through its SafePal App, ensuring secure storage and management of assets on mobile devices. It is the first hardware wallet supported by Binance, providing a secure environment for managing digital assets.

The SFP token is a BEP-20 token that supports various crypto-assets, including those on Ethereum, Binance Smart Chain (BSC), and TRON. It offers discounts, incentivizes users, and acts as the governance token for proposing and voting on new features.

SafePal offers an array of exceptional products designed to meet the diverse needs of its users. SafePal S1 Hardware Wallet, an offline wallet supporting over 30 blockchains and 10,000+ cryptocurrencies, embeds advanced security features. The SafePal Cypher protects mnemonic phrases against various hazards. It also introduces innovative features like the WHO Wallet Holder Offering and GiftBox, which reward users and facilitate learning about new projects.

New @iSafePal App Version 4.6.2 is live!

🔹Added support for @ton_blockchain Network tokens

Download @iSafePal Wallet App https://t.co/MyahnvHWAT https://t.co/AsUyF0p19c

— SafePal – Crypto Wallet (@iSafePal) May 27, 2024

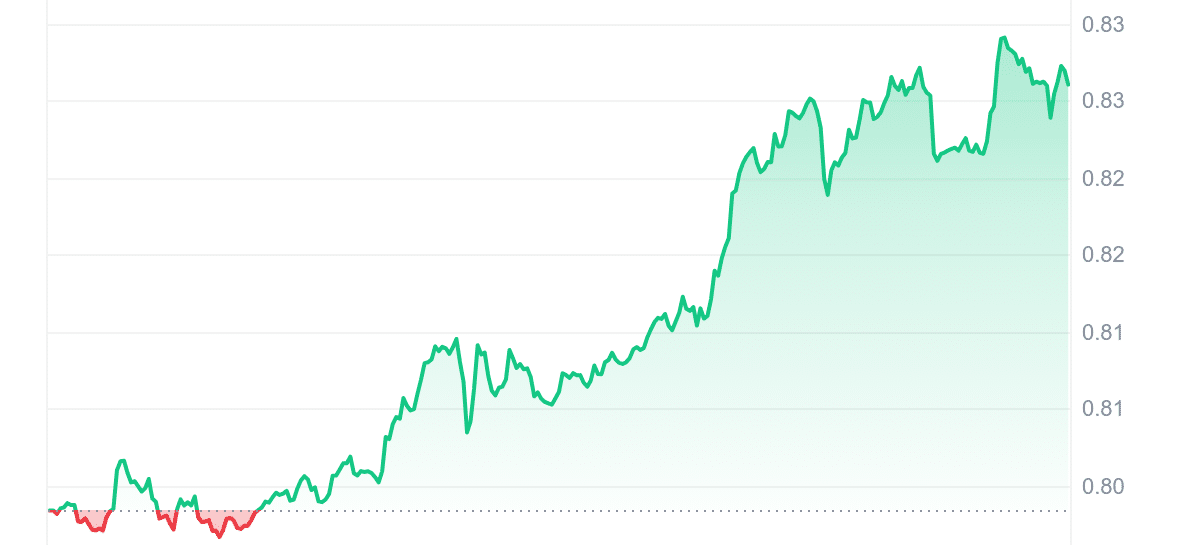

SFP’s is now priced at $0.827199, marking a 3.50% increase in the last 24 hours and a 102% increase over the past year. It exhibits medium liquidity, with a 30-day volatility of 2% and a volume-to-market cap ratio of 0.0219.

In addition, SFP trades 41.86% above the 200-day SMA of $0.583112, indicating stability. The 14-day RSI at 56.59 indicates a neutral stance with potential sideways movement ahead. Moreover, the last 30 days, 14 days have been positive, accounting for 47% of the total, indicating moderate market activity.

5. WOO Network (WOO)

WOO Network connects traders, exchanges, and institutions by providing superior liquidity and trading execution at minimal costs. Its token, WOO, facilitates centralized and decentralized finance activities such as staking, fee discounts, and access to exclusive features.

WOO X and WOOFi are critical platforms in this network. WOO X is a high-performance, centralized trading platform. It offers superior liquidity, execution, and advanced trading tools for spot and perpetual futures. WOOFi is a decentralized application offering swaps, staking, and yield-generating pools across multiple blockchain networks like Arbitrum and Avalanche.

Security in the WOO Network is ensured through centralized and decentralized measures. Centralized security practices, such as two-factor authentication, anti-phishing codes, and AML compliance, safeguard user accounts and transactions. Deep liquidity acts as a shield against market manipulation. Meanwhile, zero-fee trading options spark user interest, boosting platform activity and reinforcing security.

Why has WOO adopted @LayerZero_Labs's Omnichain Fungible Token (OFT) standard on @MerlinLayer2 and Ethereum? This pivotal move maximizes $WOO utility, enabling seamless transfers across networks without fees or slippage.

Learn more:https://t.co/Lvw07sSSu7

— WOO (@WOO_ecosystem) May 23, 2024

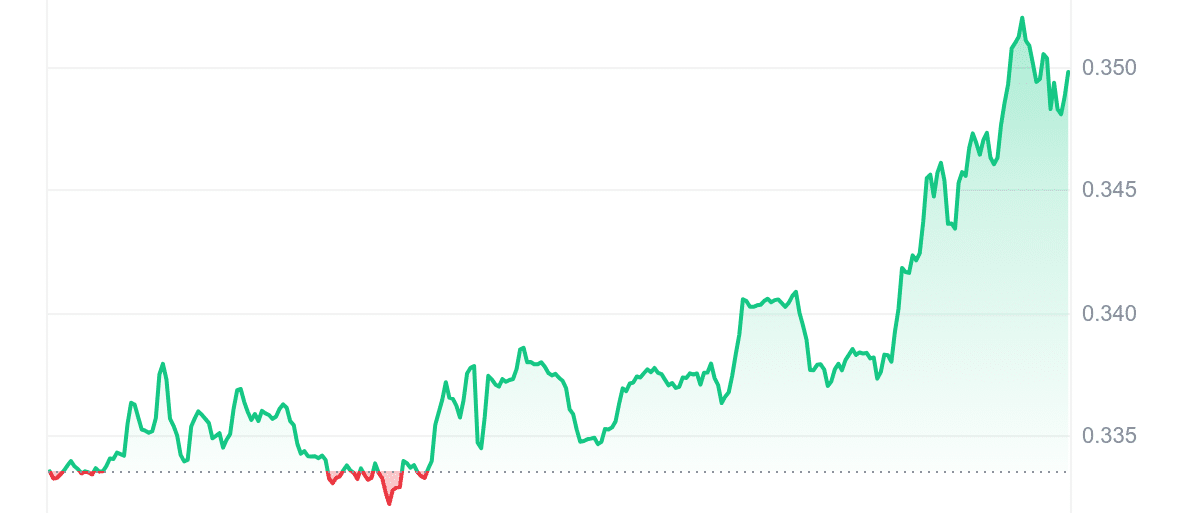

WOO’s price is $0.350586, reflecting a 5.06% surge in the last 24 hours and a 58% increase over the past year. The gainer exhibits a neutral stance, trading above the 200-day simple moving average (SMA) by 66.66%. Its 14-day Relative Strength Index (RSI) is 62.68, indicating sideways movement ahead.

While half of the last 30 trading days have seen positive gains, the 30-day volatility remains low at 7%. With medium liquidity evidenced by a volume-to-market cap ratio of 0.0280, WOO’s market cap stands at $654.23M, supported by a 24-hour volume of $18.29M.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage