Join Our Telegram channel to stay up to date on breaking news coverage

Cryptocurrencies are known for their high volatility and sudden price shifts. While this has traditionally appealed to short-term traders, the market is evolving. Institutional investors and a new perspective on crypto as a unique asset class drive this change. There are unique strategies to use for long-term investment, including buy-and-hold, dollar-cost averaging, and diversification through ETFs.

As more people consider long-term investments, it’s crucial to identify today’s top gainers. These cryptocurrencies are making significant strides, reflecting broader market trends. Let’s explore what makes today’s top gainers notable and how these strategies can benefit your portfolio.

Biggest Crypto Gainers Today – Top List

The market is buzzing with today’s top crypto gainers. Chiliz, surging by 13.23%, is grabbing attention with its innovative fan engagement partnerships. Nervos Network, up 8.51%, stands out for its dual-layer blockchain architecture. SushiSwap, rising by 3.31%, attracts users with its unique AMM features and rewarding system. Kaspa, increasing by 6.69%, impresses with advancements in its GHOSTDAG protocol and high block rates.

1. Chiliz (CHZ)

Chiliz is the digital currency for sports and entertainment, developed by a Malta-based FinTech provider. It operates the Socios platform, allowing users to partake in the governance of their favorite sports brands.

By purchasing CHZ, fans can buy fan tokens, influence club-related decisions, and engage with their clubs. Chiliz bridges the gap between active and passive fans, creating new revenue streams for sports organizations.

Recently, Chiliz partnered with Naver Pay, a mobile payment service, to expand its global services through Web3 innovations. This partnership aims to enhance user experiences in sports and entertainment. It will serve 33 million registered users and 18 million daily users in South Korea.

They plan to strengthen the fan token ecosystem, develop exclusive ticketing and payment services, and host fan-centric events. This collaboration promises to bring innovative solutions to South Korea’s sports enthusiasts.

We're excited to announce Naver Pay partners with Chiliz to enhance fan engagement and power global expansion 🤝

Naver Pay is utilized by the majority of the South Korean population with 33 million registered users and 18 million daily users.https://t.co/pCHtGpWPE3

⚡ $CHZ

— Chiliz ($CHZ) – The Sports Blockchain ⚽🏆 (@Chiliz) May 22, 2024

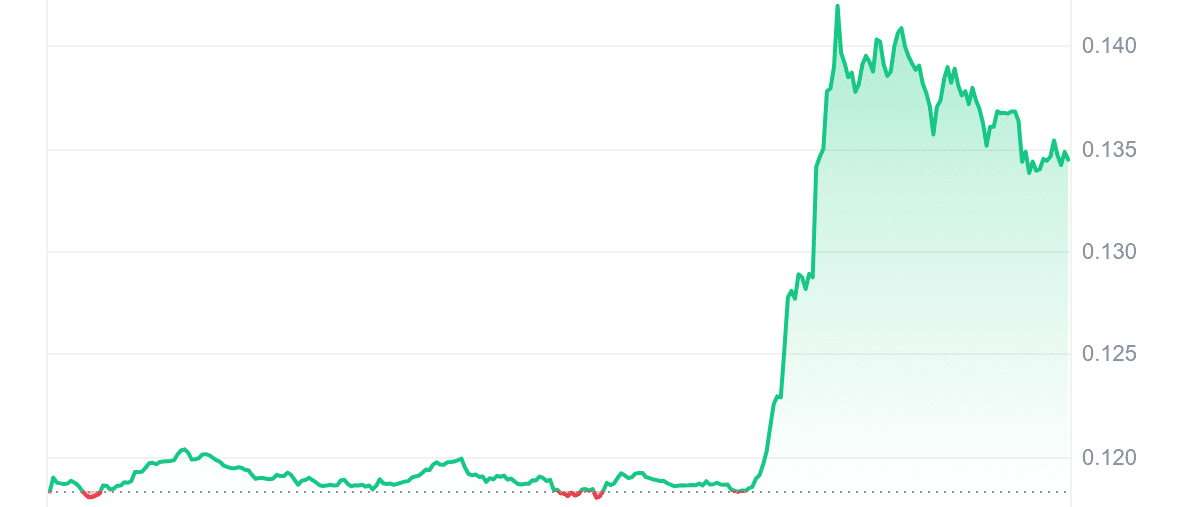

This partnership has positively affected the CHZ price, now $0.133912 with a 13.23% increase in the last 24 hours and a 35% rise over the past year. It is trading 69.18% above its 200-day SMA, indicating strong performance. The 14-day RSI of 44.01 suggests a neutral market stance.

The last 30 days saw 14 green days, showing positive momentum. With a 30-day volatility of 4%, CHZ remains relatively stable. The volume-to-market cap ratio of 0.3169 indicates high liquidity. No doubt, the Naver Pay partnership will further drive CHZ’s growth.

2. Nervos Network (CKB)

Nervos Network is an open-source public blockchain project. Its goal is to create a peer-to-peer crypto-economy network where users can access secure blockchain services. It features a dual-layer architecture: the base layer (Common Knowledge Base) for consensus and smart assets, and the computation layer for transactions.

The Common Knowledge Base drives the ecosystem using Proof-of-Work (PoW) and its cryptocurrency, CKByte (CKB). Developers have the capability to craft decentralized applications (dApps) that function seamlessly across multiple blockchain systems, thereby bolstering scalability and security measures.

The CKB token, deployed on a PoW blockchain, ensures security and decentralization. The network is open-source and regularly audited by third parties like CertiK. Additionally, the team holds hackathons with cash prizes to identify security flaws.

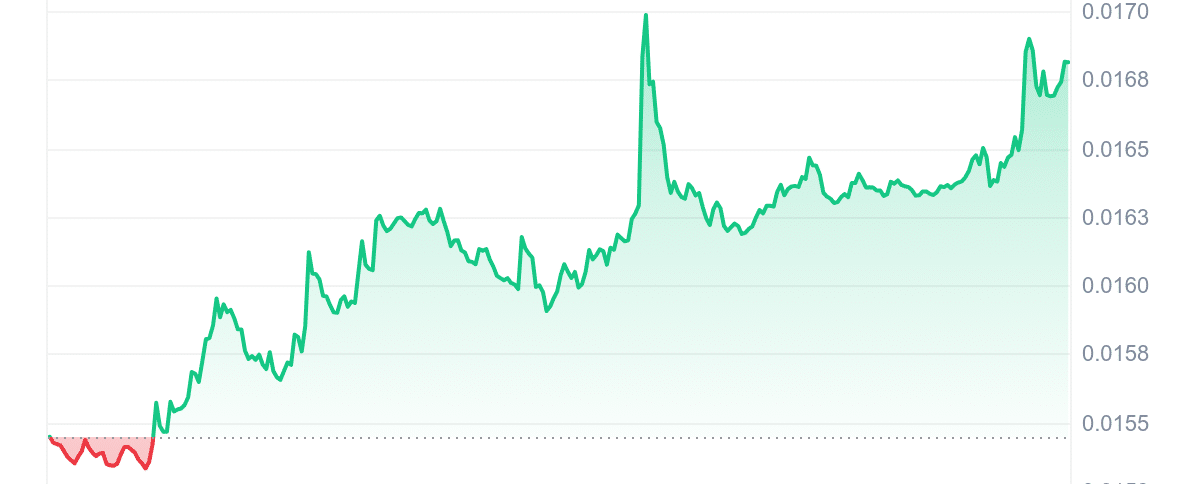

The CKB price is $0.016829, reflecting an 8.51% increase in the last 24 hours and a 408% surge over the past year. It is trading 128.38% above its 200-day SMA, which is $0.007369. The market stance is neutral, as indicated by a 14-day RSI 48.15.

Check out the latest updates to the #Nervos doc site: https://t.co/vpxOUPKA0p

Simplified Navigation: Flat menu structure for easier browsing

Quick Start (5 min) Guide:

• Set up local dev env. in 5 min using pre-built boilerplates

• Run CKB Devnet locally w/ pre-funded test… pic.twitter.com/1xOINitgKf— CKB Dev↾⇃ (@CKBdev) May 17, 2024

In the last 30 days, there have been 11 green days, or 37%. The 30-day volatility is at 7%, indicating relative stability. Nervos also has high liquidity, with a volume-to-market cap ratio of 0.1330.

3. Mega Dice (DICE)

Mega Dice’s presale has exceeded expectations, raising over $1.3 million towards a $5 million soft cap, with room to reach the $10 million hard cap. This demand reflects the crypto community’s belief in a user-owned online casino. The presale hype has also boosted Mega Dice’s social channels, with significant growth in Telegram and Twitter followings.

The tokenomics of DICE aligns profits and incentives for all stakeholders. Of the 420 million DICE supply, 35% is allocated for presale buyers, 15% for airdrops, and other portions for liquidity, affiliate programs, and marketing. Notably, 10% is dedicated to staking rewards, allowing players to earn passive income. This structure ensures user and platform interests are aligned, fostering a thriving ecosystem.

Our Season 2 AIRDROP is still ongoing! Don't miss your chance to grab a share of the $750,000 airdrop! 😍

The $DICE presale has already reached $1.3M and is well on its way to the next target of $2M! 🚀

Remember, 1 $DICE = 0.075. Price will increase when we hit $2M🚀

— Mega Dice Casino (@megadice) May 24, 2024

The $2.25 million airdrop campaign has been launched, positioning DICE as a disruptive GameFi token. The $DICE Season 2 Airdrop is live, with a $750,000 prize pool. To qualify, users must wager $5,000 or more between May 15 and June 28, 2024, with a maximum possible airdrop of $37,500 per player. After the period ends, qualifying users will receive $DICE credited to their casino accounts. With its casino integration, solid tokenomics, and growing community, Mega Dice Token is on its way to becoming a GameFi giant.

4. SushiSwap (SUSHI)

SushiSwap is an automated market maker (AMM) and a decentralized exchange using smart contracts to create markets for token pairs. It aims to diversify the AMM market with features like increased rewards for network participants via its in-house token, SUSHI. Its primary focus lies in catering to DeFi traders and organizations seeking to leverage the surge in project tokens and establish liquidity.

It operates by setting up automated trading liquidity between any two cryptocurrency assets. This eliminates order books and liquidity issues that traditional decentralized exchanges face. The platform charges a 0.3% fee on transactions within its liquidity pools, with users receiving SUSHI tokens as rewards along with governance rights.

Learn how Sushi protects users from honeypots: https://t.co/KGaXsXE9Ps

— Sushi.com (@SushiSwap) May 23, 2024

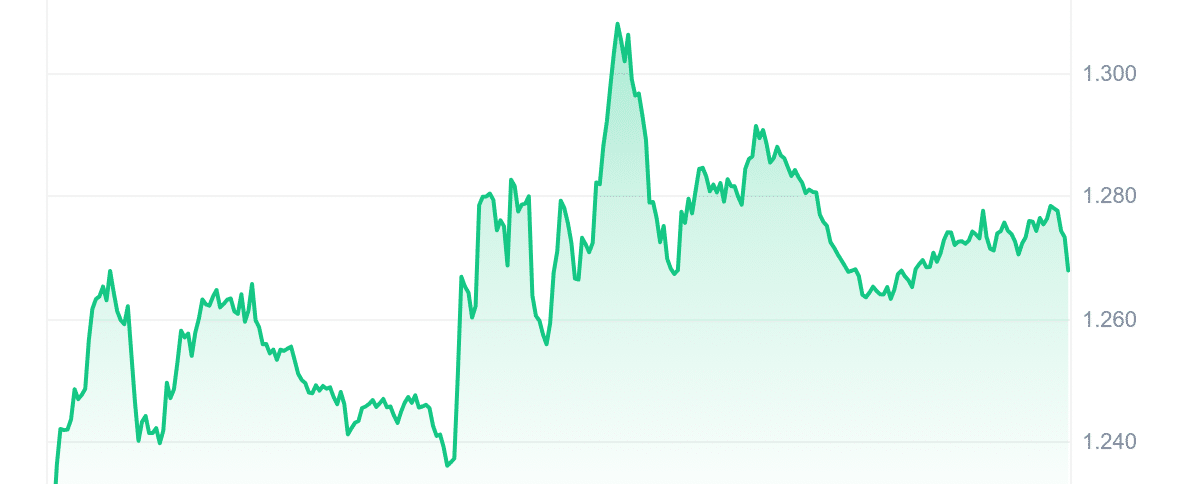

SUISHI’s current price is $1.268291, up 3.31% in the last 24 hours. Over the past year, the price increased by 51%, trading 42.46% above the 200-day SMA of $0.890746. The 14-day Relative Strength Index (RSI) is 42.12, indicating neutral market conditions. SushiSwap has seen 15 green days in the last 30 days and a 30-day volatility of 7%. It has high liquidity, with a volume-to-market cap ratio of 0.3927, a market cap of $315.08M, and a 24-hour volume of $123.72M.

5. Kaspa (KAS)

Kaspa is a proof-of-work cryptocurrency that is implementing the GHOSTDAG protocol. Unlike traditional blockchains, GHOSTDAG allows blocks created in parallel to coexist and orders them in consensus. This results in a blockDAG structure, providing secure operations with high block rates and minimal confirmation times. Kaspa aims for up to 100 blocks per second, including features like DAG topology queries, block data pruning, and support for future layer two solutions.

Kaspa has released the first stable Rusty Kaspa (RK) node, version 0.14.1. This marks a significant milestone, shifting to an optimized engine for better performance. RK nodes comprise about 25% of the P2P network and 29% of the hash rate.

This release brings immediate benefits like lower disk usage, faster sync times, and enhanced RPC interfaces. It sets the stage for future network advancements, including increasing block rates and supporting smart contracts.

🙏🏼Thanks for moving to #RustyKaspa, @AntPoolofficial. We're over halfway there!

📢Reminder: Move over now for more efficient node operation and be ready for #10BPS when it's time!#Rustlang #Kaspa $KAS https://t.co/cxJruDAaN2 pic.twitter.com/Sc6E0aRm0G

— Kaspa (@KaspaCurrency) May 24, 2024

How has this development affected its performance? KAS’s price today is $0.142608, up 6.69% in the last 24 hours and 676% over the past year. It trades 124.07% above its 200-day SMA of $0.063593.

The 14-day RSI is 54.20, indicating a neutral position. In the last 30 days, 15 were positive, showing a 50% success rate. The 30-day volatility is low at 7%. With a market cap of $3.38B and a 24-hour volume of $122.14M, Kaspa has a high liquidity ratio of 0.0361, reflecting strong investor interest.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage