Join Our Telegram channel to stay up to date on breaking news coverage

In today’s global market, innovative solutions in the fintech sector have surged, particularly in cryptocurrency. As digital assets gain mainstream acceptance, consumers seek convenient and reliable platforms to access and trade cryptocurrencies.

Amidst this, Revolut launches Revolut X, a crypto trading platform in the UK, aiming to rival significant exchanges. Offering access to over 100 cryptocurrencies, including Bitcoin and Ether, it boasts fixed fees of 0% for makers and 0.09% for takers. Users can enjoy seamless fiat-to-crypto conversion and vice versa without additional costs or limitations.

Biggest Crypto Gainers Today – Top List

Welcome to today’s exploration of the top crypto gainers in the market! As the crypto market evolves, determined investors look for promising projects with innovative solutions and impressive performance. In this article, we dive deep into the success stories of today’s four unique gainers: SwissBorg, Rocket Pool, Terra Classic, and Lido DAO. We will uncover the unique features and market insights driving these projects, offering valuable insights and opportunities for potential investment gains.

1. SwissBorg (BORG)

SwissBorg is reshaping wealth management paradigms by fostering a community-centric approach to finance. At the core of their ecosystem lies the Wealth App. It’s a user-friendly platform enabling secure transactions of digital assets utilizing cutting-edge MPC keyless technology. With over 450,000 global users, the app boasts features like AI-powered asset analysis and Portfolio Analytics. It helps users make informed investment decisions tailored to their financial goals.

The BORG token is the cornerstone of the SwissBorg ecosystem, offering a range of multi-utility functionalities. Through the BORG Yield Program, users can earn yields linked to the performance of the SwissBorg ecosystem measured by the SwissBorg Community Index. Additionally, BORG holders enjoy exclusive benefits such as Premium Membership. This grants access to zero-fee exchanges and yield multipliers. Moreover, the SwissBorg National Council provides a decentralized governance mechanism, enabling token holders to actively participate in shaping the platform’s future.

🚨 Here ye, here ye! The moment we've all been waiting for has arrived! $BORG is now on Solana! 🚀

🛸 BORG is going on-chain to @Solana leveraging @Wormhole Native Token Transfers (NTT).

You can NOW benefit directly from the entire @solana ecosystem with our $BORG token. 💪🏽… pic.twitter.com/UGmnCVMVNR

— SwissBorg (@swissborg) May 7, 2024

BORG’s recent price surge of 18.68% reflects its growing popularity and investor interest. Over the past year, the token has seen a 73% increase, indicating a positive trajectory. Despite fluctuations, it maintains moderate volatility, with a 30-day volatility rate of 10%. The token demonstrates sufficient liquidity, with a volume-to-market cap ratio of 0.0124. SwissBorg presents an intriguing option for investors seeking exposure to innovative financial solutions within the crypto market.

2. Rocket Pool (RPL)

Rocket Pool (RPL) is a decentralized Ethereum staking pool offering up to 4.33% APR for ETH2 staking. Users can join the Rocket Pool with its decentralized node operator network or run their nodes with only 16 ETH. This offers an additional RPL rewards system, resulting in up to 6.36% APR for ETH.

Rocket Pool distinguishes itself with liquid staking, increasing exchange rates without additional taxable events on initial staked collateral. Furthermore, it ensures risk mitigation through smart nodes, distributing losses from misbehaving nodes across the network. The open-source, audited smart contracts guarantee non-custodial staking and maximal decentralization.

The Smartnode has been updated to v1.11.2

The latest version is recommended for node operators using Geth, Teku, Lodestar, and Nethermind

Please review the changes carefully before upgrading: https://t.co/0wiwtW3SES pic.twitter.com/qM6yX04vUX

— Rocket Pool (@Rocket_Pool) December 19, 2023

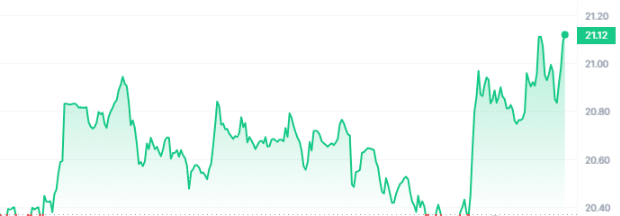

Indeed, RPL is an innovative project; however, despite its gains today, its price analysis paints a mixed picture in the market. The price is currently valued at $21.53, showing a slight increase of 2.77% in the last 24 hours. However, its performance over the past year has been challenging, with a significant decline of 55%.

Also, RPL trades at a notable 25.44 % below the 200-day Simple Moving Average (SMA) of $28.87, indicating a deviation from its long-term trend. Despite 13% volatility over the past 30 days, its 14-day RSI of 44.22 suggests potential sideways movement. In the last 30 trading days, 43% have shown positive trends, while it demonstrates medium liquidity, reflected in a volume-to-market cap ratio of 0.0118.

3. WienerAI (WAI)

Most meme coins have interesting backstories, and WienerAI is no exception. Born in a lab in New Silicon Valley, AD 2132, WienerAI is the brainchild of a mad puppy-loving scientist, The Architect. Engrossed in his work and enjoying a sausage snack during the splicing procedure, he created WienerAI – a hybrid of the pup, AI, and sausage.

Despite the incredulous nature of this tale, WienerAI has quickly gained traction in the market. Its crypto presale, launched on April 25th, has already raised over $1 million in just a few days, demonstrating a surprising enthusiasm for this peculiar blend of technology and canine spirit.

WienerAI shines with its unique feature of immediate staking upon token purchase. Over 1 billion WAI tokens are already staked, boasting an enticing APY of over 800%. This move encourages active engagement and rewards early adopters, fostering a sense of community ownership. Additionally, it introduces a trading bot feature, aligning with its vision of a harmonious AI-driven future.

Once you harness the power of AI for your trading…you'll never look back.

🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖 pic.twitter.com/VCHlvuoDON

— WienerAI (@WienerDogAI) May 7, 2024

Each $WAI token is priced at $0.000705 in its current presale phase, presenting early investors with an entry opportunity. Moreover, the project’s decision not to impose a fixed hard cap provides flexibility during the presale period. Furthermore, investors can easily acquire $WAI tokens using Ethereum (ETH), Tether (USDT), or conveniently through credit/debit card transactions.

4. Terra Classic (LUNC)

Terra Classic is a blockchain protocol utilizing fiat-pegged stablecoins to facilitate global payments. It combines the stability of fiat currencies with the censorship resistance of Bitcoin, aiming to offer fast and affordable settlements. Terra’s algorithm adjusts stablecoin supply based on demand to maintain a one-to-one peg with fiat currencies. Partnering with various payment platforms, Terra has gained traction in the Asia-Pacific region, fostering adoption and usability.

The LUNC token serves as Terra Classic’s native governance and utility token, used for minting stablecoins and controlling the ecosystem’s supply via automated algorithms. Investors can earn returns by staking LUNC tokens on the Terra platform or utilizing them to trade on exchanges. Additionally, LUNC tokens can be burned to obtain stablecoins on the Terra Classic network, providing flexibility and utility within the ecosystem.

Use @AndromedaProt aOS to build apps on Terra 🚀🛠️

Learn all about it ahead of the mainnet launch ⤵️ https://t.co/UBobU8xczt

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) April 5, 2024

LUNC is priced at $0.000108, marking a recent 1.44% uptick, indicative of the coin’s dynamic nature. However, despite trading below the 200-day Moving Average by 99.95%, it’s been on a resilient journey, boasting a 27% surge over the past year. LUNC has seen 50% of trading days ending positively in the past month, promising potential rewards. Furthermore, with high liquidity (0.0499 volume-to-market cap ratio) and low volatility (11% 30-day volatility, RSI of 57.12), it’s an enticing opportunity for stable growth.

5. Lido DAO (LDO)

Lido DAO is a decentralized autonomous organization (DAO) that offers staking infrastructure for various blockchain networks. It enables users to stake their ETH and receive stETH tokens in return, representing their staked ETH and rewards. LDO is the governance token, allowing holders to participate in critical decisions and proposals. The platform ensures security through decentralized governance, audited smart contracts, and third-party security audits.

Lido aims to democratize staking by pooling ETH from multiple users, eliminating the need for technical expertise or a minimum staking amount. Its V2 version introduces Liquid Staking, allowing users to trade stETH tokens and participate in LSDFi protocols. The network’s security is upheld by a smart contract that safeguards funds and holders overseeing node operators’ selection and penalization.

LDO has demonstrated a 1.96% surge in the last 24 hours, indicating a favorable short-term trend. It trades slightly above the 200-day SMA, which reflects resilience despite market fluctuations. With 47% of the last 30 trading days showing green, investor sentiment remains optimistic. Despite moderate volatility, with a 30-day volatility of 13%, LDO maintains high liquidity, boasting a volume-to-market cap ratio of 0.0661. This analysis shows LDO’s consistent performance, offering investors a reliable opportunity for governance participation and potential returns.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage