Join Our Telegram channel to stay up to date on breaking news coverage

As we embark on a journey to examine today’s top gainers, let’s briefly explore the latest trends in the global crypto market. Bitcoin whales are on a buying spree, accumulating 71,000 BTC during the recent market downturn at the fastest rate since April 2023, when several U.S. banks collapsed. This surge in whale activity, highlighted by CryptoQuant, coincides with Bitcoin’s dip to $54,200 on July 5.

Despite smaller traders offloading their holdings, a net increase of 261 wallets holding at least 10 BTC was observed in early July, indicating long-term bullish sentiment. However, not all whales follow this trend; a dormant whale transferred 1,000 BTC worth nearly $60 million after a 12-year hiatus. Currently, BTC is trading at $62,500, rebounding from recent lows amid market challenges.

Biggest Crypto Gainers Today – Top List

Today’s pick of top crypto gainers highlights a spectrum of resilience and volatility. Maple and Pendle have demonstrated remarkable growth and innovation. Maple excels in decentralized corporate credit markets, while Pendle pioneers the tokenization of future yields. Synthetix and Dash present a contrast with their unique value propositions. Synthetix focuses on synthetic asset trading, while Dash emphasizes fast, private payments.

While Maple and Pendle boast impressive year-over-year performance and robust trading above their 200-day simple moving averages, Synthetix and Dash exhibit both challenges in their long-term market outlook. They trade below their 200-day SMA and show declines over the past year. Let’s delve into each of these to assess their potential for inclusion in a portfolio.

1. MAPLE (MPL)

Maple is a decentralized corporate credit market offering transparent, on-chain financing for borrowers and sustainable yield for liquidity providers. Managed by Pool Delegates, Maple’s lending pools perform due diligence and set loan terms.

MPL governs the protocol, enabling holders to participate in governance, share in fee revenues, and stake insurance. Literally, Maple connects institutional lenders with borrowers, combining compliance with smart contract efficiency. Institutional borrowers secure under-collateralized loans without fear of liquidation, while liquidity providers earn yields from diversified exposure to top-tier crypto institutions.

On July 9, 2024, Maple partnered with Zodia Custody, a digital asset custodian backed by Standard Chartered and others. Zodia Custody will hold collateral pledged to Maple, enhancing security and compliance for institutional clients. The partnership also allows Zodia Custody wallets to support the Maple token, maximizing returns for institutions in high-interest environments.

We're excited to announce a strategic partnership with @ZodiaCustody, a leading institution-first digital asset custodian to further progress Maple's goal to be the home of digital asset lending and borrowing in the space.

➡️ Read more here: https://t.co/ov2KpyMwEX

— Maple (@ETHCC) (@maplefinance) July 9, 2024

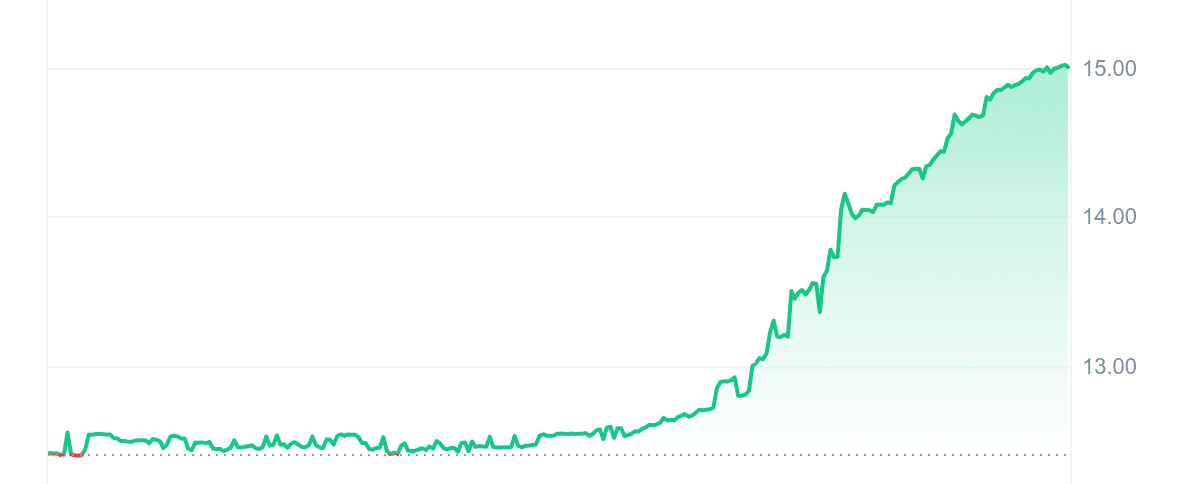

MPL is riding high with a current price of $14.89, marking an impressive 20.06% surge in the last 24 hours. Its liquidity is solid, with a volume-to-market cap ratio of 0.0324. The 14-day RSI of 43.41 suggests it’s in a neutral zone, likely to trade sideways. Over the past 30 days, MPL has had 14 green days (47%), and its volatility is comfortably low at 5%. Remarkably, MPL is trading 61.52% above its 200-day SMA of $9.22, showing significant strength compared to Dash, which is struggling below its 200-day SMA. MPL’s price has risen by 122% in the last year, outperforming 67% of the top 100 crypto assets, a stark contrast to Synthetix’s performance.

2. Pendle (PENDLE)

Pendle is a DeFi protocol that focuses on tokenizing and trading future yields. By allowing users to separate the ownership of the underlying asset from its future yield, Pendle enables the creation of new financial instruments that can be traded on its platform. The core of Pendle’s offering is its automated market maker (AMM), designed to support assets that experience time decay, addressing the challenge of valuing future yields, which can fluctuate based on numerous factors. This design is pivotal in providing users more control over future yield, offering them optionality and opportunities for its utilization.

Pendle’s primary uses include staking to secure the network, yield farming to optimize earnings, governance participation, and liquidity provision. Its security framework also includes comprehensive audits, rigorous code reviews, and continuous monitoring to protect against threats. The protocol’s commitment to transparency and community engagement through open-source practices further bolsters its security.

Post Mortem

For context – Squarespace purchased all domain registrations and related customer accounts from Google Domains in June 2023, which forced the migration of domains.

Recently, attackers exploited a vulnerability in Squarespace, hijacking domains hosted on their… https://t.co/0lgcvzss2r

— Pendle (@pendle_fi) July 12, 2024

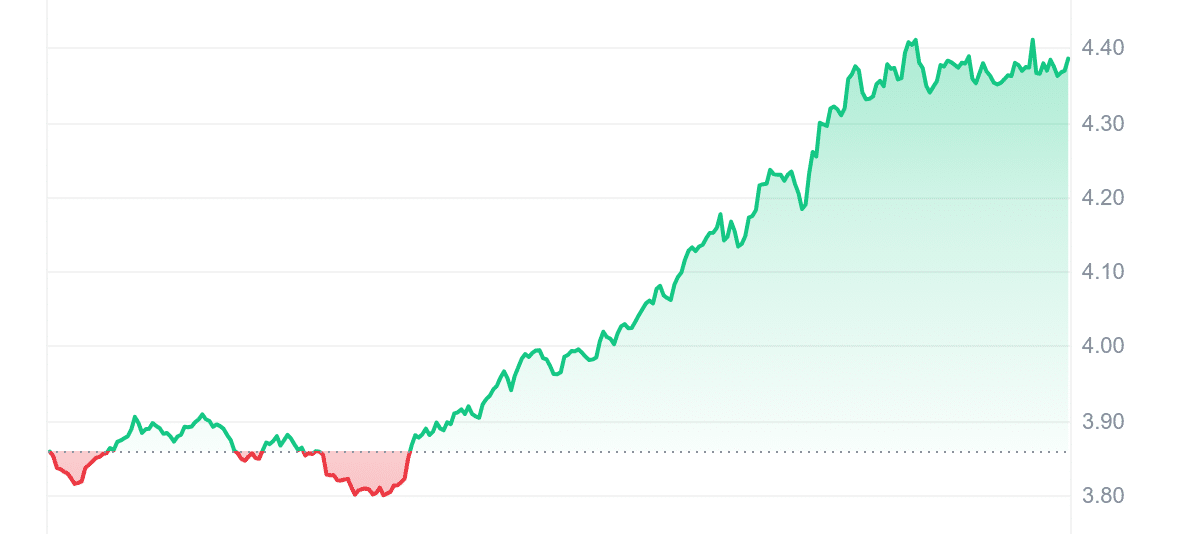

PENDLE is a star gainer, currently valued at $4.40, with a 14.57% increase in the last 24 hours. A 0.4326 volume-to-market cap ratio underscores its high liquidity. Unlike SNX, Pendle’s 14-day RSI of 48.46 and strong bullish trend, trading 465.46% above its 200-day SMA of $0.778006, make it a standout. Over the past year, Pendle’s price has skyrocketed by 402%, besting 87% of the top 100 crypto assets, in stark contrast to Dash’s 17% decline. Pendle’s 30-day performance of 14 green days (47%) mirrors that of MPL, demonstrating consistent growth and investor confidence.

3. Mega Dice (DICE)

Mega Dice ($DICE), a Solana-based GameFi token, is doing great in the crypto market, raising over $1.5 million in its presale. Adding to the excitement, Mega Dice recently launched a staking feature, allowing holders to earn passive income from the platform’s profits. Currently priced at $0.09093, the presale price increases every seven days, so now is the time to invest and lock in the lowest prices.

Post Mortem

For context – Squarespace purchased all domain registrations and related customer accounts from Google Domains in June 2023, which forced the migration of domains.

Recently, attackers exploited a vulnerability in Squarespace, hijacking domains hosted on their… https://t.co/0lgcvzss2r

— Pendle (@pendle_fi) July 12, 2024

With a user base exceeding 10,000 and monthly wagering surpassing $50 million, Mega Dice is quickly becoming a leader in the crypto casino domain. The $DICE token facilitates transactions across diverse games and betting opportunities, offering holders lucrative rewards, cashback, and exclusive promotions. A planned DEX listing is set to boost liquidity and potentially skyrocket the token’s price, positioning $DICE ahead of competitors.

The launch of Mega Dice staking means owning $DICE, which is akin to holding a stake in a profitable online casino. Token holders can earn daily rewards tied to the casino’s performance, with 42 million tokens allocated for staking over a two-year distribution plan. This structure allows for hourly compounding of earnings, maximizing returns. The staked tokens can be claimed post-presale or after the lock-up period, providing a fair opportunity for all investors to reap the benefits. Don’t miss out on this groundbreaking opportunity—secure your $DICE tokens today and join the winning streak.

4. Synthetix (SNX)

Synthetix is a decentralized liquidity protocol on Optimism and Ethereum, providing deep liquidity and low fees for protocols like Kwenta, Lyra, Polynomial, 1inch, and Curve. Collateralized by SNX, ETH, and LUSD, it issues synthetic assets (Synths) that track and return underlying asset values without direct ownership. Synthetix aims to enhance the cryptocurrency space by introducing non-blockchain assets and expanding access to robust financial markets.

Synthetix functions as a decentralized exchange (DEX) for synthetic assets, allowing autonomous Synth trading. SNX holders can stake tokens to earn transaction fees from the Synthetix Exchange. Using oracles, the platform tracks asset prices, ensuring seamless trading without liquidity issues. SNX tokens are collateral for minting Synths and are secured in smart contracts. The network uses a proof-of-stake (PoS) consensus, with stakers earning rewards from network fees and the protocol’s inflationary monetary policy.

Synthetix v3 is steadily rolling out.

Here is a breakdown of all features the v3 system introduces (and a short history of @synthetix_io protocol development).

– "Liquidity layer of DeFi"

– CDP protocol with 0% interest + perps infra

– Delta-neutral debt pool

– Multi-collateral— definikola (@definikola) July 8, 2024

SNX has seen a decent uptick, with its price reaching $1.916236 after a 12.72% boost in the last 24 hours. It stands out with its high liquidity, boasting a 0.3027 volume-to-market cap ratio. While SNX shares a similar neutral RSI to MPL at 42.82, its performance over the past year tells a different story. Unlike Pendle, which has surged by 402%, SNX has unfortunately dipped by 32%, highlighting the challenges it faces. Trading 42.67% below its 200-day SMA of $3.37, SNX has outpaced only 4% of the top 100 crypto assets, indicating room for improvement.

5. Dash (DASH)

Dash is a cryptocurrency and blockchain-focused on fast, affordable global payments. Launched in 2014 as a fork of Litecoin, it enhances Bitcoin with stronger privacy and quicker transactions. Key features include a two-tier network with masternodes, InstantSend for instant payments, ChainLocks for immutability, and PrivateSend for privacy. Dash serves individual users and institutions, including merchants and financial services. Its governance system allocates 10% of block rewards to project development, ensuring a competitive and decentralized ecosystem.

Dash will launch its Evolution platform on July 29th, aiming to make cryptocurrency more user-friendly. Evolution will introduce features like usernames, contact lists, invoicing, and recurring payments at the protocol level, removing the need for centralized entities. The Genesis phase will focus on network stability and bug fixes, followed by the activation of Dash Platform Name Service (DPNS) and DashPay. This release is expected to enhance Dash’s usability for everyday payments and drive mainstream adoption.

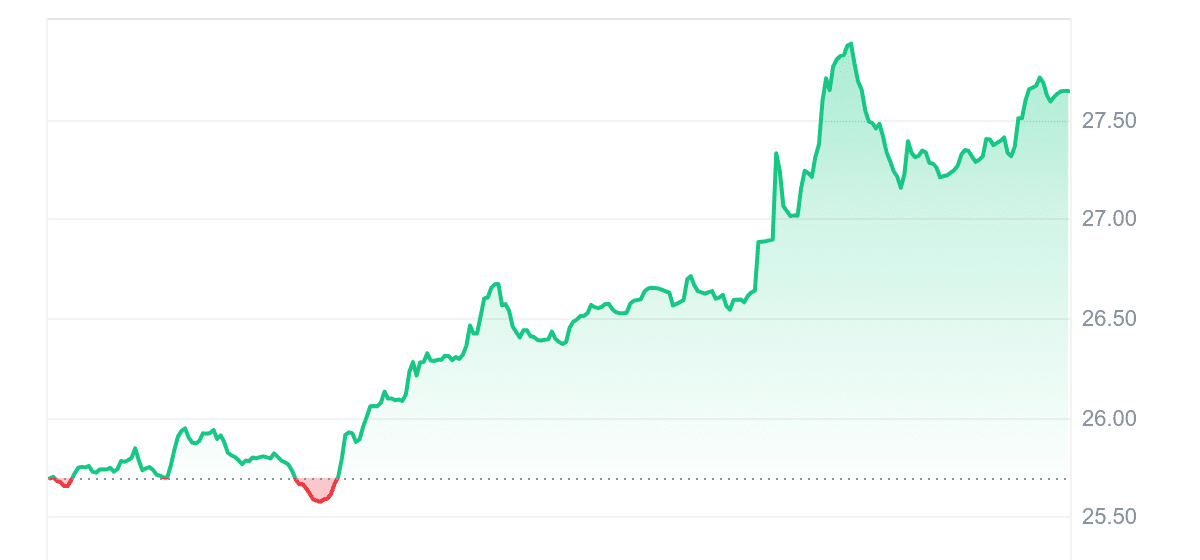

DASH is currently priced at $27.76, experiencing a modest 7.91% rise in the last 24 hours. It maintains high liquidity with a 0.1411 volume-to-market cap ratio. Unlike MPL and Pendle, Dash’s 14-day RSI of 48.49 suggests a neutral market stance. Over the past 30 days, Dash has had 16 green days, slightly better than MPL and Pendle. However, it trades 14.73% below its 200-day SMA of $32.50, indicating potential bearish sentiment. With a 17% price decline over the past year, Dash’s performance pales in comparison to Pendle’s impressive gains, highlighting the diverse dynamics within the crypto market.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage