Join Our Telegram channel to stay up to date on breaking news coverage

Cryptocurrency adoption is accelerating globally, with major institutions and governments increasingly integrating digital assets into their operations. This widespread acceptance marks a significant shift toward mainstreaming crypto, driven by its potential for secure, efficient, and transparent transactions.

In a landmark deal, Coinbase has inked a $32.5 million agreement with the U.S. Marshals Service to provide custody and trading of its digital assets. This partnership highlights Coinbase’s role in supporting law enforcement agencies and managing seized cryptocurrencies. Coinbase Prime, the firm’s institutional arm, will securely store and manage these assets, showcasing the integration of traditional law enforcement with the digital currency market. The U.S. government, holding over $13.8 billion in crypto, can significantly impact global markets.

Biggest Crypto Gainers Today – Top List

In today’s volatile crypto market, where digital fortunes are made and lost in moments, a few tokens have emerged as stars of the day. Helium Mobile, ArcBlock, Chromia, and Oasis Network stand tall among the top gainers, each showcasing remarkable resilience and growth.

Helium Mobile surged 17.69%, using T-Mobile’s infrastructure and the Solana blockchain for strong cellular connectivity and crypto earnings. ArcBlock rose 12.25% in 24 hours, with a remarkable 2,566% annual increase, highlighting its role in dApp development and market resilience. Chromia, with its modular blockchain supporting gaming and real estate, saw a 7.94% increase, promising scalable solutions with high liquidity. Oasis Network, pioneering confidential computing with Sapphire EVM and ROSE token, rose 1.19%, poised for growth in AI and Web3 innovations.

1. Helium Mobile (MOBILE)

Helium Mobile is a wireless phone service built on the decentralized Helium network. It offers reliable cellular services by operating on the Solana blockchain and leveraging T-Mobile’s 5G infrastructure. Subscribers can earn crypto tokens while using their phones. The $20 monthly plan includes unlimited talk, text, and data. A unique feature is the “Mobile Hotspots,” which let users create mini cell towers, eliminating dead zones.

Users can stake tokens to secure the network and earn rewards. The token also facilitates transactions and service fees. Helium Mobile’s dynamic coverage blends nationwide and community-built networks, enhancing connectivity. The platform’s Proof of Coverage algorithm validates hotspot locations and network integrity. Subscribers can earn MOBILE tokens as rewards, which can be traded on exchanges like Coinbase.

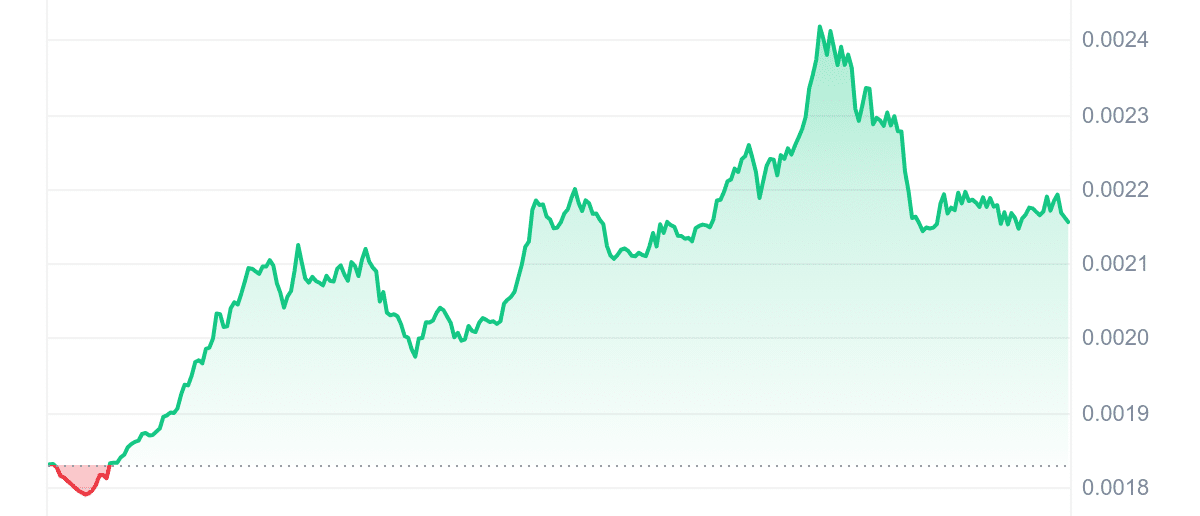

MOBILE stands out with a remarkable 24-hour surge of 17.69%, leading to short-term momentum among its peers. Its 601% annual price increase is impressive, though not as high as ArcBlock’s. With a high liquidity ratio of 0.1825, it’s easier to trade than ABT, which has a moderate liquidity ratio of 0.0261.

Two years ago, Helium introduced the Network of Networks—a platform designed to launch complementary, distinctive, decentralized networks.

Today, @HeliumFndn announced to expand its mission beyond wireless technology to include decentralized physical infrastructure networks… pic.twitter.com/5YSOWKCDE8— Helium🎈 (@helium) July 1, 2024

Its RSI of 60.50 is similar to ABT’s 46.41, both indicating a neutral stance, but it has had more green days (14) in the last 30, showing more consistent short-term performance. It trades significantly above its 200-day SMA by 559.31%, indicating strong long-term growth, and has a volatility of 18%, suggesting a slightly riskier investment. Overall, MOBILE outperformed 95% of the top 100 crypto assets, showcasing its strong position in the market.

2. ArcBlock (ABT)

ArcBlock simplifies the development of decentralized applications (dApps) and custom blockchains. It provides foundational components like flexible SDKs, code packages, and developer tools. ArcBlock aims to remove barriers to blockchain adoption by making development faster and more user-friendly. The platform offers enterprise-level dApp creation and connects to any blockchain, promoting accessibility and flexibility for developers.

ArcBlock’s key features include the Open Chain Access Protocol (OCAP) for cross-blockchain connectivity and Blocklet for serverless architecture. It supports both on-chain and off-chain computations, enhancing performance and cost efficiency. ArcBlock is cloud-agnostic, allowing dApps to run on any cloud infrastructure and web browser. This approach positions ArcBlock as a versatile and powerful platform for blockchain 3.0 development. The ABT token, an ERC-20 token on the Ethereum blockchain, powers the platform.

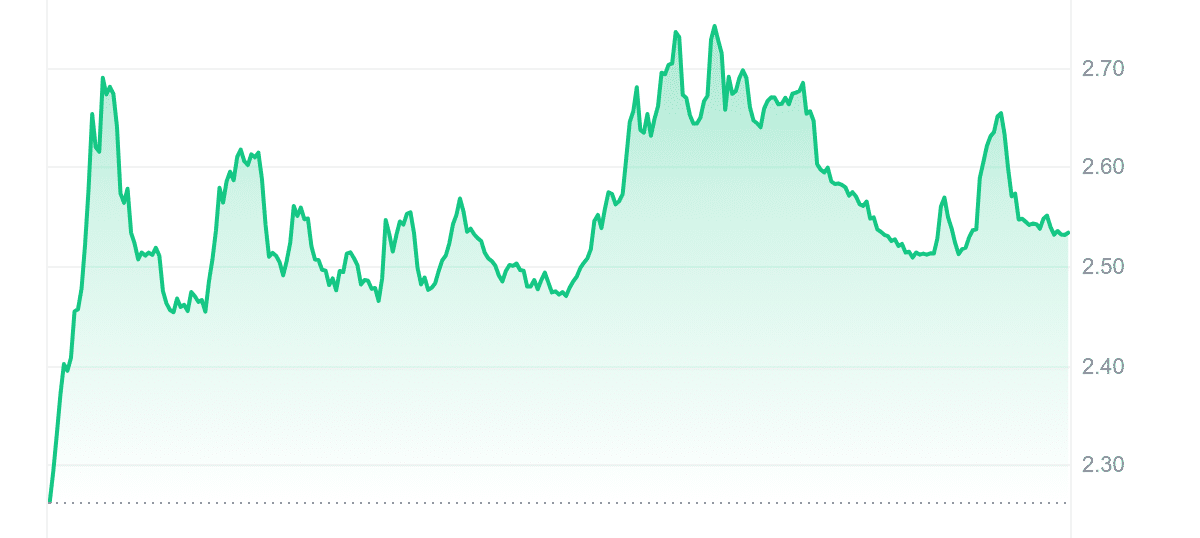

ABT impresses with a solid 24-hour increase of 12.25% and a staggering 2,566% annual price rise, surpassing the other tokens in long-term growth. Its moderate liquidity ratio of 0.0261 makes it less liquid than MOBILE and CHR. With an RSI of 46.41, it remains neutral, similar to MOBILE.

🫣 The Blocklet Store got a major update.

This update introduces 'Stake to Publish' in the Blocklet Store. Staking $ABT ensures quality, as bad actors risk losing their stake for distributing spam or malware in published Blocklets.

Learn More: https://t.co/BiBgiyhLcu

— ArcBlock (@ArcBlock_io) July 1, 2024

However, ArcBlock had only six green days in the last 30, indicating less consistent short-term performance than MOBILE’s 14 and CHR’s 12. Its volatility of 17% matches CHR, suggesting a balanced risk level. Trading 291.39% above its 200-Day SMA, ABT shows strong upward momentum, outperforming 97% of the top 100 crypto assets, making it a formidable contender despite its lower short-term performance.

3. Pepe Unchained (PEPU)

Pepe Unchained is shaking up the crypto scene with its impressive early success. In just 16 days, it raised over $2 million during its presale, which started on June 16. This frog-themed coin is not just another meme coin; it plans to launch a unique layer-2 network specifically for meme coins. This network will speed up transactions and reduce fees, making it easier and more fun for investors to trade their favorite meme coins.

$2M raised in record time! 🎉💸

Pepe's blockchain is on fire. Thank you for the incredible support! Get ready for even more exciting developments 🐸🚀 pic.twitter.com/yQcveiQO1X

— Pepe Unchained (@pepe_unchained) July 2, 2024

The presale excitement for PEPU is palpable, with tokens priced at just $0.0082267 each. With 20% of its 8 billion token supply set aside for presale investors, Pepe Unchained is all about community. Unlike many other projects, PEPU has no team allocation and has been audited by SolidProof and Coinsult. This transparency and dedication to its community make it a standout. The project’s community-first approach is a refreshing change in the meme coin landscape.

What sets Pepe Unchained apart is its “double staking” protocol, promising an annual yield of 1,133%. This high yield has already drawn in investors, with over 141 million PEPU tokens staked before the official launch. With upcoming DEX listings and a growing social media following, PEPU is gearing up to make a big splash. Its high staking rewards and ambitious plans make it a meme coin to watch closely this year.

4. Chromia (CHR)

Chromia is a modular, relational blockchain platform that simplifies building decentralized applications (DApps). Founded by ChromaWay in 2014, it supports sectors like finance, real estate, gaming, and public services. The platform uses relational blockchain architecture, allowing faster transactions and lower fees. Chromia supports diverse DApps, such as My Neighbor Alice, LAC PropertyChain, and Hedget. Developers can use familiar languages like SQL and JavaScript, enhancing usability.

Recently, Chromia announced the launch of its MVP Mainnet on July 16th. This project will expand the CHR token’s operations and provide the base for the Chromia network. The MVP Mainnet will manage core functions, including hosting fees and provider payouts. Chromia’s founders highlight the journey from Colored Coins to integrating blockchain with relational databases. The new mainnet aims to streamline user experiences and drive future development.

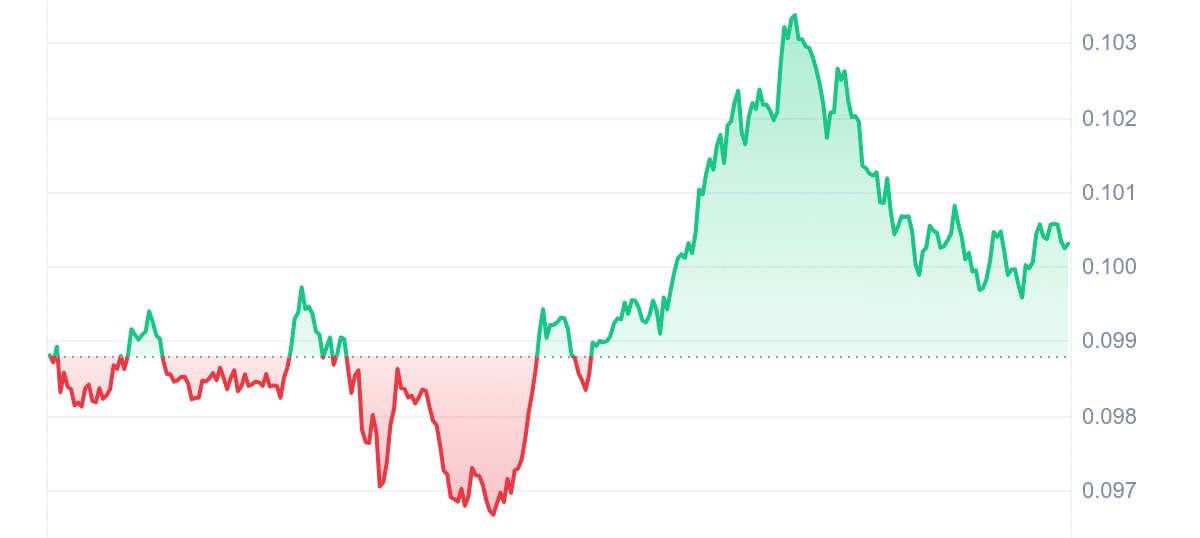

CHR posted a 7.94% increase in the last 24 hours, showing strong short-term potential, though less than MOBILE and ArcBlock. Its 83% annual increase is modest compared to the others, but it boasts high liquidity with a volume-to-market cap ratio of 0.6944, the highest among its peers, making it highly tradable. The RSI of 69.74 suggests it’s nearing overbought territory, unlike the more neutral stances of MOBILE and ABT.

JUST IN: Chromia MVP Mainnet Launch Confirmed for July 16th, 2024.

Get ready to launch 🚀

🔗 https://t.co/70VMn6A4M4 pic.twitter.com/WUKr8VIDRz

— Chromia | Power to the Public (@Chromia) July 2, 2024

CHR’s 12 green days in the last 30 are more consistent than ABT’s but less than MOBILE’s. Its volatility of 17% is on par with ABT’s, indicating a balanced risk level. Trading 101.60% above its 200-day SMA shows good long-term strength. It outperformed 58% of the top 100 crypto assets, placing it solidly in the middle of the pack regarding performance and risk.

5. Oasis Network (ROSE)

Oasis Network is a pioneering layer one blockchain enabling scalability and confidential computing. Oasis features Sapphire, the first confidential EVM, allowing Web3 and AI developers to build dApps with smart privacy. With its unique layered architecture, Oasis supports DeFi, AI, GameFi, NFTs, data tokenization, and DAO governance. It also has native support for rollups at the consensus layer. The native token, ROSE, is used for gas fees, staking, delegation, and governance.

Oasis Protocol has refreshed its brand, focusing on AI and privacy in Web3. Over the next six months, Oasis plans to enhance the developer experience and expand its ecosystem. This includes improving documentation, tooling, and libraries. Additionally, Oasis increased brand recognition by sponsoring ETHDam, attracting an audience of about 700,000 people.

Pontus-X, the first third-party custom ParaTime on Oasis by @deltaDAO, offers enterprise solutions for corporate clients, integrating EU-regulated e-money EUROe tokens for compliant privacy in data and AI https://t.co/oEuOEuFHBo

— Oasis (@OasisProtocol) July 2, 2024

Oasis Network saw a modest 1.19% increase in the last 24 hours, the lowest among its peers, but still shows steady growth with a 91% annual increase. It has high liquidity with a 0.0616 volume-to-market cap ratio, making it more liquid than ABT but less than CHR. With an RSI of 52.68, it maintains a neutral stance similar to MOBILE and ABT.

It has had ten green days in the last 30, indicating more consistent performance than ABT but less than MOBILE. Its volatility of 11% is the lowest among the tokens, suggesting the least risk. Trading 72.06% above its 200-day SMA, it shows decent long-term strength, outperforming 59% of the top 100 crypto assets, making it a stable, though less aggressive, investment option.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage