Join Our Telegram channel to stay up to date on breaking news coverage

Exciting news from Hong Kong’s Securities and Futures Commission as they give the green light to three spot Bitcoin and Ether exchange-traded funds (ETFs)! Harvest Global Investments and HashKey Capital-Bosera Asset Management partnership secured conditional approval, while China Asset Management’s Hong Kong unit gears up to offer virtual asset management services. Plus, OSL Digital Securities steps in to provide custodial services.

Furthermore, US spot Bitcoin ETFs’ success fuels excitement, managing $56.2 billion in assets. With a market worth $50 billion, Hong Kong’s ETF potential pales compared to the $8.87 trillion US market. Nevertheless, interest in Hong Kong ETFs could match US levels, capturing 0.5% to 1% of the market.

Biggest Crypto Gainers Today – Top List

In the dynamic crypto market, trading volume soared to an impressive $ 632.45B over the last 24 hours. While the sentiment leans towards Greed, with a daring reading of 65 on the Fear & Greed Index, only 8% of cryptocurrencies are currently making bullish strides. Aragon emerges as today’s leader of top gainers, boasting a remarkable 13.15% gain, while Centrifuge struggles as the unfortunate loser, facing a daunting -15.09% loss. Join us as we dive into the thrilling journey of Aragon and three other impressive coins in today’s winners’ spotlight!

1. Aragon (ANT)

Aragon is a Spanish-led project aimed at facilitating decentralized organizations for enterprises. Operating on Ethereum, it offers a digital jurisdiction through the Aragon Network, functioning as the first DAO. Businesses, investors, and startups converge on Aragon, which boasts its decentralized court system. ANT token, integral to governance, fuels this ecosystem. Aragon empowers users to create and manage DAOs as an open-source project, fostering blockchain adoption in business operations.

Community empowerment is at the heart of Aragon, where users drive the decision-making process by voting for protocol changes. Aragon simplifies corporate blockchain adoption by utilizing cutting-edge open-source tools and offering a comprehensive dApp experience. With streamlined accounting, governance, and seamless community-building features, Aragon empowers users to shape their decentralized organizations to fit their unique needs. It fuels progress towards common objectives by fostering connections among individuals with shared interests and opening doors to potential profits.

Thanks to @WalletConnect for unlocking tons of functionality for DAOs! Our Lead Designer shares his test with @hedgeyfinance vesting plans 👇 https://t.co/uoiLbDAVC1

— Aragon 🦅 (@AragonProject) April 12, 2024

ANT’s current price is $9.43, experiencing a significant surge of 17.30% within the last 24 hours while maintaining a market dominance of 0.02%. Over the past year, Aragon has seen impressive growth, with prices soaring by 167%. It trades 52.61% above the 200-day Simple Moving Average (SMA), indicating sustained upward momentum. The 14-day Relative Strength Index (RSI) suggests neutrality, with 13 green days observed in the last 30, showcasing a 30-day volatility of 6%. Additionally, with a volume-to-market cap ratio of 0.0517, Aragon demonstrates robust liquidity, ensuring ample trading opportunities for investors and traders.

2. OKB (OKB)

OKB is a utility token released by the OK Blockchain Foundation and OKEx exchange, offering a range of features within its ecosystem. As the native asset of OKExChain, OKB facilitates spot and derivatives trading. It also enables users to access special platform features and receive transaction discounts. Moreover, OKB plays a crucial role in OKEx Earn and the allocation of funds on the OKEx Jumpstart platform, enhancing user engagement and participation.

With a current price of $57.65 and a surge of 8.58% in the last 24 hours, OKB demonstrates resilience in the volatile cryptocurrency market. Its market dominance is 0.15%, showcasing its significance in crypto. While trading 10.87% above the 200-day Simple Moving Average, OKB maintains a neutral stance, supported by a 30-day volatility of 6%. With medium liquidity and a volume-to-market cap ratio of 0.0160, OKB offers investors ample trading opportunities while mitigating risk.

Hiya creators, builders, founders 👩💻👨💻

🚨 We're opening X Layer Mainnet to the Public 🚨

With +200 dApps building, X Layer is now accessible to everyone, not just developers.

Experience the power & security of our zkEVM L2 network firsthand.

Start building:… pic.twitter.com/K59dg0sJrG

— X Layer (@XLayerOfficial) April 16, 2024

In the latest development, OKX has introduced X Layer, a layer-2 blockchain built on Polygon’s Chain Development Kit. This advancement underscores OKX’s commitment to scalability and interoperability within the crypto ecosystem. By leveraging Polygon’s technology, OKX aims to enhance user experience and expand its ecosystem, connecting users to over 170 decentralized applications. The launch of X Layer marks a significant step towards establishing OKX as a prominent player in Web3. It fosters innovation and accessibility for millions of users worldwide.

3. Slothana (SLOTH)

Slothana’s presale is nearing its conclusion, and the recent surge in investor interest suggests a potential bullish phase. The new meme coin, based on Solana, has garnered significant attention in just two weeks, raising over $10 million. It has emerged as one of the largest ongoing presales on the Solana blockchain. It offers early investors a favourable entry price of 1 SOL for 10,000 $SLOTH tokens, aligning with the team’s ambitious market cap target of $420 million.

Investors can participate in the presale by sending SOL to the project’s wallet or buying tokens through the Slothana website, with distribution at the presale’s end. The absence of a predefined hard cap has fueled intense FOMO among potential buyers, emphasizing the need for swift action before the presale concludes.

🚀 Hold onto your branches, Slothana faithful! 🌿 We're gearing up to drop some major news: the official launch date is on the horizon! ⏰ Get ready to mark your calendars and set your alarms, because a countdown timer will soon grace our site. Let the hype for the Slothana…

— Slothana (@SlothanaCoin) April 14, 2024

As the presale enters its final stages, excitement reaches a fever pitch for the token’s upcoming airdrop to investors’ wallets. To qualify for the airdrop, investors must transfer $SLOTH tokens from a personal wallet. As investors eagerly await further developments, Slothana is on the brink of becoming Solana’s next sought-after meme coin. Its captivating aesthetic and the momentum generated during its presale phase ignite anticipation among crypto lovers.

4. Core (CORE)

Core is an L1 blockchain compatible with Ethereum Virtual Machine (EVM), facilitating Ethereum smart contracts and decentralized applications (dApps). Powered by the innovative “Satoshi Plus” consensus mechanism, it combines delegated Bitcoin mining hash and delegated Proof-of-Stake (DPoS) to ensure network security and scalability. Governed by a decentralized autonomous organization (DAO), Core focuses on revolutionizing blockchain technology.

The uniqueness of Core lies in its utilization of the “Satoshi Plus” consensus mechanism. This mechanism addresses the blockchain trilemma by balancing decentralization and scalability. By incorporating elements of Bitcoin’s Proof-of-Work (PoW) and Ethereum’s DPoS, Core achieves optimal security and efficiency. Additionally, Core incentivizes developers through the S-Prize token, fostering ecosystem growth and innovation.

BTC Journey Series is here!

Another campaign in the series is now live on @Galxe, all about Core-Native Bitcoin Wrapping – CoreBTC 🔶

Complete tasks and earn XP points for each campaign in the series. Doing so, you’ll receive exclusive rewards at the end of the series 🏆 pic.twitter.com/OscPyd8KWM

— Core DAO 🔶 (@Coredao_Org) April 15, 2024

With a current price of $2.56 and a surge of 60.19% in the last 24 hours, Core presents significant growth potential. Trading at 268.98% above the 200-day SMA, it maintains a neutral stance with a 14-day RSI of 55.23, indicating potential price stability. Despite exhibiting high volatility at 58%, Core ensures ample liquidity with a volume-to-market cap ratio of 0.0613. Over the past year, Core’s price has surged by 54%, reflecting investor confidence in its unique consensus mechanism and ecosystem development.

5. Bora (BORA)

Bora is a decentralized gaming and entertainment ecosystem designed to attract GameFi sector applications and avoid Ethereum’s high gas fees. With a two-tiered blockchain setup, the BORA token operates on the Klaytn blockchain, focusing on metaverse and gaming use cases. The Bora chain acts as an execution layer for decentralized apps. Offering development kits and Bora Points for incentives, Bora prioritizes cross-chain interoperability, security, scalability, and reliability.

The Bora blockchain comprises three layers. These include the core layer, which supports infrastructure and data network, and the service layer, housing APIs and development kits. This dual-layer structure provides an appealing alternative for game developers, facilitating easy testing and development. Bora’s transaction throughput, at 2,200 TPS, surpasses even low-gas fee chains like BNB Chain, enhancing developers’ efficiency.

Hi folks, @ArcheWorld_NFT is launching a new collaboration event with @vrtx_dao !!

🏆 Prizes: 60,000 BSLT in total (60 winners)

🕓 Period: 4/11 ~ 4/24 (GMT+9)Chceck out the quest event at https://t.co/x5wpQFR0nM and increase the chance of winning BSLT! https://t.co/Ny54MXQS4L

— BORA (@bora_ecosystem) April 11, 2024

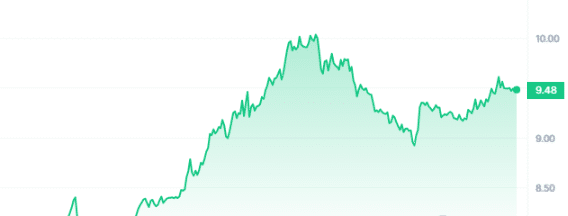

Bora’s price analysis provides insight into its recent status and future potential. Currently priced at $ 0.159314, it’s shown a 2.18% surge in 24 hours, reflecting modest growth. Despite a -18% decline over a year, it trades 11.06% above the 200-day SMA. The RSI at 45.95 indicates a neutral sentiment, possibly leading to sideways trading. Also, 40% of the last 30 days were positive, suggesting stability. With 8% volatility, Bora offers predictability but has low liquidity, showing room for improvement.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage