Join Our Telegram channel to stay up to date on breaking news coverage

Amid rising tensions in the Middle East, Bitcoin experienced its sharpest decline in a year, plummeting 7.7% on Saturday. Alongside Ether, Solana and Dogecoin, the largest cryptocurrency, incurred losses as Iran’s retaliatory strikes against Israel escalated tensions further.

The current situation also affected traditional assets. Stocks tumbled while safe-havens like bonds and the dollar gained ground. The crypto sell-off intensified over the weekend, leading to one of the heaviest two-day liquidations in at least six months.

Biggest Crypto Gainers Today – Top List

In contrast to previous days, today’s market showcases an abundance of favorable price movements. 91% of cryptocurrencies have seen gains over the last 24 hours, while only 9% have experienced losses. However, amidst this, it’s crucial to look beyond short-term wins. Factors like innovative project features, collaborations, and long-term viability are pivotal in making wise investment decisions. Our top four gainers today embody these outstanding characteristics and more. Let’s analyze each to uncover their potential for sustained growth and profitability.

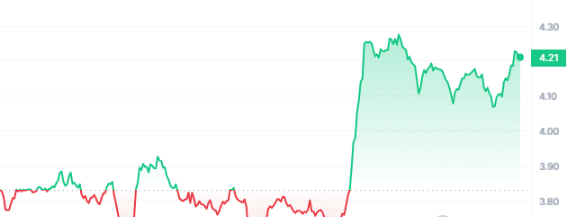

1. Qtum (QTUM)

Qtum, a proof-of-stake (PoS) blockchain, merges Bitcoin’s robustness with Ethereum’s versatility. It addresses interoperability, governance, and smart contract integration challenges. Qtum’s Account Abstraction Layer blends Bitcoin’s UTXO model with Ethereum’s smart contracts. This facilitates seamless application development across various virtual machines. The Decentralized Governance Protocol enables network parameter adjustments without hard forks, promoting agile evolution.

Moreover, this technology caters to decentralized finance (DeFi), mobile applications, and cross-chain compatibility. With its ability to execute smart contracts within unspent transactions, it targets decentralized mobile app empowerment and blockchain integration. Spearheaded by the Qtum Foundation, the project garners support from major Chinese investors and collaborates with entities like PwC to foster blockchain adoption.

Qtum is committed to empowering developers and maximizing the potential of its tools. As Qtum continues to innovate in the blockchain space, the community can expect updates on the progress of these developments.

➡️ https://t.co/4oQ0y8cbFI

➡️ https://t.co/oAwNZmWUha

➡️…— Qtum (@qtum) April 13, 2024

QTUM’s current price is $4.21, marking a notable 9.88% surge in the last 24 hours. With a market dominance of 0.02%, it exhibited a 24% increase over the past year and traded 18.44% above the 200-day SMA at $3.56. The 14-day RSI of 39.37 suggests a neutral stance, while 53% positive trading days in the last 30 days indicate stability. Its 30-day volatility remains low at 7%, ensuring a steady market. Moreover, it boasts high liquidity with a volume-to-market cap ratio of 0.4231, supported by a $442.12M market cap and a $187.08M 24-hour volume. Potential investors should carefully assess Qtum’s metrics against their investment objectives to gauge its profitability accurately.

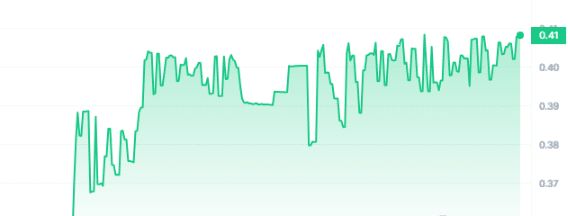

2. Orbler (ORBR)

Transitioning from the vibrant world of Web2 to the decentralized realms of Web3, Orbler emerges as a dynamic marketing platform. ORBR, its native utility token, serves as its driving force, propelling Orbler’s innovative endeavors forward. ORBR opens doors to exclusive features, premium insights, and tailored tools on the Orbler Web3 Marketing Platform. Holders earn additional ORBR tokens through staking in various pools, empowering community-driven growth strategies.

Orbler’s mission platform fosters engagement through interactive tasks, while its social media enhancer amplifies Web3 project presence. The platform prioritizes community building, offering tools for collaboration and adventure-driven interactions. Seamlessly integrated into the Web3 ecosystem, Orbler provides robust support for projects and users.

Excited to announce our partnership with @SRCAI_official, pioneering AI-powered Web3 app that rewards routine driving data. 🚀 With @Orbler1, we're accelerating innovation to enhance driving experiences and revolutionize road rewards!#AI #Web3 #BTC pic.twitter.com/2zC1hqhprm

— Orbler (@Orbler1) April 11, 2024

Despite recent price fluctuations, Orbler demonstrates tenacity with a 14.93% surge in the last 24 hours. However, its price has decreased 82% over the past year, trading significantly below the 200-day SMA. ORBR’s 30-day volatility stands at 26%, reflecting manageable fluctuations. Meanwhile, a neutral RSI suggests potential sideways movement, accompanied by a modest 47% positive trading days in the last month. Considering its relatively low liquidity, a cautious evaluation of Orbler’s potential against market dynamics is prudent.

3. Sponge V2 (SPONGE)

Sponge V2, the sequel to the widely lauded Sponge meme coin, has captured significant investor interest. It mirrors the impressive 100x gains of its predecessor in 2023. Exceeding $18 million in total staked and bridged value, Sponge V2 offers enticing rewards. It boasts annualized rates surpassing 166% on Ethereum and 364% on Polygon. These lucrative incentives have fueled investor participation, driving the project’s growth.

We're on high damp alert this week 🚨 $SPONGE #SpongeV2 #100x #Alts pic.twitter.com/Uo0gq0E28y

— $SPONGE (@spongeoneth) April 15, 2024

The project’s thriving community engagement is evident, with over 9 billion tokens staked on its dApp. Sponge V2 prioritizes transparency and legitimacy. This is evident through its strategic partnerships and listings on reputable exchanges like Uniswap, Poloniex, Toobit, MEXC, and Gate.io. Looking ahead, Sponge V2 plans to list on more extensive exchanges, enhancing accessibility and visibility in the crypto sphere.

Moreover, Sponge V2 aims to challenge conventional criticisms directed at meme coins by introducing the innovative Sponge Play-to-Earn Racer game. The project seeks to broaden its audience by merging gaming elements with cryptocurrency rewards. This approach provides added value to token holders, potentially driving increased demand and ensuring its enduring sustainability.

4. Ontology (ONT)

Ontology is a project focused on enhancing trust, privacy, and security in Web3 through decentralized identity and data solutions. The aim is to offer a high-speed, cost-effective public blockchain that ensures trusted access to Web3 while emphasizing user privacy and adherence to regulatory standards. The project provides a range of real-life use cases, empowering businesses to build customized blockchains atop Ontology’s infrastructure.

What sets Ontology apart is its commitment to interoperability and user experience. Support for three virtual machines and tools like ONTO Wallet and ONT ID ensures seamless cross-chain access and puts Web3 directly in users’ hands. By simplifying registration and data management processes, Ontology enhances the overall user experience and encourages broader adoption of blockchain technology.

🍾As we celebrate another year of @LetsExchange_io, we want to toast @OntologyNetwork for being our lighthouse in the foggy seas of crypto. Your guidance and support have been invaluable.

🌊Here's to navigating the future charting new territories together!#LetsExchangeTurns3,… pic.twitter.com/8waeVuCdQO

— LetsExchange (@letsexchange_io) April 12, 2024

Investors may find Ontology’s performance metrics intriguing. ONT demonstrates upward momentum with a 16.39% surge in the last 24 hours and a 7% increase over the past year. It appears stable in the short term when trading 27.74% above the 200-day SMA, with a 14-day RSI indicating neutrality. Additionally, its 30-day volatility of 8% and high liquidity suggest a favorable environment for investment, with potential for steady growth and reduced risk.

5. GMX (GMX)

GMX is a decentralized exchange (DEX) offering perpetual cryptocurrency futures trading with leverage up to 50X on popular assets like BTC and ETH. Launched as Gambit Exchange in September 2021, GMX has amassed a total trading volume exceeding $130B. It has also attracted a user base of 283K, positioning itself as the leading derivatives DEX on Arbitrum and Avalanche blockchains.

What distinguishes GMX is its utilization of an innovative automated market model (AMM), unlike the order book system commonly employed by centralized exchanges. Through its native multi-asset pool, GLP, GMX rewards liquidity providers with a share of generated fees. In this process, liquidity providers enjoy a share of generated fees without the risk of impermanent loss. This model, coupled with the platform’s integration with Chainlink’s oracles for accurate market prices, ensures efficiency and fairness in trading.

GMX recently concluded its Arbitrum S.T.I.P. campaign and it's time to assess its success. Did the protocol effectively transform GMX v2 into foundational DeFi infrastructure for @Arbitrum..?

Part 2: Trading Incentives

To recap, the STIP campaign aimed to:

🔹 Encourage… pic.twitter.com/W1qRm1r1Tw

— GMX 🫐 (@GMX_IO) April 12, 2024

GMX has experienced a remarkable surge of 10.22% in just the past 24 hours. However, it’s worth noting that its price has seen a significant 68% decrease over the past year, currently trading well below the 200-day SMA by –42.20 %. Despite this, with a 14-day RSI signaling neutrality at 43.83, GMX’s 30-day volatility at 12% alongside its high liquidity still beckons strategic investors. Nonetheless, navigating market conditions with care remains crucial for maximizing opportunities.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage