Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin’s dramatic plunge set off a chain reaction of liquidations in speculative crypto positions. This ignited a frantic selloff in smaller digital assets like Solana, Cardano, and Polkadot. Amidst geopolitical tensions, $780 million in bullish crypto wagers were liquidated within 24 hours, marking the most significant monthly drop. Consequently, this occurrence prompted investors to seek refuge in traditional safe havens such as bonds and the dollar.

However, Ether, the second-largest cryptocurrency, dropped by up to 12%, marking its most significant intraday decline since November 2022 before recovering. Meanwhile, this occurred amidst heightened scrutiny from the US Securities and Exchange Commission. Despite market turbulence, anticipation grows for Bitcoin’s upcoming halving as buyers capitalize on discounted prices before the code adjustment.

Biggest Crypto Gainers Today – Top List

To gauge the exceptional performance of gainers in the cryptocurrency market, it’s crucial to assess the prevailing market conditions. With a total trading volume of $666.12 billion in the last 24 hours, grasping the cryptocurrency market dynamics becomes imperative. Additionally, assessing the market becomes even more critical with a Neutral sentiment reflected in the Fear & Greed Index at 72 (Greed). Amidst this scenario, where only 2% of cryptocurrencies have gained value while 98% have experienced losses, identifying top gainers takes on added significance.

1. Orbs (ORBS)

Orbs is a public blockchain infrastructure renowned for its scalability, low fees, security, and user-friendly design. Launched in 2017, Orbs is a decentralized network tailored for enterprises and large-scale consumer applications. The platform utilizes the ORBS token to incentivize validators and maintain network integrity. It employs a proof-of-stake (PoS) ecosystem and randomized proof-of-stake (RPoS) consensus mechanism to ensure efficient operation for decentralized applications (DApps).

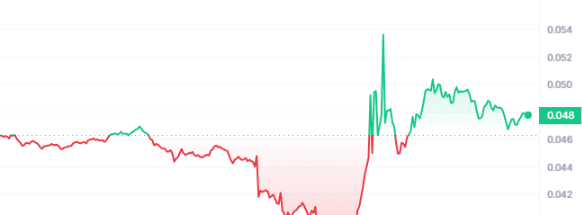

Exploring Orbs’ price movements unveils unique perspectives for investors, offering a glimpse into its market trajectory and potential. Priced at $0.048133 presently, ORBS has seen a moderate 3.66% uptick over the last 24 hours, suggesting consistent advancement. In the previous year, ORBS has seen a surge of 46%, positioning itself 40.06% higher than the 200-day SMA at $0.034052. Despite a neutral RSI of 43.21, suggesting sideways trading, ORBS maintains high liquidity with a volume-to-market cap ratio of 2.2782.

dTWAP & dLIMIT orders powered by Orbs go live on @PancakeSwap! 🥞🤝🌐

The two fully decentralized order types enable traders to set limit stop losses, dollar cost average, and more!📈

➡️ https://t.co/aVGKmvyyZZ⬅️ pic.twitter.com/yH0w7XJpNb

— Orbs (@orbs_network) April 11, 2024

In recent news, Orbs has integrated its technology with PancakeSwap’s multi-chain DEX, offering millions of DeFi users advanced trading features. The integration includes dLIMIT and dTWAP protocols, enabling efficient order execution without compromising decentralization. This partnership underscores Orbs’ leadership in the DeFi innovation sector, expanding its market reach and enhancing user experience on PancakeSwap.

2. MATH (MATH)

MATH is a multifaceted crypto platform launched in 2018, featuring Math Wallet, MATH VPOS Pool, Math DApp Store, MathStaking, MathPay, and MathChain. MATH supports over 63 public blockchains and offers many investment opportunities and financial services. These include automated quant trading, high APR on digital assets, instant loans, and fee-free global payments.

The uniqueness of MATH lies in its comprehensive ecosystem, integrating various applications to cater to diverse crypto needs. Math Wallet provides a seamless user experience across multiple blockchains, while the Math DApp Store offers access to a range of decentralized applications. MATH VPOS Pool allows users to stake crypto and earn up to 30% APR, promoting active participation and incentivizing network growth. Furthermore, MathChain is a second-layer blockchain based on Substrate, enhancing scalability and interoperability within the MATH ecosystem.

Come join the Maneki-neko NFT blind box created by MathWallet x WSPN x Stable and win the top prize of $5000!

Join: https://t.co/8zIQUg5qR8 https://t.co/WqJChMDS0n pic.twitter.com/sySnq9C2gP— MathWallet (@MathWallet) April 12, 2024

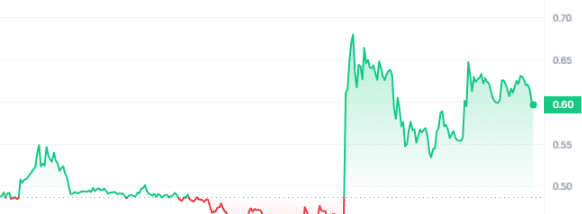

MATH has demonstrated significant growth potential with a price of $0.600547 and a 21.59% surge in the last 24 hours. Over the past year, it surged by an impressive 447%, trading significantly above the 200-day SMA, which stands at $0.087640. It maintains high liquidity despite high volatility, boasting a volume-to-market cap ratio of 0.1821. As MATH continues to innovate and expand its ecosystem, it presents compelling opportunities for investors looking to diversify their portfolios.

3. 99Bitcoins ($99BTC)

Renowned in crypto education, 99Bitcoins launches the Learn-to-Earn (L2E) platform with its native token, $99BTC. It simplifies crypto complexities via user-friendly methods like diagrams and videos. Now, with the introduction of the L2E platform, the team aims to democratize access to crypto knowledge and empower learners to earn rewards in the process.

It aims high in token sales, setting a soft cap of $5.353 million and a hard cap of $11.070 million. With 15% of the total 99 billion tokens allocated, the presale emphasizes community engagement. The presale progresses through seven stages, each gradually inviting investment until meeting the soft cap, marking the start of subsequent hard cap rounds.

Initially launched on Ethereum, $99BTC is bridging to BRC-20, unlocking new growth avenues. Embracing the BRC-20 bridge, $99BTC aims to innovate and expand utility in Bitcoin’s decentralized applications. This strategic move enhances its compatibility and opens doors to broader investment opportunities for stakeholders across the crypto ecosystem.

4. Decimal (DEL)

DecimalChain, a blockchain and token constructor launched in August 2020, introduced DEL as its primary cryptocurrency. DEL facilitates direct peer-to-peer transactions, distinguishing itself for its eco-friendly approach and user-friendly interface. Validators on the Decimal network receive newly generated DEL as a reward, incentivizing user participation and democratizing access to blockchain technology.

DecimalChain leverages advanced blockchain developments to offer features like asset tokenization and instant payments. DEL holders benefit from secure storage, low-cost transfers, and a fixed total supply of 94 billion coins, ensuring stability and long-term value. As DecimalChain continues to innovate, it promises to revolutionize digital transactions and foster collaboration within the blockchain community.

Decimal main news

New videos on Youtube and TikTok

We made a complete guide, to explain step by step, everything about Decimal console. And we also talk about the first children's cartoon made to teach Bitcoin to kids.Decimal & Makarovsky's AMA session on Binance Live

On… pic.twitter.com/KTuGheV9ob— DecimalChain (@DecimalChain) April 12, 2024

Investors can glean valuable insights from Decimal’s performance metrics. Despite a significant 79% decrease in the past year, DEL has experienced a 20.20% surge in the last 24 hours. Trading below the 200-day SMA at $0.007315, DEL exhibits a 30-day volatility of 14%, signaling moderate price fluctuations. However, with low liquidity and trading -63.16% below the 200-day SMA, investors should approach DEL cautiously, considering its volatile nature and market conditions.

5. CREAM Finance (CREAM)

CREAM Finance, an integral part of the yearn.finance ecosystem, is a decentralized DeFi lending protocol. Launched unexpectedly on Ethereum and later on Binance Smart Chain, the CREAM token empowers users. It’s accessible across Ethereum, Binance Smart Chain, Polygon, and Fantom, providing financial services for individuals, institutions, and protocols.

CREAM, a Compound Finance fork, distinguishes itself by its open-source, permissionless, and blockchain-agnostic nature. It offers yield farming rewards to foster network inclusivity and development. Users can passively earn yield by depositing assets like Ether or wBTC, akin to a traditional savings account. It offers a suite of features, including lending, borrowing, staking, and governance functionalities, catering to diverse DeFi needs.

Claim page is now live for crETH2 holders at block number 18278200.

Go to https://t.co/HQ26BdmODo to claim your ETH from the STRK airdrop. https://t.co/QDfi9RpoVK

— Cream Finance 🍦 (@CreamdotFinance) March 11, 2024

Its price surge of 15.40% in the last 24 hours aligns with a notable 236% increase over the past year. Despite a neutral RSI of 39.37 suggesting sideways trading, CREAM Finance boasts high liquidity. It maintains a volume-to-market cap ratio of 0.5772, enhancing investor confidence in the project’s stability and potential. Trading substantially above the 200-day SMA, the cryptocurrency exhibits positive market sentiment. A manageable 30-day volatility of 23% reinforces this, along with 63% green days in the last 30 days. Such stability and growth potential make this gainer an attractive investment opportunity for discerning investors.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage