Join Our Telegram channel to stay up to date on breaking news coverage

In a surprising turn of events, Bitcoin’s recent volatility has outpaced that of Ether, marking a significant departure from its usual stability. Data reveals that Bitcoin’s 30-day historical volatility has soared to nearly 60%, surpassing Ether’s by almost 10% points, marking the widest spread seen in at least a year.

Despite the ongoing volatility, Bitcoin continues to maintain its dominance in the market, even as its price experiences a minor decline. Currently priced at $69,563, with a slight decrease of -0.91% over the last 24 hours, Bitcoin’s market capitalization stands strong at $1.37 trillion, representing a market dominance of 51.83%. With Bitcoin’s impending halving on Apr 21, anticipation grows over its potential impact on market dynamics and price volatility.

Biggest Crypto Gainers Today – Top List

In today’s market, attention is drawn to four standout top gainers: Theta Fuel, eCash, Kava, and Aptos. Theta Fuel distinguishes itself by powering transactions and smart contracts on the Theta blockchain, utilizing a hybrid model to optimize both blockchain and edge network functionalities. eCash distinguishes itself with its commitment to supporting Ethereum Virtual Machine compatibility and enhancing scalability and transaction finality. Kava operates as a lending platform within the decentralized finance space, offering increased buying power through its unique lending mechanism and robust governance framework. Aptos showcases innovation with its high transaction throughput and Byzantine Fault Tolerance system, aiming to foster mainstream adoption of web3 applications. Join our in-depth analysis of each of these coins to uncover their uniqueness on all fronts.

1. Theta Fuel (TFUEL)

Theta Fuel powers transactions and smart contracts on the Theta blockchain, a decentralized infrastructure for video, AI, and entertainment. Alongside its counterpart token, THETA, TFUEL facilitates payment, reward, and staking on the Theta Network, which integrates a proof-of-stake (PoS) blockchain with an Edge Network for video streaming and computational tasks. Led by industry giants like Google, Samsung, and Sony, Theta Network enjoys robust corporate backing, with advisors including YouTube co-founder Steve Chen and Twitch co-founder Justin Kan.

Theta distinguishes itself with a hybrid model comprising the Theta Blockchain and the Theta Edge Network. This dual-network setup optimizes blockchain capabilities for transaction processing and smart contracts while the Edge Network handles video delivery and AI computations. Moreover, Theta’s Web3 infrastructure and NFT marketplace, ThetaDrop, underscore its commitment to disrupting traditional media and entertainment sectors.

EdgeCloud is coming soon in Q2 w/ many AI models supported at launch! AI devs can select & deploy popular genAI and LLMs like Stable Diffusion, Llama 2, Mistral and many other open-source models straight out of the box, or deploy their own custom models.https://t.co/sdVUtweXRM

— Theta Network (@Theta_Network) March 31, 2024

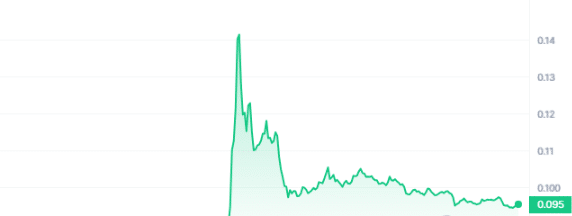

TFUEL surged by 13.51% in the last 24 hours, with a current price of $0.094804. Over the past year, it has seen a significant 72% increase, trading well above the 200-day SMA at $0.041365. Despite a neutral 14-day RSI of 56.41, TFUEL has exhibited positive momentum, with 57% green days in the last 30 days. Additionally, its low 30-day volatility of 8% and high liquidity, reflected in a volume-to-market cap ratio of 0.2004, present favorable conditions for investors seeking stability and potential growth in the evolving Web3 ecosystem.

2. eCash (XEC)

eCash aims to establish itself as a cryptocurrency primarily designed for everyday transactions. It distinguishes itself from its predecessors by introducing base units called “bits,” simplifying transaction values. Utilizing a proof-of-stake consensus layer named “Avalanche,” eCash seeks to enhance scalability, transaction finality, and protocol extension.

Its standout feature lies in its commitment to supporting Ethereum Virtual Machine (EVM) compatibility and interoperability with Ethereum’s decentralized finance (DeFi) sector. The development team has outlined five core missions, including ensuring anonymous and almost free transactions alongside globally secure and immutable transactions with swift finality. To achieve these goals, eCash’s roadmap encompasses various ambitious solutions, such as canonical transaction ordering and Schnorr Signatures.

Happy #Easter! 🌷🐰

Wishing everyone joy and prosperity on this special day. 🎉

Keep an eye out as we share Easter eggs🥚 throughout the day— the first person to claim will receive $XEC! pic.twitter.com/5VRfxfsri2

— eCash (@eCashOfficial) March 31, 2024

Ranked #40 in the Layer 1 sector by market capitalization, eCash boasts a price of $0.00006935, reflecting a 5.75% increase in the last 24 hours. With a market dominance of 0.05%, it has surged by 117% over the past year, trading notably above the 200-day SMA at $0.00003064. The gainer appears oversold with a 14-day RSI of 28.36, indicating a potential uptrend. Despite 43% green days in the last 30 days, its 30-day volatility remains low at 13%, suggesting stability. High liquidity, indicated by a volume-to-market cap ratio of 0.0359, alongside consistent positive trading trends, makes it a good investment choice.

3. Slothana (SLOTH)

Slothana, a novel meme coin running on the Solana blockchain, has quickly gained traction, raising an impressive $5,450,927 million in its presale within days. This rapid success can be attributed to two primary factors. Firstly, Slothana’s mascot, a sloth aspiring for financial freedom, deeply resonates with crypto lovers, injecting humor and personality into the project and enhancing its appeal. Secondly, Slothana’s straightforward presale system, inspired by successful projects like $BOME and $SLERF, eliminates complex tiers, allowing users to send $SOL tokens to a designated wallet address directly.

This streamlined approach aligns with the laid-back nature of its mascot, simplifying the process for investors compared to other projects with convoluted presale structures. Participants send $SOL tokens to the specific wallet address listed on the Slothana website, receiving an airdrop of $SLOTH tokens upon launch. However, it’s essential to use a private wallet and avoid centralized exchanges (CEX) to qualify for the airdrop.

On the 7th day, Slothana said, 'Let there be memecoins!' And lo, the crypto world rejoiced as the laziest deity of them all blessed us with meme magic. Unto my fellow believers in the slothful gospel of crypto, may your baskets be full of memecoins this easter🐣 #slothana

— Slothana (@SlothanaCoin) March 31, 2024

Currently, 1 $SOL equates to an attractive 10,000 $SLOTH, making Slothana a compelling investment opportunity. With a robust marketing team, Slothana is well-positioned to capitalize on the anticipated surge in meme coin activity expected in Apr 2024, driven by events like the Bitcoin block halving and Doge Day. Investors are eagerly flocking to the project, aiming to secure early positions and potentially lucrative returns.

4. Kava (KAVA)

Kava operates as a Layer-1 blockchain, combining Cosmos’s speed and interoperability with Ethereum’s developer capabilities. It serves as a lending platform within the decentralized finance (DeFi) space, built on Cosmos for enhanced functionality. Its ecosystem revolves around two native tokens: USDX, a stablecoin backed by digital assets, and KAVA, utilized for governance and staking.

Unique to Kava is its lending mechanism, allowing users to lock tokens as collateral and mint USDX stablecoins, providing increased buying power. Additionally, holding USDX enables users to earn interest from borrowers’ payments. The platform incentivizes lenders with rewards for providing liquidity, ensuring ample asset backing for the stablecoin. Kava’s approach enhances traders’ spending power and investment potential.

Over $100,000,000,000 $USDt issued by @Tether_to and $10,000,000,000 $WBTC offered by @BitGo and now available to the Kava EVM and @cosmos ecosystems.

Tap into the deep liquidity and unlock fresh utility today.

Kava Chain is just getting warmed up! 🙌

— Kava (@KAVA_CHAIN) March 28, 2024

In terms of market performance, Kava is ranked #13 in the DeFi Coins sector and #43 in the Layer 1 sector by market cap. With a price of $1.073903, it saw a 3.66% rise in the last 24 hours. Its market dominance stands at 0.04%, indicating stability. The cryptocurrency is trading 31.96% above the 200-day SMA, signaling positive trends. While the 14-day RSI suggests neutrality, the majority of the last 30 trading days were positive, with a 63% green day count. Kava boasts high liquidity, with a volume-to-market cap ratio of 0.1064, further solidifying its investment appeal.

5. Aptos (APT)

Aptos is a Layer 1 Proof-of-Stake (PoS) blockchain led by a team of developers with prior experience in Facebook’s Diem projects. Driven by the Move programming language, Aptos aims to foster mainstream adoption of web3 and address real-world challenges through decentralized applications (DApps). With a theoretical transaction throughput exceeding 150,000 transactions per second (tps), Aptos demonstrates its scalability potential. It leverages a Byzantine Fault Tolerance (BFT) system for network resilience, ensuring a robust foundation for its ecosystem’s stability and reliability.

What sets Aptos apart is its innovative approach to transaction processing. It employs a parallel execution engine (Block-STM), enabling simultaneous processing and validation of transactions. This innovative approach enhances efficiency and scalability, mitigating the risk of network congestion and failed transactions.

Wen 1 billion? 🤔

Recent reports predict the industry will reach “nearly one billion [users] in 2024” (https://t.co/l3DUcYmdX6)

Leaders from @AptosLabs, @JamboTechnology, @LayerZero_Labs, and @Merkle_Trade will take the #AptosDeFiDays stage to share what it will take for the… pic.twitter.com/1nsZOHFk45

— Aptos (@Aptos) March 30, 2024

With its current price at $17.49 and a 5.82% surge in the last 24 hours, Aptos demonstrates steady growth potential. It maintains a robust position, trading significantly above the 200-day SMA at $7.14. Despite a 30-day volatility of 13%, Aptos exhibits high liquidity, with a volume-to-market cap ratio of 0.1305. Moreover, its positive market sentiment is indicated by a 53% increase in price over the past year. Additionally, there have been 57% green days in the last 30 days, showing Aptos’s attractiveness as an investment opportunity in blockchain.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage