Join Our Telegram channel to stay up to date on breaking news coverage

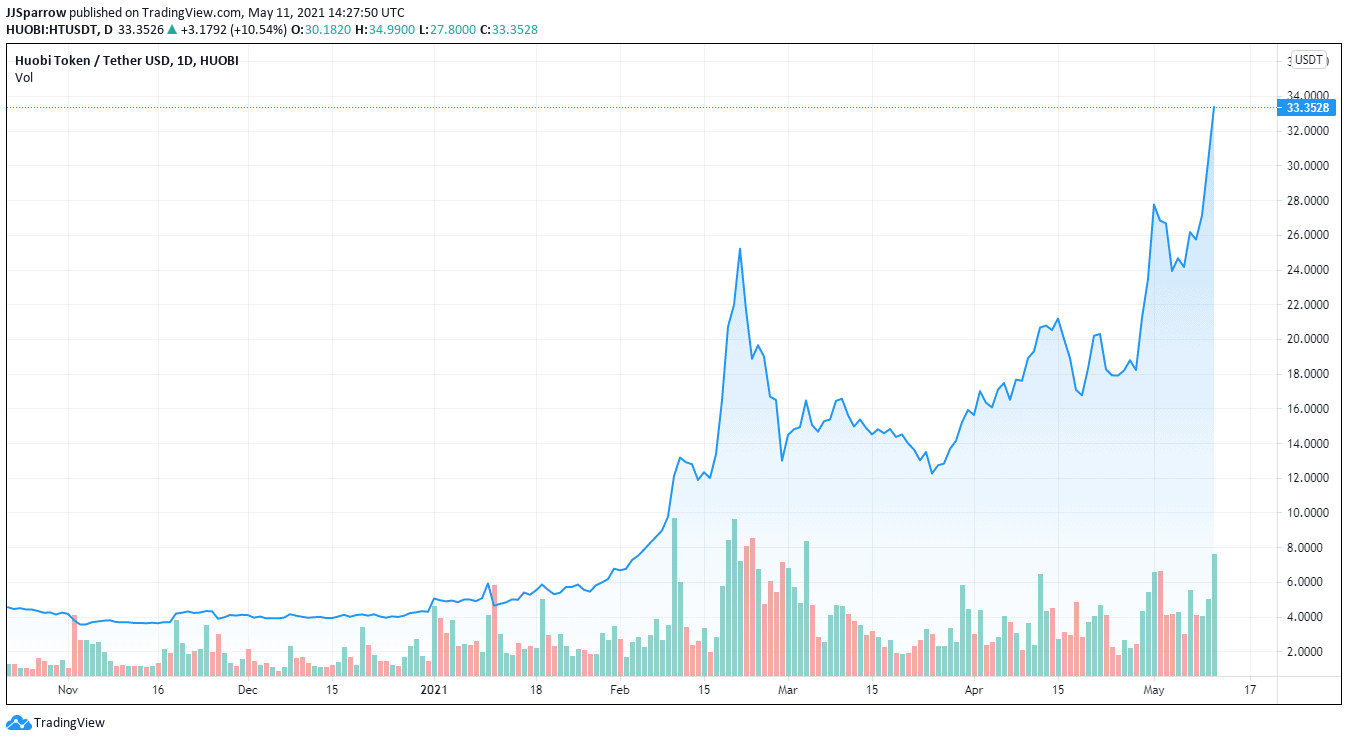

It has risen by 3,200% in the past four months and is expected to increase further, so is it time to buy Huobi token (HT) for your crypto portfolio?

The token was created by Huobi Global, in a similar way to how Binance created the Binance Coin (BNB) as its native token for paying trading fees. BNB has also been on a tear, having risen 300% in 2021. But, why should you buy Huobi tokens when BNB leads the pack?

Buy Huobi token before the crowd

BNB is the best-performing crypto token in its niche, trading at over $600. It’s the third-most valuable cryptocurrency with a market cap of $101 billion, at press time.

Other native tokens might be playing catchup, but HT is making remarkable strides forward. It currently ranks 32nd largest digital asset by market cap, with 1.00 HT token now exchanging for $33.40, according to crypto data aggregator Coingecko.

Here are three reasons why you should buy Huobi tokens before it becomes the next BNB.

1. Governance – You Can Vote For Coins to List

Need a major reason to buy Huobi tokens? Holders can use the token for governance.

Huobi Global operates an hybrid exchange called the Huobi Autonomous Digital Asset Exchange (HADAX) and the Huobi Token plays a critical role on this platform. HADAX lets users vote on the crypto projects they want Huobi to list on its general exchange platform.

In the HADAX ecosystem, users are also rewarded with free tokens for voting for these projects. The rewards are given by the competing projects when they are eventually listed. If they fail to make the grade, users are refunded their Huobi Tokens.

2. Reduced TX Fees and Generous Buyback Program

Investors who buy Huobi tokens are rewarded with discounted trading fees on Huobi exchange. This is similar to what BNB holders enjoy on Binance. But unlike Binance’s scheme, the Huobi Tokens operate on a subscription basis.

According to Huobi Global, the subscription works on five tiers, with each section having different benefits. In addition, Huobi uses a buyback mechanism, similar to Binance’s token burn to reduce the token supply. This takes place every quarter, with 20% of the exchange’s profits used to buy HT on the open market. As the supply is reduced, token price rises.

Do you still need more reasons to buy Huobi tokens? If yes, let’s check the third reason.

3. Bullish Supply and Demand Drivers

The HT token is also expected to see price appreciation due to the interest from speculators. With the growing adoption of crypto in the general financial space, exchanges have seen an influx of investors into the nascent industry.

This has seen the demand for digital coins shoot up and Huobi Tokens has been one of the beneficiaries.

Huobi is one of the top 10 crypto exchanges with over $26 billion in daily trades, according to Coinmarketcap. The exchange’s digital token, which traded at under $5 at the close of 2020, has surged to $33 in just four months due to growing demand from institutional investors for crypto assets.

There has also been growing interest from the public regarding the rewards provided by crypto projects during the voting rounds. Given that Huobi has been a top-performing exchange for so long, many crypto investors believe its HT token could eventually become the next BNB.

Huobi Token currently trades at $32.93 for a 13.4% increase today and is the 29th ranked coin on Coinmarketcap.

Alongside with Binance and OKEx, Huobi is one of the top-three exchanges used by Chinese traders.

Get Free Crypto Signals – 82% Win Rate!

3 Free Crypto Signals Every Week – Full Technical Analysis

Join Our Telegram channel to stay up to date on breaking news coverage