Join Our Telegram channel to stay up to date on breaking news coverage

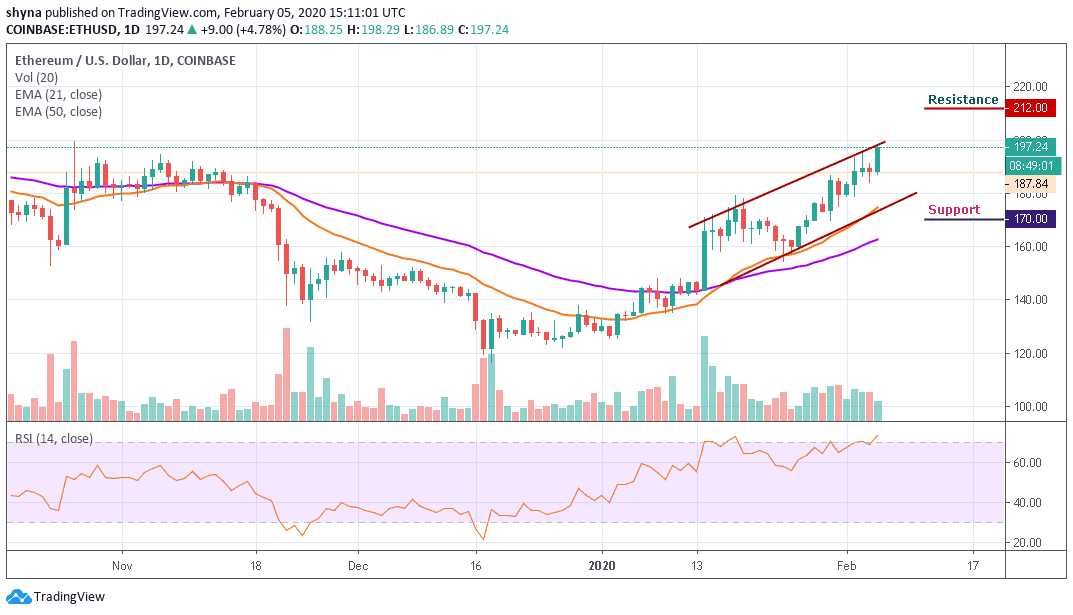

Bitcoin Cash (BCH) is on a tear, up 15% in the past 24 hours. The top bitcoin fork is now trading at $435, a level not seen since in seven months.

From an 18 December 2019 low of $169, the price has risen 157% to date.

Buyers are piling into the forked token, which broke from the bitcoin chain in August 2017. BCH blocks are 32MB compared to bitcoin’s 1MB.

Halvening?

So what’s behind the sudden surge in price?

Well, Bitcoin Cash is halving its block reward in early April to 6.25 BCH. The prospect of constrained future supply should strengthen the price, so that will certainly have helped.

Then there’s the row about the proposed BCH development fund, which a large and vocal section of the community sees as a tax, with some miners threatening to fork, as if we don’t have enough bitcoin clones already. But that doesn’t explain the price charging higher 14%.

Bitcoin halo

Another factor to consider is that when bitcoin is doing well, so does the rest of the market, but often especially so its biggest forks.

BCH being the first and most prominent bitcoin clone of them all can get pulled along in the bitcoin slip stream because of a phenomenon seen before that is all to do with branding.

The halo effect of the bitcoin name rubs off on BCH – and so does the psychological attraction to buyers of its lower price, in the hundreds compared to bitcoin in the 1,000s.

BCH is not the only bitcoin clone that has been making waves recently.

BSV v BCH

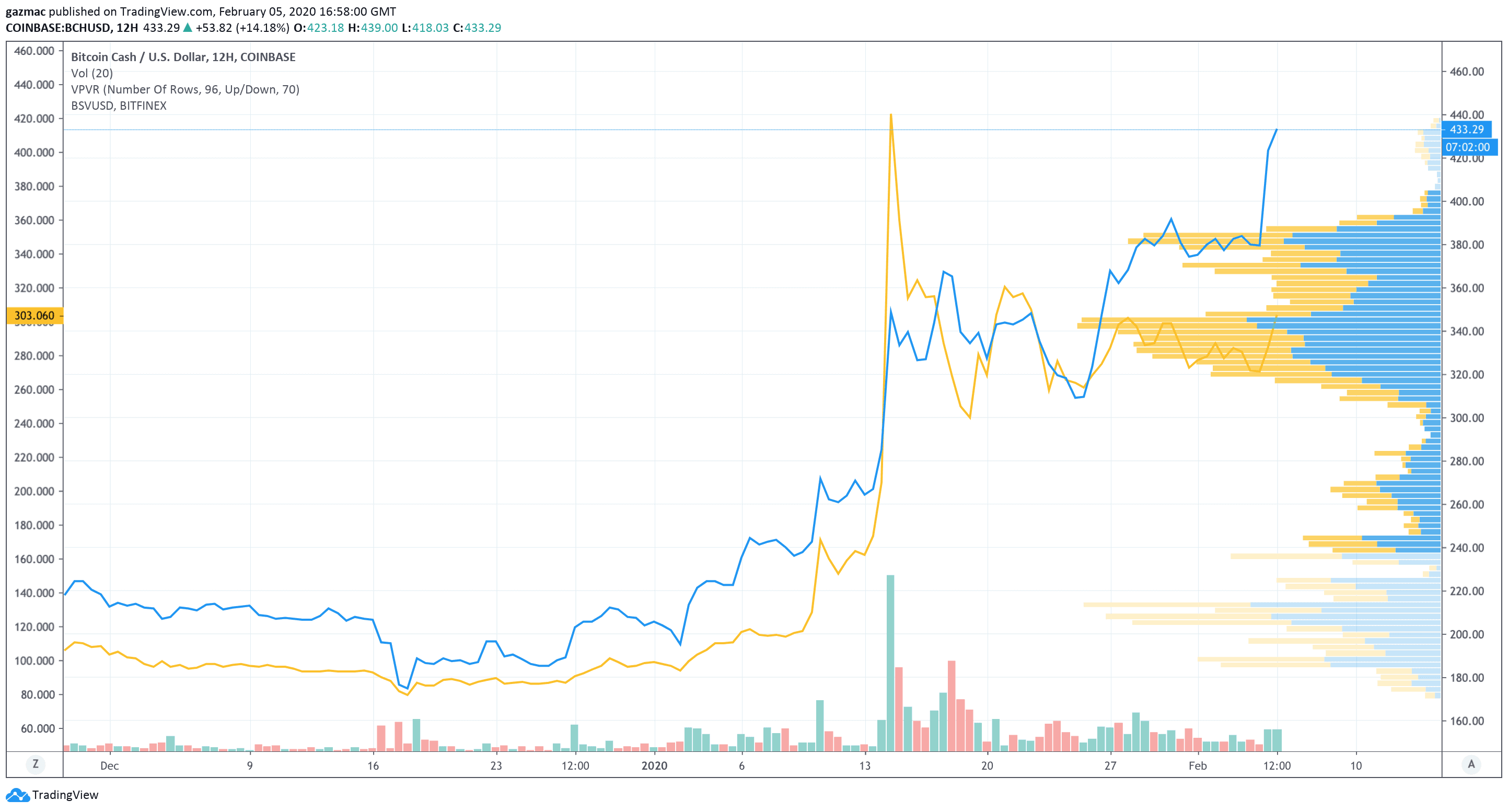

Just three weeks ago BCH looked like it was losing its battle with rival BSV when it suffered a flippening on 13 January (see chart below).

Bitcoin Satoshi Vision arguably benefits less from the bitcoin brand because of the way it was born and the behaviour of its most prominent supporters.

Backed by Craig Wright and billionaire Calvin Ayre, BSV split from BCH in November 2018, with the battles around the fork still blamed by many for triggering a sharp decline in the bitcoin price because of the confusion it caused in the marketplace.

Now the price of BCH is around the same level as the BSV near-term high of $440. Those who hold to market manipulation theories may see something in that.

However, it is another millionaire backer that is smiling today. Roger Ver, the owner of the bitcoin.com website, is the main cheerleader and evangelist for BCH.

Smart contracts – serious dev work pays off

It could be said that the BCH community has been less loud than the BSV crowd but has got more done, aside from its much bigger network footprint.

BCH can now run smart contracts, which means in addition to running decentralised applications it can also be used to launch new tokens in much the same way that Ethereum does.

That development work is now paying off for the BCH community and holders of the token.

However, it hasn’t just been the protocol that has been developing; the ecosystem around the coin has been growing.

Despite much abuse and derision thrown the way of Ver and bitcoin.com, it must be admitted that he has done a pretty good job in leveraging the bitcoin name. To such an extent some say, that he deliberately uses the bitcoin.com site to blur the difference between bitcoin and BCH. His – and the BCH community’s – habit of referring to bitcoin as ‘bitcoin core’ is seen as part of this claimed subterfuge.

Bitcoin.com, one of the most visited sites in crypto, has had something of a makeover with the landing page of news articles now replaced by the homepage for a brand-new crypto exchange. Indeed, just the other day I came across a link to an ad for product marketing manager for the exchange, so expect to see a lot more from bitcoin.com exchange.

So is this a good time to buy BCH?

So, with that said and done, is it the right time to buy bitcoin cash? Probably not, if you are trying to time the market, as just like the Tesla price today (5 February, down 14%), buyers can end up following the crowd and then all of a sudden the herd changes direction.

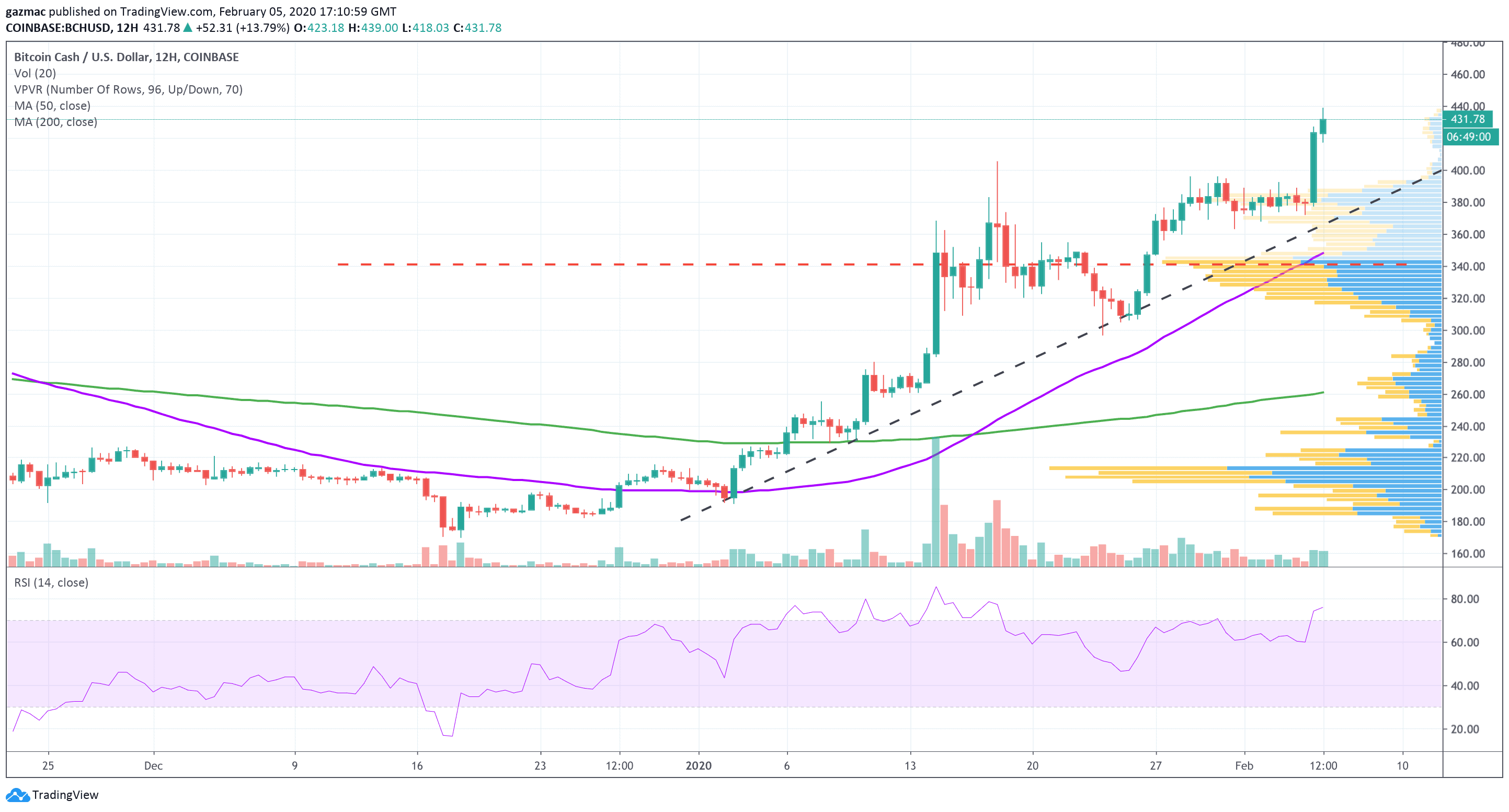

With the relative strength index of 76, BCH can be seen as overbought at these levels (see chart below).

But if you are looking at this with at least a few months view or longer, then of all the projects out there, BCH is doing some serious work to make crypto fit for consumers.

With the 50-day moving average (purple line) crossing the 200MA (green line) on 16 January, bulls should be confident of further progress ahead.

To break the trendline (black dashed line), BCH will have to fall below 380.

Add to that the head and shoulder neckline giving support (red dashed line) at $340 and the volume profile showing the strength of resistance, bulls are treading on solid ground.

Join Our Telegram channel to stay up to date on breaking news coverage