Join Our Telegram channel to stay up to date on breaking news coverage

The non-fungible token market has seen an incredible growth in recent years, attracting investors and artists to the space to create and trade digital assets. Nonetheless, the NFT market has plunged in recent weeks, leaving many NFTs shielding more than 70% in their floor prices. Below we will look in-depth at whether NFTs are really dying or they are just taking a breather:

The Rise Of NFTs

Non-fungible tokens came into the spotlight sometime in 2021, creating a massive frenzy and interest among crypto traders and investors. At the time, the nascent NFT sector attracted most institutions, businesses, and celebrity investors, including Cristiano Ronaldo and Paris Hilton.

The NFT mania reached its peak season when an NFT of former Twitter boss Jack Dorsey’s first tweet sold for $2.9 million. The tweet “Just setting up my twttr” — which Dorsey posted in March 2006 — was purchased by Malaysia-based entrepreneur Sina Estavi on the Valuables platform.

In August 2021, Ringers #879 became one of the top most expensive NFTs ever sold at 1,800 ETH ($5.9 million) before recently reselling at $6.2 million. In 2022, Bored Aped Yacht Club and CryptoPunks NFTs gained traction in the NFT market, also becoming one of the most traded expensive NFTs. Certain bored Ape NFT collections even sold for over $3 million.

Earlier this year, NFTs retested another market hype before being taken down by the meme coins mania. Memecoins are crypto tokens, sometimes depicted with comical or animated memes, which are supported by enthusiastic online. The meme coins are popularly known in the market as shitcoins.

The NFT Recession

Since most meme coins do not have intrinsic value in terms of utility, the memecoin season did not last for long. In the second quarter of this year, the non-fungible token had taken back market dominance, with Bitcoin ordinals becoming one of the most traded NFTs. Bitcoin NFTs have inspired the evolution of Ethscriptions, another type of NFTs hosted on the Ethereum network.

A SHORT CLIP: What is a protocol?

From July 5 Spaces, edit by @_mackinac pic.twitter.com/bq9YPIXRGM

— Middlemarch.eth (@dumbnamenumbers) July 15, 2023

Unfortunately, the non-fungible token market has suffered another market downturn. The recent NFT slump began in mid-June and left many NFTs in huge losses. The Bored Ape Yacht Club, an NFT collection from digital asset incubation firm Yuga Labs, is a perfect example of NFTs impacted by the recent market downturn.

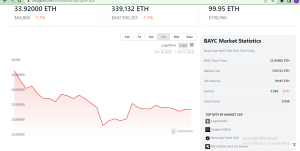

Bored Ape NFTs:Source: CoinGecko.com

Bored Ape Yacht Club NFT collection recently went down from a floor price of over 100 ETH to now 34 ETH. Azuki, an NFT collection from digital asset firm Chiru Labs featuring a limited edition of 10,000 NFTs, is another NFT collection that has gone down miserably in recent weeks. The NFT collection fell from 15 ETH to now 7 ETH.

In 2022, Franklin, an NFT collector, and crypto influencer, bought his Bored Ape Yacht Club at around $3 million. At the time of publishing, his Bored Ape NFT collection has a best offer of 34 WETH ($65,000.) What has gone wrong in the NFT market? Are NFTs dying or just taking a breather?

This NFT was once worth $3 million.

Now it’s only worth $65,000.

What went wrong? pic.twitter.com/DKxsmD6mgI

— Franklin (@franklinisbored) July 17, 2023

What Went Wrong?

Regulatory uncertainty in the broader crypto industry is a probable candidate partially responsible for this latest crash. In the past several weeks, the crypto market has suffered intense regulatory scrutiny, with top exchanges such as Coinbase and Binance even facing legal charges. The regulatory uncertainty has created FUD, dragging the NFT market down. It has also pushed the flagship crypto Bitcoin down below $30,000.

The platforms and marketplaces where NFTs trade is another factor attributed to the recent market crash. It’s worth noting that Blur and OpenSea have been rivaling for market dominance. The most major point of contention concerning the Blur NFT marketplace allegedly manipulating the NFT market comes from its native token, $BLUR.

Recently, reports emerged that a handful of prominent traders and investors might have been using the platform’s incentivization system to influence NFT prices. Despite the recent NFT downturn, many investors are still bullish that the NFT market will again stand on its feet.

NFT Marketplaces are the ones tanking the NFT market

I'm fully convinced @xerocooleth is right

Here's why

The marketplace wars are not fought over volume

They're fought over having the lowest floor

Whoever controls the floor controls the market & future volume

This means…

— trevor.btc (@TO) July 4, 2023

Related NFT News:

- Jack Butcher Drops New NFTs – Opepen Edition NFTs Spike 30% In Price

- Why Are NFT Floor Prices Crashing? – Here’s What You Need To Know

- Top Selling NFTs This Week – Fatzuki NFTs Rise In Rankings

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage