Join Our Telegram channel to stay up to date on breaking news coverage

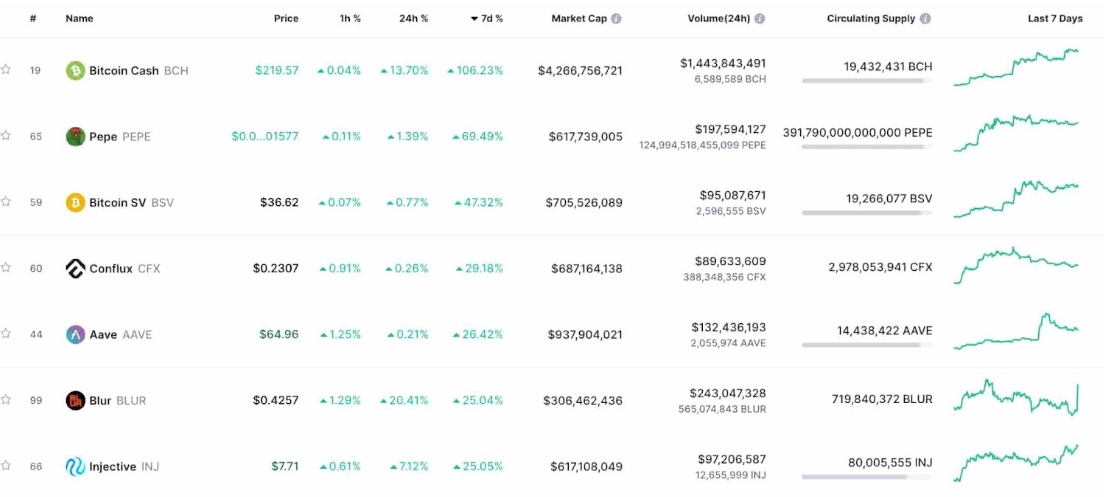

Bitcoin Cash experienced an astonishing surge on the weekly chart, soaring by an impressive 106.2% from $106.4 to its present value. This remarkable ascent propelled Bitcoin Cash’s market cap to a substantial $4.25 billion, surging by approximately $2.19 billion in that timeframe.

This surge can be attributed to the increasing demand for cryptocurrencies, the optimism surrounding the Bitcoin Cash network’s upcoming hard fork, and the possibility of a new asset being created.

The demand for cryptocurrencies has increased as more people become aware of them and start investing in them. Meanwhile, the anticipation of a new asset being created during the Bitcoin Cash hard fork has also been driving the price.

The price of BCH has surged over 127% year-to-date.

Analysis of Bitcoin Cash’s Price

The price of BCH surged over 13% in the past 24 hours, reaching $219.8 at the time of writing.

In just a week, Bitcoin Cash witnessed an astounding surge of 106.2%, propelling its price from $106.4 to its present value, while its market cap experienced a staggering rise of $2.19 billion, reaching a substantial $4.25 billion.

The surge is attributed to a combination of factors, such as increased media attention and the fact that many cryptocurrency exchanges have now started offering trades in Bitcoin Cash.

The recent announcement from the Chinese government that it would no longer ban cryptocurrency trading has also been a contributing factor.

How Does BCH’s price skyrocket?

Bitcoin Cash has soared in value, riding the wave of a broader crypto market surge fueled by growing investor confidence in institutional crypto integration.

BlackRock, the world’s largest asset manager, has taken a significant step towards embracing cryptocurrencies by filing with the SEC to launch a spot Bitcoin ETF.

This move signals a major shift in the perception of digital assets, as it would allow investors to access Bitcoin through one of the most prominent Wall Street firms. The potential approval of the BlackRock Bitcoin ETF could have far-reaching implications for the mainstream adoption of cryptocurrencies.

In the wake of the initial application, Invesco, Valkyrie, and WisdomTree swiftly joined the ranks of prominent financial institutions seeking similar opportunities in the following days.

The positive shift in market sentiment propelled Bitcoin’s price above $30,000, while other cryptocurrencies followed suit, experiencing significant gains across the board.

A Three-Year High in BCH Social Dominance

The launch of EDX Markets, supported by renowned institutional investors like Fidelity Investments, Citadel Securities, and Charles Schwab, contributed to an additional surge in Bitcoin Cash’s price, solidifying its position in the crypto market.

These investors and the launch of EDX Markets provided greater institutional trust and confidence in Bitcoin Cash. This, in turn, increased the demand for the currency, leading to its price surge and helping to solidify its place in the crypto market.

EDX Markets is a regulated, secure trading platform for large-scale institutional investors. The launch of this platform provided large investors with access to Bitcoin Cash, which created a surge of demand for the cryptocurrency, driving up its price and cementing its position in the crypto market.

📈 With the assistance of #EDXMarkets, launched on June 20th, #BitcoinCash has been the biggest beneficiary with a massive +79% price gain in 4 days. Notably, $BCH has seen a 3-year high in social discussion rates, & volume has easily eclipsed 2023 highs. https://t.co/6fz4RL28tH pic.twitter.com/MNn59zRy8T

— Santiment (@santimentfeed) June 24, 2023

Bitcoin’s social dominance reached its highest point in three years, as reported by Santiment data.

Join Our Telegram channel to stay up to date on breaking news coverage