Join Our Telegram channel to stay up to date on breaking news coverage

Tether (USDT) the world’s largest stablecoin is gradually winning the race to become the “least risky” asset globally amidst the banking turmoil in the United States and the ongoing regulatory crackdown on crypto companies.

Inflation is still a pesky problem despite signs of it cooling down in the US. Investors within the traditional financial sector are turning to the digital asset industry and particularly to coins and tokens that seem relatively stable—and the situation is not different with investments within the crypto space.

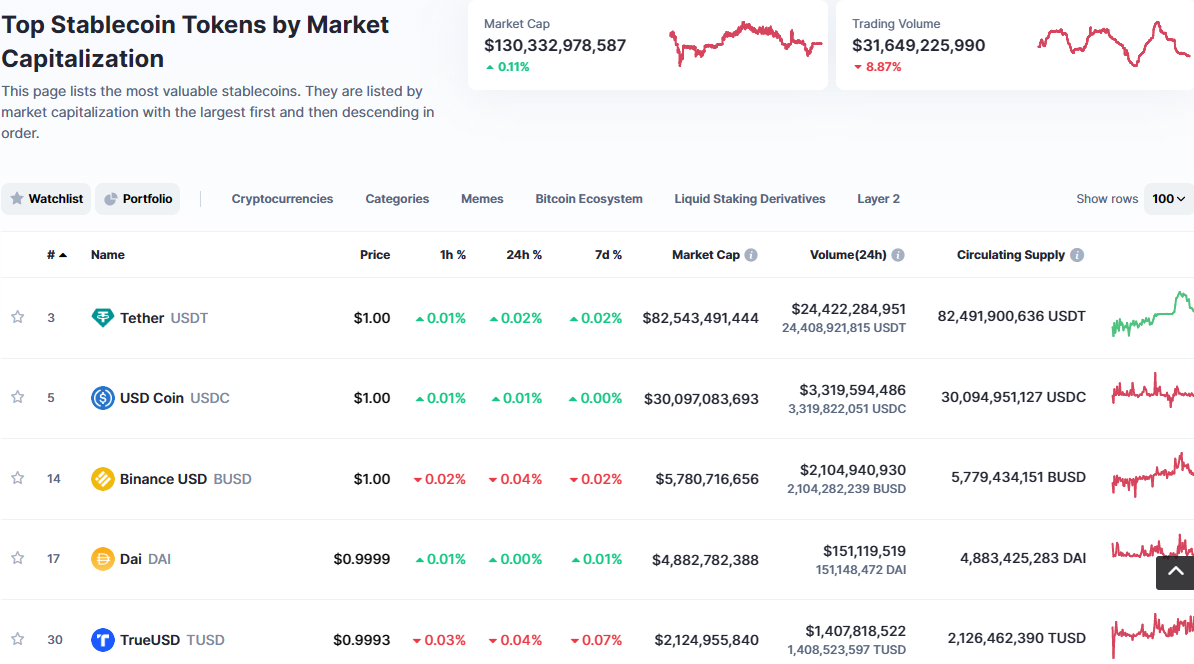

Tether is the third-largest crypto, boasting slightly over $82 billion in market capitalization with a $24-hour trading volume of $20 billion (a share of 6.83%), almost $6 billion more than that Bitcoin at $14.3 billion.

What Are Stablecoins?

Stablecoins are digital currencies specifically designed to minimize price volatility. Pegged to stable assets, such as fiat currencies, gold, or other cryptocurrencies, they offer increased stability while retaining the borderless, fast transaction features of cryptocurrencies, making them ideal for everyday payments, remittances, and preserving value.

In addition to being the largest stablecoin, USDT has seen its value grow significantly since March. Tether maintains its value through a 1-to-1 peg against a regulated dollar reserve, with a prevailing supply cap of roughly 85 billion tokens.

Demand for Tether has soared since March, such that its value has not dropped below $1 since mid-April in addition to reaching $1.0002 in the previous week.

US Banking Crisis Fueling Demand for Tether

The collapse of three crypto-friendly banks in March, including Silvergate Bank, Silicon Valley Bank (SVB), and Signature Bank exposed a troubled banking system in the US that saw another financial institution; First Republic Bank taken over by JP Morgan Chase earlier this month.

Anders Kvamme Jensen, the founder of Oslo-based AKJ global brokerage and digital asset service provider believes “the banking crisis is fueling ‘hyper-bitcoinisation’ – the inevitable endgame that the dollar will be worthless.”

Bitcoin and Ethereum sustained uptrends in March before slowing down in April thanks to the troubled financial sector and a weakening dollar spurring an investor flight to the leading cryptocurrencies, Jensen added.

Anchored stablecoins like Tether are preferred as store of value digital assets and a means to seamlessly execute transactions and conversions between other cryptocurrencies. The stablecoins also serve as collateral on crypto derivatives trading platforms.

Conor Ryder, a research analyst at the digital assets data firm Kaiko, asserts that the premium on Tether represents a growing faith in its stability and the perceived security from the scrutiny of the U.S. Securities and Exchange Commission (SEC).

iFinex Inc., a company incorporated in the British Virgin Islands that also operates the Bitfinex cryptocurrency exchange, owns and manages Tether.

The image of Tether’s biggest rival USD Coin (USDC), owned by managed by Circle, a crypto company based in Boston, was tainted by its exposure to Silicon Valley Bank not to mention the SEC’s crackdown on crypto and fintech firms.

Tether’s other major rival, BUSD, also referred to as Binance Coin has seen its value drop after the New York Department of Financial Services (NYDFS) requested its issuer Paxos discontinue minting of new tokens on grounds of unresolved issues in addition to the company’s oversight of its relationship with Binance.

“The Department is monitoring Paxos closely to verify that the company can facilitate redemptions in an orderly fashion subject to enhanced, risk-based, compliance protocols,” NYDFS said in a statement in February.

On the other hand, DAI token, the fourth-largest stablecoin has continued to be suppressed by its unfamiliar peg to reverses that comprise different assets, including other stablecoins and cryptocurrencies.

“Tether is seen as less U.S.-oriented, meaning lower regulatory risk. Buying tether and bitcoin is really a vote against the U.S. system,” Jensen adds.

Tether’s Journey Has Not Always Been Smooth

Tether has grown accustomed to sidestepping controversies relating to doubts about its peg and the reserves backing its value.

Stablecoins suffered immense pressure last year following the crash of TerraUSD (UST), which orchestrated the collapse of crypto giants like Three Arrows Capital and the failure of Sam Bankman-Fried’s exchange, FTX.

Nevertheless, Tether has grown to be the gold standard for stablecoins in the industry. It is the most used token to pay trading fees on major crypto exchanges like Binance in addition to collateralizing the derivatives market.

“Tether’s safe haven status differs from bitcoin in that it is providing a safe peg to $1, one of the only stablecoins in the space that can make that claim at the minute. Bitcoin on the other hand is seen as a safe haven from monetary debasement as a form of money that is ‘outside’ the banking system,” says Ryder.

Recommended Articles:

- Top Crypto Gainers Today, May 10 – BSV, KAVA, AiDoge, Launchpad, yPredict, DLANCE, LUNC, ECOTERRA, SPONGE

- Ripple Price Could Scale A Recovery Rally As Crypto Market Reacts To Positive US Consumer Price Index Reading

- Will Bitcoin Rise Again In May? Baby Doge and Collateral Network Gain Market Traction

Join Our Telegram channel to stay up to date on breaking news coverage