Join Our Telegram channel to stay up to date on breaking news coverage

PwC just released the results of a blockchain survey they held, that recorded responses from 600 executives from 15 territories. And while 83% of organisations state that their business does something related to blockchain, only 32% of these blockchain efforts are at a usable stage.

One could chalk this down to enterprises only recently discovering the potential behind blockchain, but the survey also shed some light on other reasons:

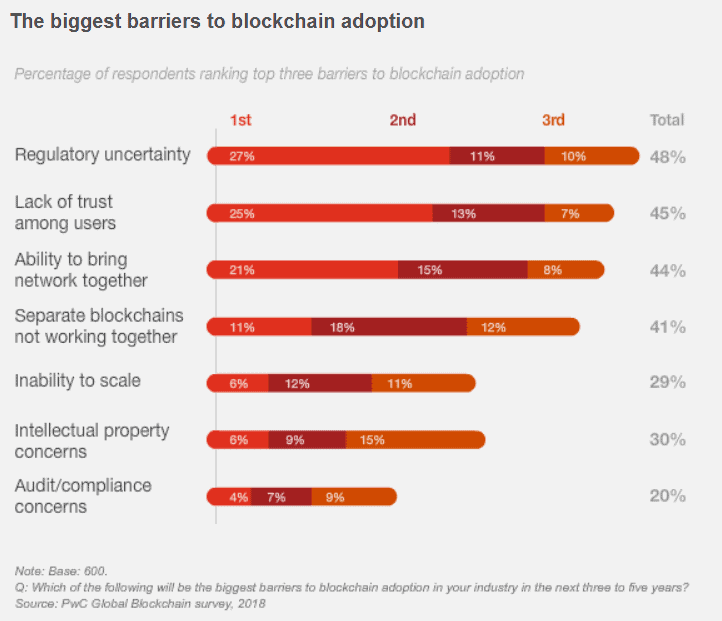

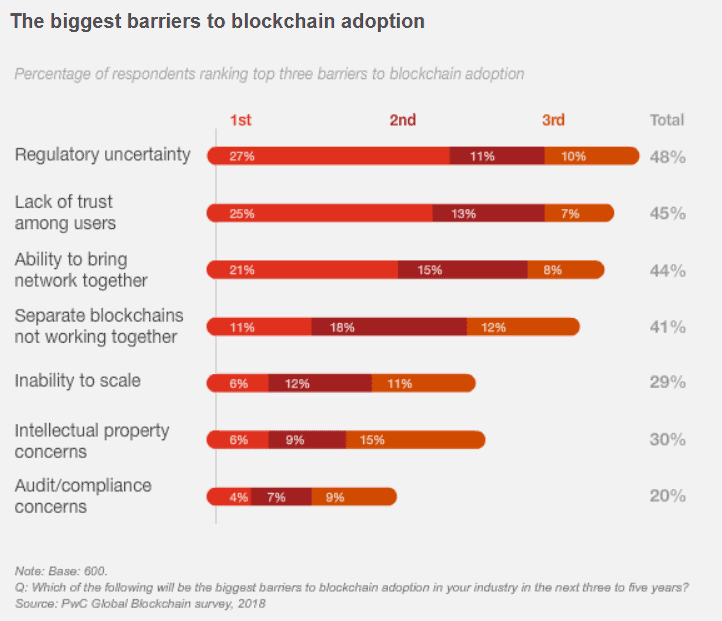

While many regulators across the globe hem and haw about how to best regulate blockchain, it is perfectly understandable that 48% of respondents cite regulatory uncertainty as a reason for their reticence on the technology. Once regulators are able to pin down the best way to regulate this ever-evolving and nascent technology, this problem would go away in time.

Unfortunately, 45% of respondents also cite the lack of user trust in blockchain as a barrier to their blockchain adoption, which is interesting because blockchain, an immutable ledger, should theoretically engender more trust.

Here Are a Few Reasons Outlined by the report:

Not Many Actually Understand What Blockchain Is

According to the PwC report, ” Even now, many executives are unclear on what blockchain really is and how it is changing all facets of business. ”

We have at least reached a point where the public is able to separate blockchain from Bitcoin, it is not easy to describe the technology beyond just mentioning that it’s a ledger. If one were to be justifying a section of their budget to develop blockchain, they would then have to delve into a description on what blockchain is and how it would impact their business.

It doesn’t help that blockchain is such an abstract technology. An end user may not be able to truly envision the blockchain technology behind any software they use, and thus, may not see its impact and potential. Unfortunately, you have to be in the club to see it at this venture.

No Confidence into Blockchain Yet

The difficult process of building one’s own blockchain, and the challenges that come from it have engendered doubts into blockchain’s reliability—particularly with speed, security and scalability.

Since the current industry has not instated a standard just yet, a lack of interoperability with other blockchain is a huge stepping stone for the industry.

There have been quite a number of global projects set up in the more blockchain-advanced finance sphere, where seemingly everyone and their mothers want to set up their own blockchain network and protocols. In equal fervour, there have also been a number of goodwill attempts to create an interoperable or open blockchain network for other institutions to park their business on, but many in the field are concerned that these extra blockchain networks are just adding one more to the clutter instead of solving the problem.

Just in July, IBM and CLS have banded together to form a blockchain network that they hope would unite the financial sector. Meanwhile Google and Digital Asset have also embarked on their own project to bring blockchain onto the cloud to provide a more adaptable version of blockchain for businesses.

While theirs and many other organisations’ mass blockchain projects show potential, their success will remain to be seen, but from where we’re standing, facilitating interoperability is still a blue ocean.

The person that is able to figure out true interoperability will be making big money—not just between blockchain and other technologies, but also between once business’ blockchain to another.

No Agreed-Upon Idea For Industry-Wide Blockchain Use

We think that there is one more reason why blockchain development so far seems more focused on in-company use: companies now are more focused on developing blockchain to work within existing rules rather than breaking the mould altogether.

PwC brings payment systems and mechanisms in banking as an example.

“Though everyone plays by the rules of existing systems today, they don’t necessarily agree on how an alternative blockchain-based model should be designed and operated.”

The same report calls for companies, even those who would otherwise be considered as competition, to collaborate on building the ecosystem together, which allows for collaborative problem solving for any of the challenges that blockchain poses.

It would be a shame if a technology like blockchain is tamped down before it is allowed to rise, and while scalability can be an issue, a startup-like collaborative mindset on the problem could bring the whole industry, even those outside of fintech, into a new future.

For now, it seems like the ray of hope in blockchain still lies in ICOs, where even the Korean Pop industry has jumped aboard to issue their own token. If not for nothing, ICOs could at least be a more easily relatable project that help ease the general masses into blockchain.

Featured image via Thought Catalog

The post Survey Shows That 45% Executives Still Don’t Trust in Blockchain Technology appeared first on Fintech Schweiz Digital Finance News – FintechNewsCH.

Join Our Telegram channel to stay up to date on breaking news coverage