The non-fungible token market that used to be the talk of the town in late 2021 and early 2022 has experienced a shocking downfall, leaving the majority of NFTs shielding more than 70% of their value. A recent study has found that many NFT investments are now worthless. In this article, we shall explore the current state and future of NFTs.

The non-fungible token began pumping sometime in 2021 and rapidly spiked to more than $2.8 billion in monthly trading sales volume as of August 2021. The NFT market continued to pump, reaching an all-time sales volume of $4.8 billion sometime in late 2021 and early 2022.

Unfortunately, the non-fungible token market has suffered a brutal comedown recently. The crypto and NFT market began tanking last year and has since continued, leaving most NFTs losing more than 80% of their value.

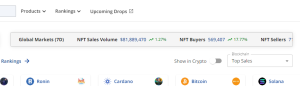

Data compiled by CryptSlam.io, an on-chain data aggregator, reveals that the global NFT market has recorded a trading sales volume of around $80 million in the past seven days, representing just 3% of its peak sales volume in August 2021.

What Went Wrong?

In their recent report, DappGambl, an on-chain analytic firm, has shared some factors that might have attributed to the sudden fall in the NFT market. To deliver more accurate data, the team compiled an analysis of over 73,257 NFTs, assessed their market health, determined the factors contributing to successful projects, and gained insights into the NFT ecosystem’s potential future.

Data analysis has found that 69,795 out of the 73,257 NFT collections have seen their market cap dropping to nearly zero Ether. This shocking statistic means that 95% of people holding NFT collections currently hold worthless investments. The firm has estimated that 95% of over 23 million people who invested in NFTs are now worthless.

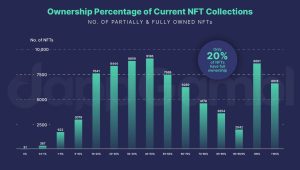

First, the research team has found an inadequate supply of NFTs in the market as one of the significant contributors to the recent market downturn. The analysis has found that out Of the total NFT collections, only 21% were entirely spoken for. This means that 79% of all NFT collections have remained unsold.

This surplus of NFT supply over demand has made buyers and potential investors more discerning, carefully evaluating the style, uniqueness, and potential value of NFTs before making a purchase. As a result, NFT projects that lack clear use cases, compelling narratives, or genuine artistic value have found it increasingly difficult to attract some attention and sales.

The interconnection between the environment and NFTs is another vital factor pushing the non-fungible token market downward. It’s worth noting that the minting process of NFTs involves certifying a digital asset as unique by making a transaction on the blockchain. Just as any other operation in the digital realm does, each minting consumes energy. Even though the amount of energy consumed by minting NFTs is small, it might have caused the market to suffer a bad reputation.

Based on DappGambl’s study, there are more than 195,699 NFTs with no apparent owners or market share. The energy required to mint these NFTs is comparable to 27,789,258 kWh, producing approximately 16,243 metric tons of carbon dioxide. In that context, NFT creators should ensure meaningful and genuine contributions to the NFT ecosystem.

The State Of NFTs Right Now

Before summarizing, the firm has decided to look at the top 8,850 NFT collections, according to CoinMarketCap.com. The research team has found that more than 1,600 NFTs are nearly dead. An 18% of the top NFT collections have a floor price of zero, indicating that a significant portion of even the most prominent collections are struggling to maintain demand.

Furthermore, 41% of the top NFTs are modestly priced between $5 and $100, which signals a lack of perceived value among these digital assets. Fortunately, less than 1% of these NFTs boast a price tag of over $6,000, shedding light on the rarity of high-value assets even within the cream of the crop.

After taking a light slumber in the past several months, the non-fungible token market appears to be crawling back to life. In the past 24 hours, the global NFT market has recorded a trading sales volume of $11.3 million, representing a 6.59% spike from the previous day. The NFT market showcases the strong potential of reverting the bearish sentiments. The NFT market might soon retest another hype.

Source: CryptoSlam.io, NFT trading sales past 24 hours

Related NFT News:

- Proof Joins Space Blue To Exhibit Moonbirds NFTs In The Lunaprise Art Museum In Space

- NFTs Make A Comeback After Long Bear – Here’s The 10 Top Selling NFTs Today

- Global NFT Adoption Data – Will A New NFT Bull Run Kick Off In 2024?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users