Join Our Telegram channel to stay up to date on breaking news coverage

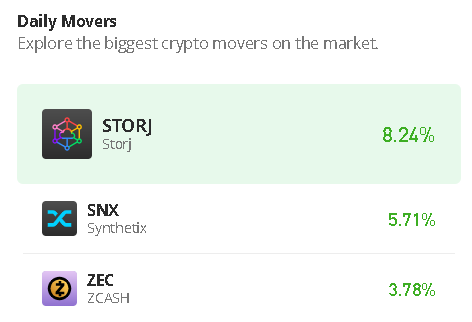

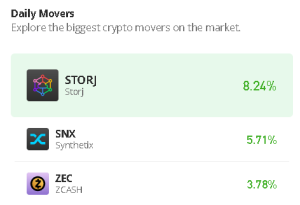

The Storj price prediction reveals that STORJ is hovering above the moving averages as the coin touches the daily high at 0.317.

Storj Prediction Statistics Data:

- Storj price now – $0.295

- Storj market cap – $165 million

- Storj circulating supply – 405 million

- Storj total supply – 424.9 million

- Storj Coinmarketcap ranking – #182

STORJ/USD Market

Key Levels:

Resistance levels: $0.370, $0.390, $0.410

Support levels: $0.220, $0.200, $0.180

STORJ/USD touches the resistance level of $0.317 today, trading above the 9-day 21-day moving averages. However, the Storj price also crosses above the upper boundary of the channel to touch the daily high before retreating to where it is trading currently. Meanwhile, the STORJ/USD will have to cross above the channel to increase the buying pressure as traders expect the coin to the upside.

Storj Price Prediction: STORJ/USD Could Expand More

Looking at the daily chart, the Storj price is exchanging hands above the 9-day and 21-day moving averages but any bearish movement below the 21-day moving average could bring the coin to the support levels of $0.220, $0.200, and $0.180. From above, a sustained movement across the upper boundary of the channel may create momentum for the bulls with the focus to move the market to the next resistance levels of $0.370, $0.390, and $0.410 respectively.

At the time of writing, the technical indicator Relative Strength Index (14) signal line is crossing above the 60-level, which indicates that STORJ/USD may continue to trade bullishly. Moreover, the 9-day MA may need to stay above the 21-day MA for the buyers to concentrate on stirring action to the north.

Against Bitcoin, following the trade for the past few days, bulls have shown a great commitment to STORJ trading by following the recent positive sign. Furthermore, the current market trend may continue to go up if the buyers can sustain the pressure further.

However, if the bulls succeeded in pushing the coin above the upper boundary of the channel, the market price could hit the resistance level of 1200 SAT and above. On the contrary, a retest could allow the coin to go below the 9-day and 21-day moving averages and lower the price to the support level of 750 SAT and below. However, the technical indicator Relative Strength Index (14) crosses above the 50-level, suggesting additional bullish signals into the market.

Alternatives to Storj

The Storj price showcases that the market may push higher over resistances at various trading capacities in the following sessions. Recently, a correction took effect from a $0.31 resistance to trade around the current level of $0.29 level has let bulls regain their stances to re-start a northward-pushing process for another cycle.

However, the Wall Street Memes will be listed on several centralized and decentralized exchanges once the presale ends. This will be followed by a large campaign to raise awareness and introduce the token to the public. Meanwhile, the token has raised almost $12 million in the presale so far.

Read more:

- Bitcoin Price Prediction for Today September 22: BTC Price Rises as Buyers Recoup above the $18.2K Low

- Ethereum Price Prediction: ETH/USD Makes A Quick Retreat; Can Price Maintain $720 Support?

- DASH (DASH/USD): Bulls Play in an Ascending Channel, Resuming Bears

New OKX Listing - Wall Street Memes

- Established Community of Stocks & Crypto Traders

- Featured on Cointelegraph, CoinMarketCap, Yahoo Finance

- Rated Best Crypto to Buy Now In Meme Coin Sector

- Team Behind OpenSea NFT Collection - Wall St Bulls

- Tweets Replied to by Elon Musk

Join Our Telegram channel to stay up to date on breaking news coverage