Join Our Telegram channel to stay up to date on breaking news coverage

XLM Price Analysis – August 16

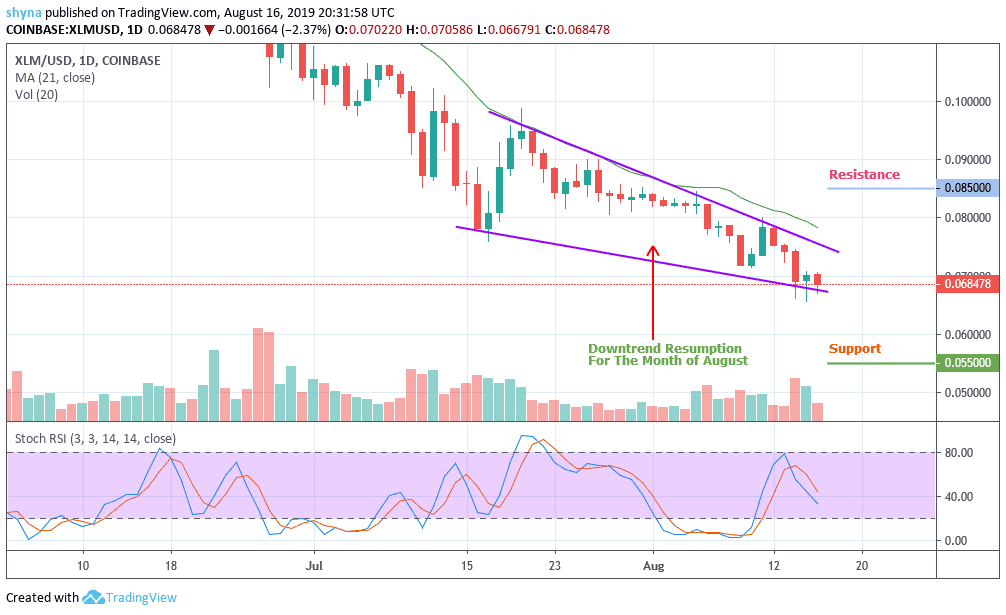

The XLM market is still looking bearish despite all indication for positive moves. The coin is now lurking around for a surge after trading in a medium-term wedge formation.

XLM/USD Market

Key Levels:

Resistance levels: $0.085, $0.090, $0.100

Support levels: $0.055, $0.050, $0.045

Looking at the daily chart, the XLM/USD pair continued to maintain a downward trend in the long run. For the moment, the market is down by 0.99%. The price of Stellar will continue to fall as long as selling pressure remains on the market. For now, the $0.065 is a support for the market.

However, the next level of resistance to watch is $0.085. If the price continues to rise, Stellar could engage in immediate resistance at the $0.090 and $0.100 levels to start the uptrend. On the other hand, the coin is close to short-term support at $0.055. A significant drop below this support may result in new technical support at $0.050 and $0.045. For the moment, the stochastic RSI faces downside. As the buying pressure increases, an upward move is expected.

XLM/BTC Market

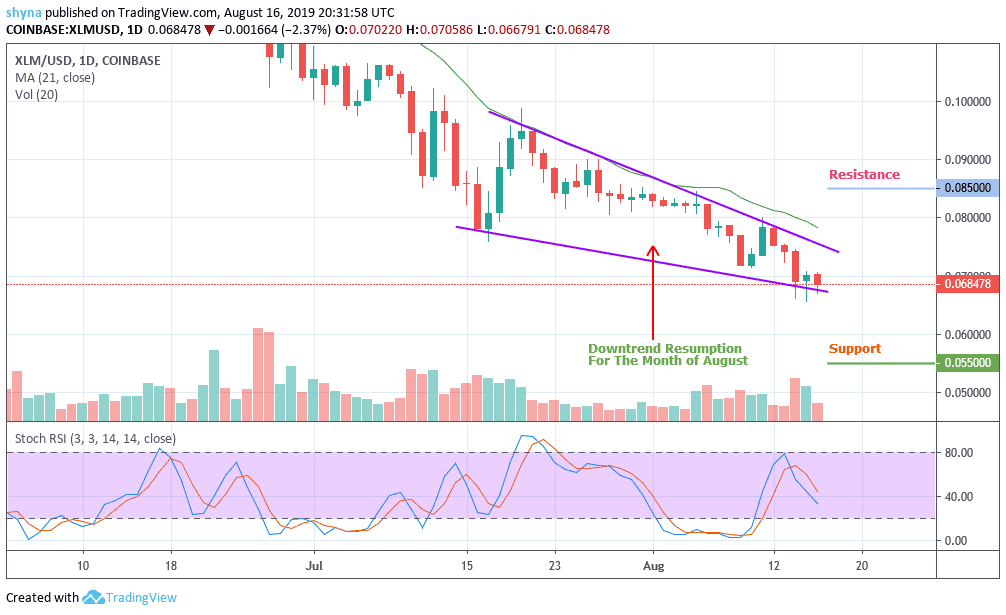

Against Bitcoin, Stellar (XLM) seems bearish as the price fell below the 700 SAT mark. Now, the bear seems to be stepping back into the market and the price could fall to 650 SAT and 600 SAT, moving below the yellow line before bouncing back to 750 SAT, 800 SAT and 850 SAT which may likely touch the 900 SAT and 950 SAT in an upward range.

However, if the market is below the 600 SAT support, the stellar price could drop to 500 SAT, 450 SAT and 400 SAT support levels, bringing the price to a new low. As the chart shows, Stellar’s volume is decreasing due to the selling pressure on the market. For the stochastic RSI, the stellar price (XLM) has recently risen to overbought level. We can expect serious selling pressure once it turns back.

Please note: insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage