Join Our Telegram channel to stay up to date on breaking news coverage

Solana (SOL) recorded its largest weekly inflows since March last year as product launches boosted its appeal, CoinShares said.

Solana is “continuing to assert itself as the altcoin of choice,” said James Butterfill, research head at CoinShares. Solana sucked in $24 million, bringing its year-to-date inflows to $55 million.

It’s recorded inflows in 28 out of 32 weeks this year, with only four weeks of outflows.

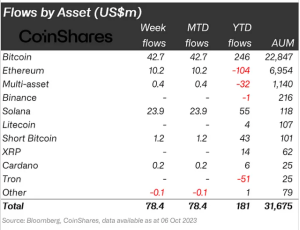

Digital asset investment products overall saw inflows for a second week, totalling US$78m, with Bitcoin dominating them with $43 million. Some investors capitalized on Bitcoin’s recent price strength and added to short-bitcoin positions, which reached $1.2 million, CoinShares said.

Trading volumes for exchange-traded products rose more than 37% to US$1.13bn for the week, it said.

There was only tepid appetite for the Ethereum futures ETF products launched in the US last week with slightly less than US$10 million flowing into them, it added.

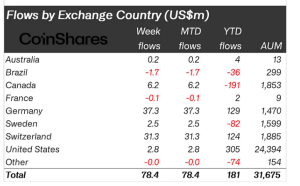

Germany and Switzerland accounted for the bulk of last week’s inflows, bringing in $37.3 million and $ 31.3 million, respectively. The US and Canada combined brought in only $9 million.

Rising Total Value Locked

Solana’s popularity as an altcoin extends beyond its recent inflow surge. According to Nansen, a crypto analysis firm, Solana’s Total Value Locked (TVL) has nearly doubled since the beginning of the year, boasting a TVL of 30.95 million SOL.

Solana’s Total Value Locked (TVL) has almost doubled since the start of the year, boasting a TVL of 30.95M SOL

Source: @DefiLlama pic.twitter.com/IAJVTipUQi

— Nansen 🧭 (@nansen_ai) October 5, 2023

Nansen also notes that Solana’s stable transaction count and its rise as a hub for active economic activity contribute to its growing prominence in the crypto world. The analysis firm sees significant potential in Solana’s liquid staking initiative, with less than 3% of staked SOL currently participating in the alt coin’s liquid staking protocols.

Solana’s 2023 Success Attributed to Institutional Investors and Strategic Partnerships

As Inside Bitcoins reported earlier, Solana’s outperformance in 2023 can be attributed to its appeal to institutional investors, marked by over 20 weeks of continuous inflows. This appeal arises from successful partnerships, including with Visa, as well as fast and cost-effective transaction.

Solana (SOL) is up 15% in 14 days and almost 28% in a month, but it’s fallen 8% over the past week. Investors looking to buy alt coins may also consider these.

Related Articles

- Best Crypto to Buy Now – Top 10+ List

- Bitcoin Price Prediction: Can BTC Reach $30,000 Amid Market Volatility while a New Presale Token Gains Traction?

- Solana Price Prediction: SOL Boosts 14% – Is This the Beginning of a Bull Run?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage