Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Analysis – July 10

Ripple price is struggling to continue higher above $0.40 against the US Dollar and declined heavily against Bitcoin. XRP price could revisit the $0.38 support before a decent recovery.

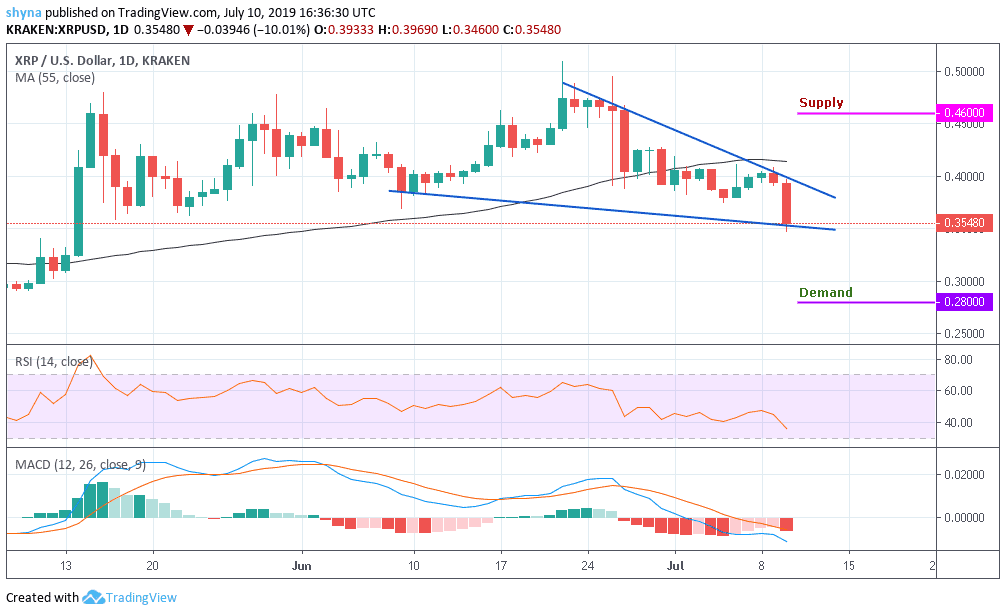

XRP/USD Market

Key Levels:

Supply levels: $0.46, $0.48, $0.50

Demand levels: $0.28, $0.26, $0.24

Looking at the trading in this week, the cryptocurrency market has been slightly bullish compared to last week, Ripple buyers have been working hard to put the resistance at $0.4 level behind them. However, the correction of this obstacle has been highly unsustainable. At the same time, technical indicators show that the prevailing trend may likely go sideways in the future sessions.

At the time of writing, $0.4 supply level remains undefeated, while Ripple is trading at $0.35. The next upward movement may likely reach $0.46, $0.48 and $0.50 supply levels. Should in case the bears continue to gain control of the market, the nearest key demand lies at $0.28, $0.26 and $0.24. Both the RSI and MACD indicators are showing bearish signals.

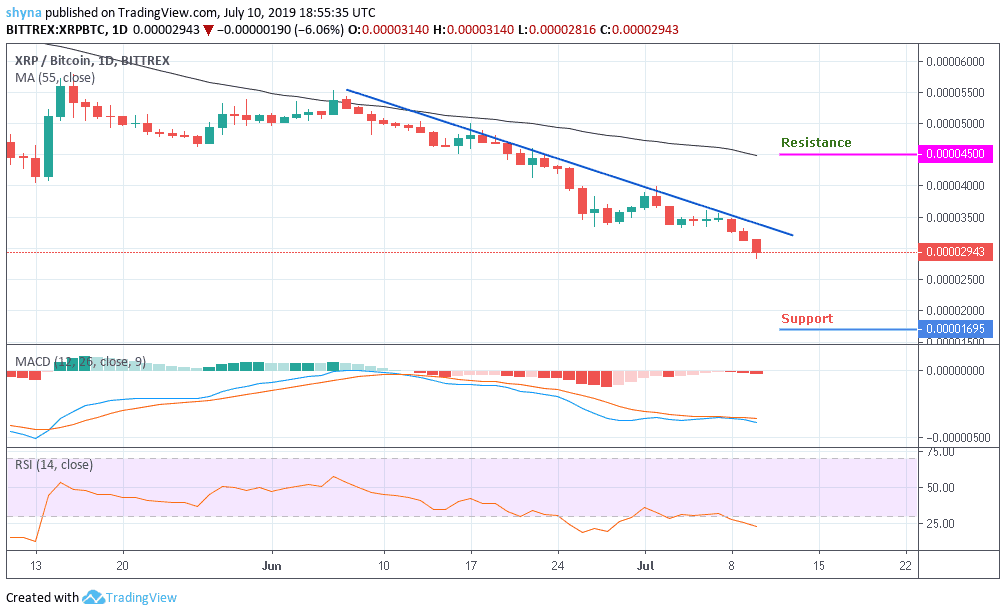

XRP/BTC Market

Against Bitcoin, the decline has continued and all support at the 3500SAT level has broken down. The price is set to test 2500SAT if Bitcoin’s gains continue to impact the XRP price. The last time the price dropped from 300SAT was December 2017, and the price is now moving away from the resistance at 4500SAT.

The bearish scenario remained dominant in a channel boundary as the sellers continued to put pressure on the market. If the sellers occupy their positions, the XRP may drop to support level of 1600SAT and below. At present, the RSI (14) is currently trading at the oversold level, while the MACD is within the bearish zone due to the current selling pressure in the market.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage