Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Analysis – December 10

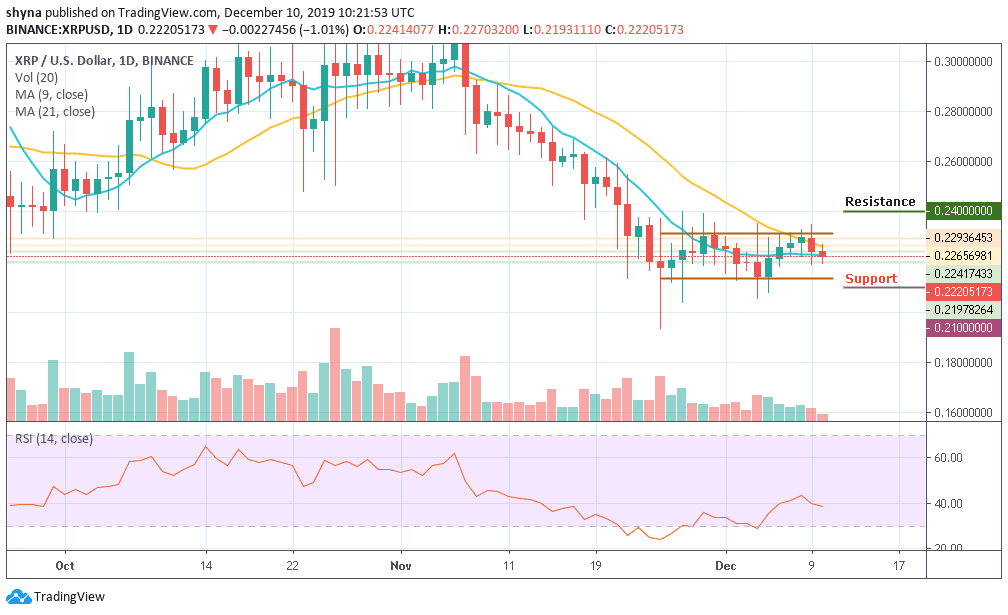

Ripple price is facing an increase in selling pressure below the $0.228 resistance against the US dollar.

XRP/USD Market

Key Levels:

Resistance levels: $0.240, $0.250, $0.260

Support levels: $0.210, $0.200, $0.190

Ripple price is slowly declining below key supports against USD. XRP/USD price might revisit the $0.213 support before it could start a fresh increase. After struggling to stay above $0.230, Ripple started a slow and steady decline. The coin traded below the key $0.225 support level to move into a short term bearish zone.

In addition, XRP/USD is currently changing hands at $0.222 and any attempt to make it cross below the 9-day moving average may open the doors for more downsides and the price could spike below the $0.218 support level. However, we should keep an eye on the $0.214 and $0.212 before creating a new bullish trend at the resistance levels of $0.240, $0.250 and $0.260.

More so, traders may experience a quick buy once the trade reaches the support at $0.215. And should the price fails to rebound, then a bearish breakout is likely to trigger more selling opportunity for traders, which might cause the price to reach $0.210 level and could further drop to $0.200 and $0.190 support levels respectively. The RSI (14) nosedive to level 39. If the price moves downward, XRP may fall further.

When compared with Bitcoin, XRP is currently trading at 3029 SAT and it’s trading under the 21-day moving average. If the above-mentioned level could serve as market support, the price can be pushed up towards the resistance levels of 3150 SAT and 3200 SAT. By reaching these levels, the price may likely visit 3250 SAT and 3300 SAT resistance levels.

However, if the bulls fail to push the price to the nearest resistance, the market may begin a downtrend and the pair could probably record further declines to 3000 SAT. Breaking this level could push the market to the nearest support levels at 2950 SAT and below. Meanwhile, the RSI (14) is about entering into the overbought zone, which may possibly give some bearish signals when faces down.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage