Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Analysis – November 3

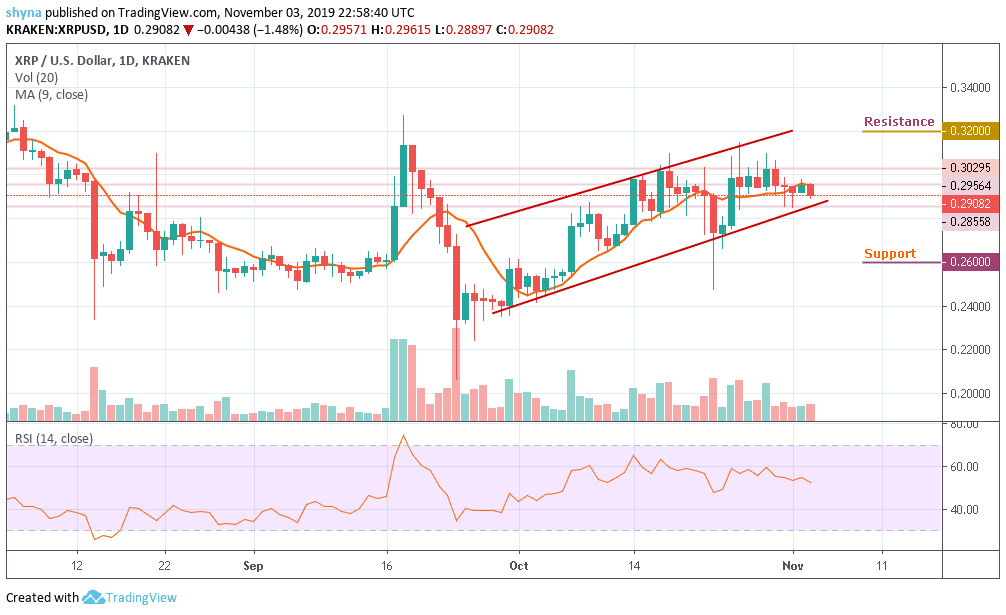

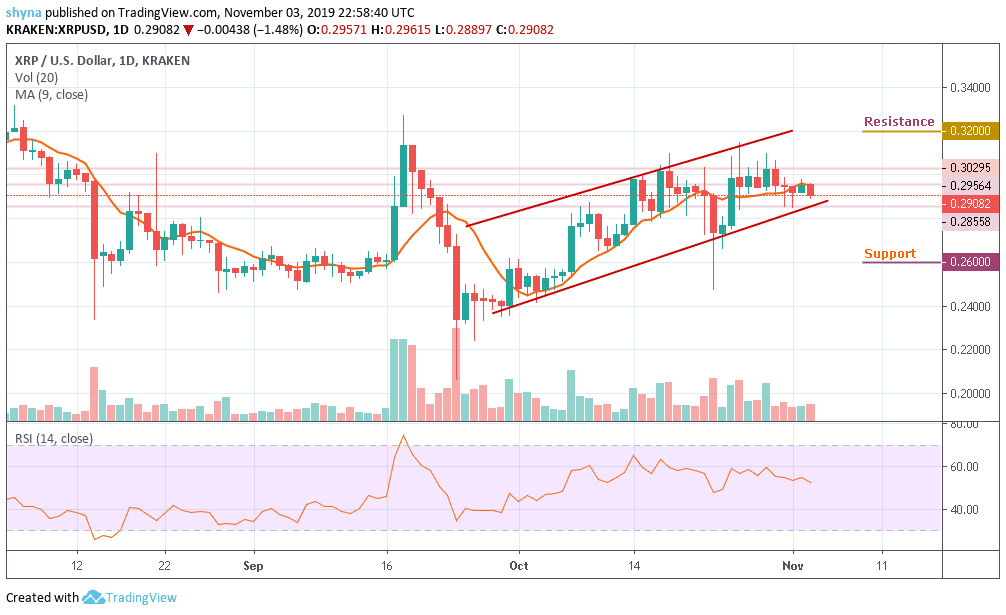

XRP/USD needs to regain ground above $0.30 to mitigate the bearish pressure. The coin is moving within a short-term bearish trend.

XRP/USD Market

Key Levels:

Resistance levels: $0.32, $0.33, $0.34

Support levels: $0.26, $0.25, $0.24

Ripple price movement is giving mixed indications. XRP/USD has already violated the immediate resistance level and is currently moving downwards. However, the price movement is quite slow and there are chances that it might end the day with a positive move. Yesterday, Ripple touched a high at $0.297 and today the price is down by -1.52% with the trading volume marked as $1,371,662,157.

Despite the recent downtrend on the market, the $0.286 remained a defensive level for the XRP market. Ripple’s XRP hit its lowest level of intraday at $0.289 and rebounded to $0.290 at the time of writing. Although the upward trend appears to be weak, a sustained movement over this barrier will improve the long-term technical picture of the third largest coin.

More so, a significant cross above the 9-day moving average could sustain the bulls to $0.30 and $0.31 highs. Meanwhile, Ripple is currently on a downward trend and still maintaining it. If XRP manages to surge above $0.31, it may see resistance at $0.32, $0.33 and $0.34, though a further drop can take it to the support levels at $0.26, $0.25 and $0.24. The Stochastic RSI indicator is showing some bearish signals.

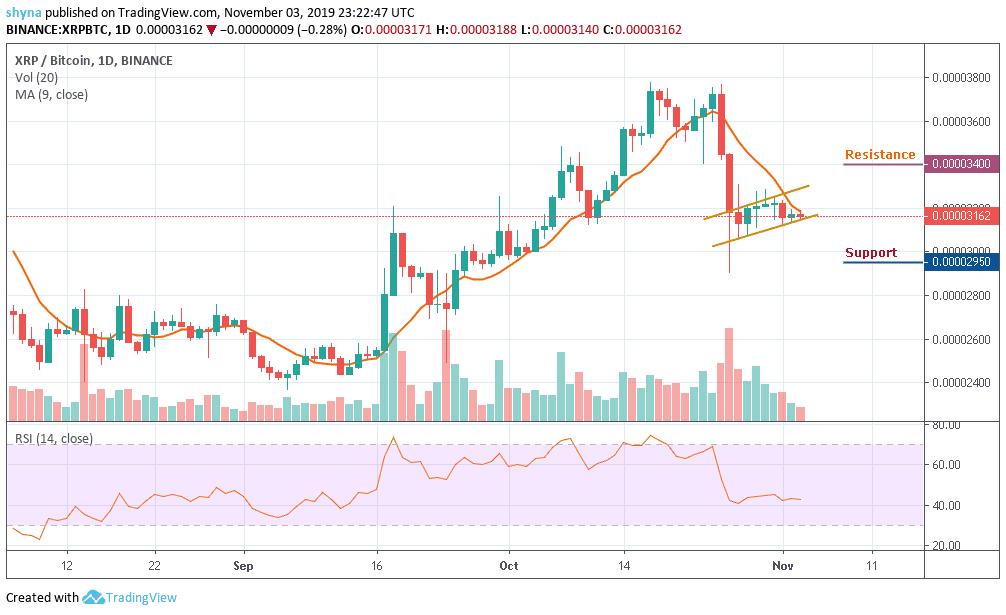

When compared with Bitcoin, the Ripple market price is ranging and trading within the rising channel since October 27. For now, it is trading at 3162 SAT and expecting a break below the channel. Looking at the chart, both the bulls and the bears are struggling on who will dominate the market.

However, should the market make attempt to fall below the channel, the next key supports could be 2950 SAT and below. Meanwhile, on the bullish side, a possible rise could take the market to the resistance levels of 3400 SAT and 3500 SAT. According to the RSI (14), the market is indecisive as the price is still moving in sideways.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage