Join Our Telegram channel to stay up to date on breaking news coverage

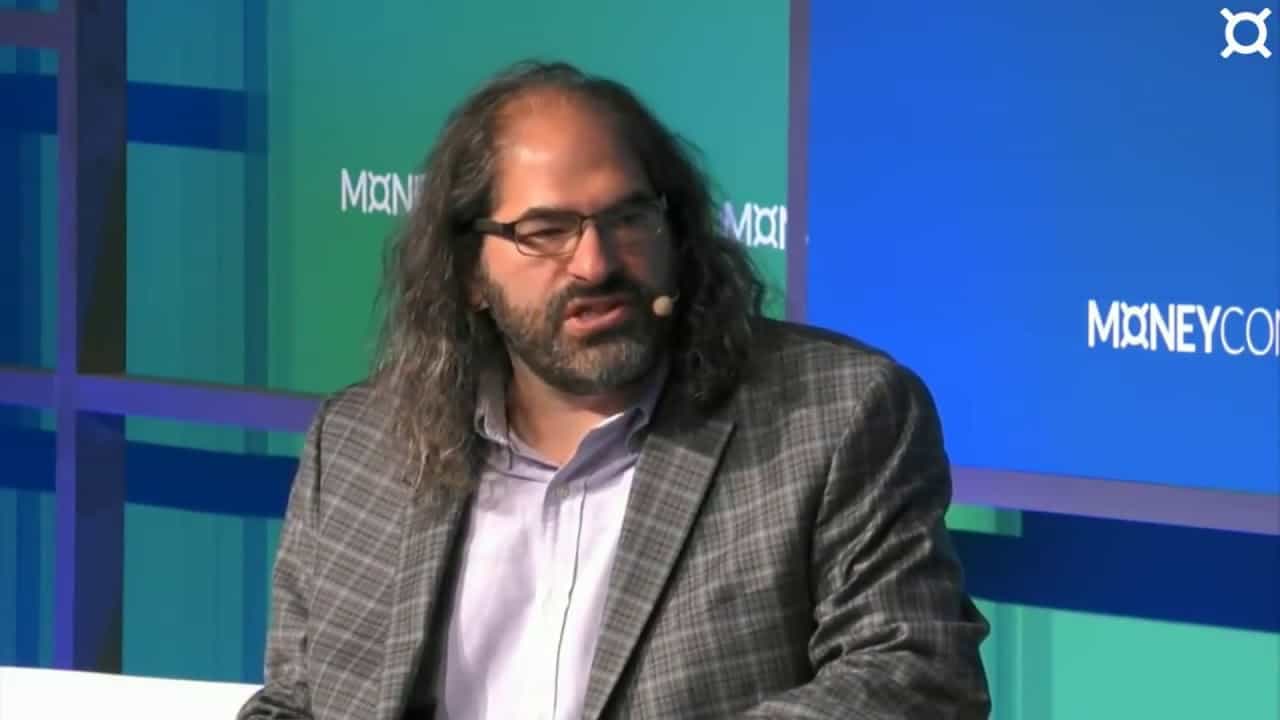

Even the most diehard crypto enthusiasts tend to make investment mistakes once in a while. David Schwartz, a blockchain executive, recently revealed that he and his wife had sold off a boatload of Ether years back in a move that hasn’t quite aged.

The Dark Side of Risk-Aversion

Earlier this week, Schwartz, who serves as the Chief Technology Officer (CT) of blockchain firm Ripple Labs, explained that he had sold 40,000 ETH tokens back in 2012 in a bid to hedge his crypto risk.

My decision to derisk was made in 2012 or so when I discussed investing in cryptocurrencies with my wife. She insisted we agree on a derisking plan right then. And I must say that every bitcoin I sold for $750 or XRP for $0.10 hurt.

— David "JoelKatz" Schwartz (@JoelKatz) October 11, 2020

The Ripple exec got into a lively discussion with some of his followers over the benefits of derisking in crypto, especially when it comes to a project that one starts. While many believed that derisking while also pushing an asset is malicious, Schwartz explained that it was only a case of rationalism. While he explained that he was all-in on crypto, he also acknowledged that the space is highly volatile and had to make moves to protect himself.

A follower eventually asked him whether or not his decision to derisk from Ripple’s in-house token, XRP, came after the company’s banking moves for 2018 and 2019 didn’t pan out. To that, Schwartz replied:

“My decision to derisk was made in 2012 or so when I discussed investing in cryptocurrencies with my wife. She insisted we agree on a derisking plan right then. And I must say that every bitcoin I sold for $750 or XRP for $0.10 hurt,” he said.

Decisions like that would definitely hurt. Since Schwartz sold his assets off, Ether has risen significantly. His massive selloff in 2012 cost him and his wife some $15.24 million, with Ether trading at $382 today.

XRP’s Continued Woes

As for the challenge of Ripple and banks, the company does appear to be lagging significantly on that front as well. XRP’s primary growth comes from adoption, and Ripple Labs appears to be more focused on building relationships with major banks. Sadly, none of those has been a prominent partnership, meaning that they’ve not been sufficient to propel the company.

Ripple Labs did pretty well last year, coasting off several partnerships and strategic investments to hit a $10 billion valuation. However, most of these partnerships focused on xRapid, its on-demand liquidity (ODL) tool.

XRP’s lagging performance has also affected the company’s partnerships. In August, Cedric Menager, a top official at Spanish banking giant Santander, explained that they were skeptical of XRP because of its insufficient presence in major markets.

Santander is one of Ripple’s top banking partners. The company initially tapped XRP to be a part of its One Pay X international payments network. However, as Menager told the Financial Times, the asset doesn’t seem capable of supporting the bank’s needs.

Ripple clarified that the Spanish bank is still using its software for cross-border transfers. However, given that Santander hopes to operate in as many banks as possible, XRP might not fit within that objective so well.

Join Our Telegram channel to stay up to date on breaking news coverage