Join Our Telegram channel to stay up to date on breaking news coverage

Years ago, investors began to look toward Bitcoin and other cryptocurrencies to add to their portfolios as a way to diversify and derisk against traditional equities and other more common investment vehicles.

Yale economist Aleh Tsyvinski conducted extensive research into how Bitcoin could benefit a portfolio through diversification, and found that the ideal portfolio construction should include at least 6% BTC, even if only for diversification purposes.

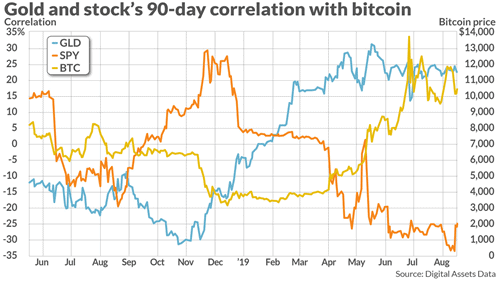

Throughout most of Bitcoin’s life the diversification trend continued due to Bitcoin and other crypto assets showing a strong anti-correlation to the stock market. The example chart below, taken from just one year ago, demonstrates the striking anti-correlation at its peak.

Suddenly, however, the two asset classes have become tightly correlated all throughout 2020. The correlation first began as the stock market to drag down Bitcoin and the rest of crypto on Black Thursday in March.

Now, the correlation has reached the highest level in history. Everything the investment world knew about Bitcoin acting as a diversification strategy in stock-heavy portfolios may now be out the window. It also means that Bitcoin may become a lot more unpredictable in the days ahead, as it responds to the strain the stock market is feeling from the economic contraction caused by the pandemic.

PrimeXBT analysts offer a look at what to expect and how to prepare for any moves Bitcoin and the stock market make in the future.

Bitcoin Correlation With S&P 500 Reaches All-Time High

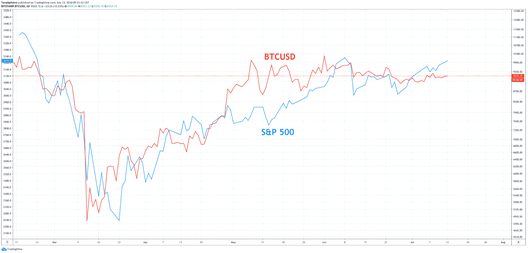

According to data, the correlation between Bitcoin BTCUSD price action and that of the S&P 500 US stock index, has reached the highest ever level.

In the chart below, Bitcoin and the S&P 500 had an anti-correlation, reaching as low as -0.15 correlation. But since the start of 2020, the two assets have become highly correlated, reaching a correlation of +0.35.

The two completely different assets started trading lock and step since just ahead of Black Thursday in mid-March.

That collapse crushed the stock market and caused Bitcoin to drop by over 50%. The rest of the crypto market gains for the year were also wiped out as a result.

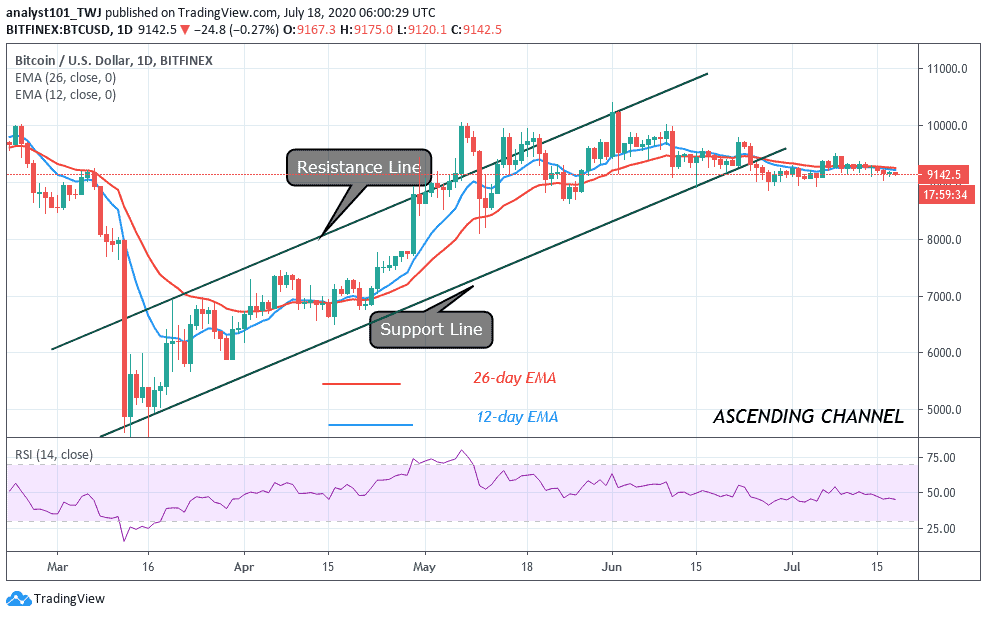

Since then, however, nearly every peak and trough matches almost perfectly. The price chart below clearly depicts just how closely correlated the two assets are, down to almost each passing day.

But what’s this mean for Bitcoin? The first-ever cryptocurrency is expected to reach valuations of $500,000 or more eventually.

The asset’s recent halving this past May 2020 was said to act as the catalyst for the new bull market, but the pandemic had other plans for Bitcoin.

Will new growth in COVID cases cause another significant crash in crypto due to the continued peak correlation with the stock market, or will the asset break out and reach the lofty Bitcoin price predictions analysts call for?

Economist Warns Of Second-Leg Down Similar to 1929 Stock Market

The world is attempting to restore some normalcy after spending months locked away in quarantine to prevent the further spread of the virus outbreak.

Between falling cases and economic stimulus, the stock market has nearly made a full recovery from highs set earlier this year.

But cases are once again spiraling out of control in the United States, and it could cause another major crash.

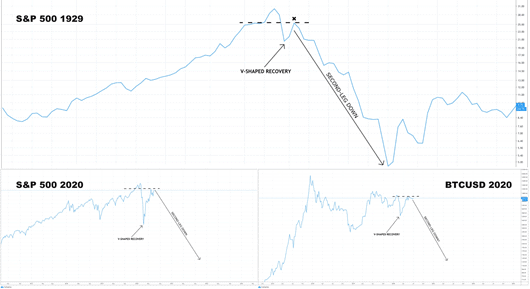

The situation reminds economist A. Gary Shilling of 1929 when investors were convinced the collapse was over, and another second-leg down took investors by surprise.

The result was an even deeper drop. Another similar drop would not only take the S&P 500 down another 40% according to the analyst, but it could also send Bitcoin to a lower low.

The leading cryptocurrency by market cap failed to break above its previous high from February 2020. The Black Thursday fall to $3,800 acted as a lower low. Another lower low is possible, sending Bitcoin back into a downtrend.

If this happens, a new bull run will be further delayed. Adding more credence to this theory is the fact that market timing experts such as the late W.D. Gann spoke of 90-year cycles in financial markets.

According to Gann’s theory, markets experience a similar fallout every 90 years or so. 2020 is roughly 90 years following the 1929 stock market collapse, and second-leg down the economist is warning of.

Low Volatility Could Hold the Key To Bitcoin Bull Market

2020 has been a disaster for the global economy and the greater financial market. Major stock indices like the S&P 500 set all-time highs in February, only to close the first quarter of the year with the worst losses on record.

Historical collapses have been followed by record-breaking rallies. Volatility in traditional equities markets is more reminiscent of cryptocurrencies.

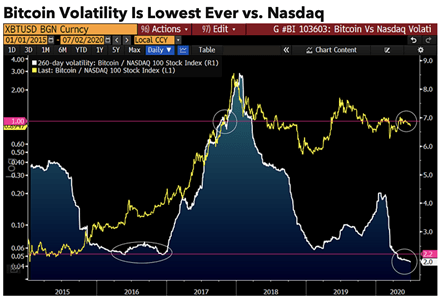

However, crypto assets like Bitcoin have been uncharacteristically stable. Volatility relative to the Nasdaq composite index, another US stock index, is at an all-time low.

The last time volatility achieved such lows against the stock index, it kicked off Bitcoin’s previous bull market.

With the halving now in the past, a new bull market is supposed to be brewing. The pandemic may have acted as a roadblock, but the pent up momentum may be released in the coming days.

For this to happen, however, Bitcoin and the S&P 500 must once again become anti-correlated – something that hasn’t been seen since before 2020 began.

Get Ready For a Return Of Record Market Volatility With PrimeXBT

Bitcoin volatility rarely stays this low, and when the relative stability finally ends, expect fireworks in the crypto asset class.

Things will get even more explosive if the stock market collapses again due to negative earnings reports coming later this month. It could spark a return to the record-breaking volatility in traditional markets.

Alternatively, if the anti-correlated relationship between BTCUSD and the S&P 500 returns, Bitcoin could experience a major breakout into a new uptrend.

If and when volatility does pick up, traders at PrimeXBT can profit from whichever direction the market turns with long and short positions.

PrimeXBT offers crypto assets like Bitcoin and Ethereum alongside traditional markets like stock indices, forex, and commodities. Both major US stock indices, the S&P 500 and Nasdaq are included, next to gold, oil, and much more.

Built-in technical analysis tools can help traders get prepared for any breakouts, and stop loss and take profit orders to ensure capital is protected, and no opportunities are missed.

Register for PrimeXBT today to get prepared ahead of any impending breakouts.

Join Our Telegram channel to stay up to date on breaking news coverage