Join Our Telegram channel to stay up to date on breaking news coverage

Following a substantial drop over the recent weekend, the crypto market appears to be gearing up for a recovery. And PayPal is benefitting from it.

Retail is Back

Yesterday, Alex Saunders, an Australian crypto-focused journalist, reported that payment processor PayPal had hit a new all-time high on Bitcoin trades. A graphic from Saunders’ post showed that trading on the platform hit $242 million in a single day, dwarfing its previous record of $129 million.

The previous record was set a little over a week ago, with Bitcoin surging through milestone after another on its ascent to $42,000. All in all, crypto trading on PayPal has surged by almost 1,000 percent this year.

PayPal only began offering crypto trading a few months ago. Some commentators feel most users are trooping in to get a feel of how the platform operates. Still, as Saunders tweeted, this surge appears to show strengthening trades from crypto retail traders.

PayPal has been one of the top contributors to the current market surge. When the company announced its foray into the crypto space in October, Bitcoin’s price started to rise, breaking and setting new records till it broke the $40,000 ceiling. At the time, many praised PayPal’s entry into the crypto space thanks to its sheer user base.

PayPal’s service reached 361 million users last year. With the company also having onboarded about 28 million merchants onto its platform, the potential for adoption is considerable. The crypto rollout is yet to be complete, but signs point towards a successful relationship between PayPal and the crypto space.

All Eyes on Bitcoin

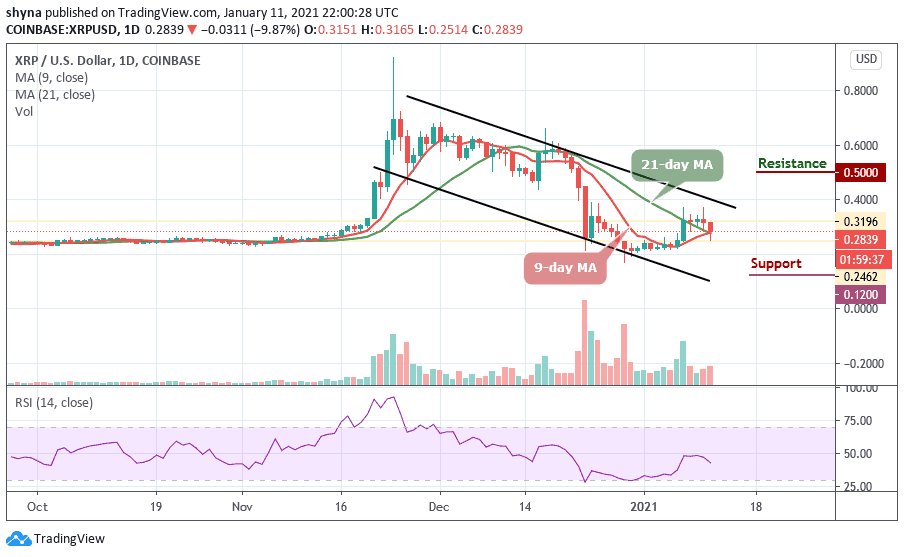

The increase in trading activity coincides with the market’s slow crawl back to the high of $30,000s. As explained earlier, Bitcoin reached $42,000 last weekend, sending investors into a frenzy. Sadly, the asset has seen a considerable drop in the past two days, dragging most of the market down with it.

As of yesterday, Bitcoin reached a low of around $30,500. The total crypto market also lost $170 billion in market cap between January 10 and 11, with the top ten digital assets losing an average of 13. 035 percent in price at a point.

Thankfully, things appear to be getting back to normal. Data from CoinMarketCap shows that the crypto market is worth over $900 billion again, and most of the top ten digital assets are posting gains in the past 24 hours.

Still, some believe that things could be worse. Alex Mashinsky, the CEO of crypto wallet service Celsius, sees Bitcoin’s drop over the weekend as the first stage of a broader correction. Mashinsky predicted that the asset would go back to the $16,000 range before the end of Q1 2021, with bears accumulating enough pressure to force a significant downturn.

Join Our Telegram channel to stay up to date on breaking news coverage