Join Our Telegram channel to stay up to date on breaking news coverage

Optimism price rose an impressive 73% from lows around $1.050 to highs above $1.82 between Jun. 11 and Aug. 7.

This rally saw OP break above key resistance areas. However, the recent retracement below the same crucial support levels points to a continuation of the ongoing correction made worse by the extended crypto winter.

Nevertheless, the price of the Layer-1 token recently rallied 18% in a recovery that halted at the moving averages. This rise in the price of Optimism was attributed to the recent development update on the network.

The Optimism Foundation updated its developers on the OP Mainnet RPC in a Sept. 26 post on the project’s official X handle.

As always, the public RPC is for developers to experiment and build. If you have a production application, check out our node providers:https://t.co/PseZDcp2qB

— Optimism (@Optimism) September 26, 2023

According to the update, the public RPC mainnet has been made more “more reliable & available” in collaboration with” @ankr, with support from @QuickNode” raising the RPC rate limit” nearly five times.

The organization also called on its developers to continue experimenting and building on the OP mainnet.

As a result, the approximately 5% gains recorded since then have sparked investor interest in the Optimism crypto project as it features among the top crypto gainers on Wednesday.

Top 8 Crypto Gainers Today!

1. $MKR 2. $OP

3. $RUNE 4. $BCH

5. $INJ 7. $SNX

8. $GMX 9. $SAND #Maker #Optimism #RUNE #BitcoinCash #Injective #SNX #GMX #SAND #CryptoInvesting #cryptocurrency #CryptoTwitter pic.twitter.com/4MVCcoIQhm— Adam Santos (@adamsantos456) September 27, 2023

Will Optimism Record Further Gains To $1.8?

The OP price action between Jun. 11 and Aug. 7 displayed an impressive recovery that drove the altcoin above critical levels, including the 50-day, and the 100-day SMA Simple Moving Averages (SMAs).

Usually, asset prices tend to deviate from key support levels before returning to the zones to establish a launching pad. For Optmism, falling back below the price range defined by the SMAs could see it revisit the $1.20 psychological level. In a likely move, the token could tag the $1.050 support flow to complete the inverted V-shaped retracement.

If this happens, it would represent a 19% drop from the current levels. The position of the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicator in the negative region supported such a correction. The price strength at 44 suggested that there were more sellers than buyers in the market.

Also, note that the price had sent a call to sell Optimism on the daily chart. This was a bullish cross on Tuesday when the 50-day SMA crossed below the 100-day SMA, suggesting that the market conditions still favored the downside.

OP/USD Daily Chart

On the upside, OP was trading above the bearish technical formation from which it escaped on Sept. 12. In addition, both the RSI and the MACD, though in the negative region, had begun tipping upwards. In fact, there was a pending call to buy Optimism from the MACD. This may take place in the next trading session once the MACD crosses above the signal line.

If this happens, it will suggest that the bulls are aggressively defending the immediate support at $1.30. Those could bolster them to push the price higher.

The resulting upswing would likely propel the token back to confront resistance from the $1.40 supplier congestion zone, embraced by both the 50-day and 100-day SMAs.

Overcoming this hurdle would open the path for the Optimism price to climb to the 200-day SMa at $1.689, or the $1.825 swing high. Such a move would constitute a 40% ascent from the current levels.

a crypto trader going by the name Universe of Crypto on social media platform X is bullish on OP saying that it had formed a bullish flag on the daily chart. He posted the following chart on Sept. 24 saying that the token could rally as much as 127% to $3.0 once it escapes from the falling wedge.

$Op has formed Bullish flag In Daily TF And is so Close To its trend line in case of Successful breakout And retest we will see it Towards 3.00$ 📈🚀#Crypto #cryptocurrency #CryptoX #CryptoCommunity #Op #Opusdt pic.twitter.com/ozzYNTWa9i

— Universe of Crypto (@UniverseCrypto7) September 24, 2023

The technical analysis above suggested that Optimism holders should not be excited about the ongoing recovery as it could be a bull trap. As such, those seeking alternative places to put their money can look into Bitcoin BSC, a new crypto project that has launched its presale and has the potential to make good returns for investors.

OP Alternatives

While there’s much uncertainty over Optimism’s recovery, a new BEP-20 token – Bitcoin BSC (BTCBSC)– has caught the eye of investors for several reasons. It is a BSC-based version of Bitcoin that aims to replicate BTC’s meteoric rise.

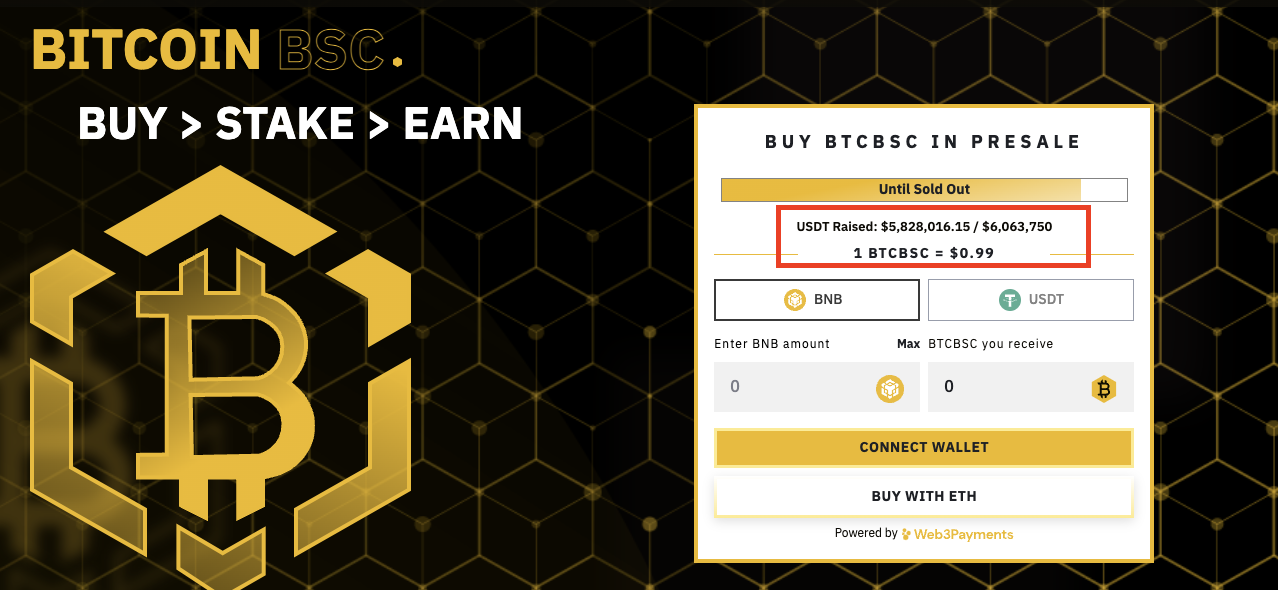

The presale offers investors a chance to relive Bitcoin’s moment back in 2011 when it sold for less than $1. As such, the presale is offering BTCBSC tokens at only $0.99 per unit. Its idea is to allow buyers today to experience the feeling of purchasing Bitcoin from 12 years ago.

Exploring the benefit of #BitcoinBSC on the BNB Smart Chain! 🌐

Built on #Ethereum's secure code, it offers robust security and smart contract capabilities, making it a game-changer for the #CryptoCommunity. 🔒 #BNBSmartChain pic.twitter.com/eulGIV9x89

— Bitcoinbsc (@Bitcoinbsctoken) September 25, 2023

Of course, that doesn’t guarantee that this crypto will also skyrocket to see the original Bitcoin’s price levels. Still, it cannot be denied that the coin has seen massive popularity upon emerging.

The BTCBSC presale raised $5.8 million in less than three weeks, reaching its soft cap of $3.96 million in about ten days.

The presale is in its final stages, as it will be sold out entirely once it reaches its hard cap of $6.06 million. That means only around $200k worth of BTCBSC is left, and they are selling out quickly.

Anyone who wishes to participate in the presale can buy the token in exchange for BNB, USDT, or ETH.

Visit Bitcoin BSC here for more information.

Related News

- Optimism Crypto – What is OP and Price Predictions

- The 5 Best Crypto To Buy In September 2023

- Best USA Bitcoin Casino

- Crypto Trading Apps

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage