Join Our Telegram channel to stay up to date on breaking news coverage

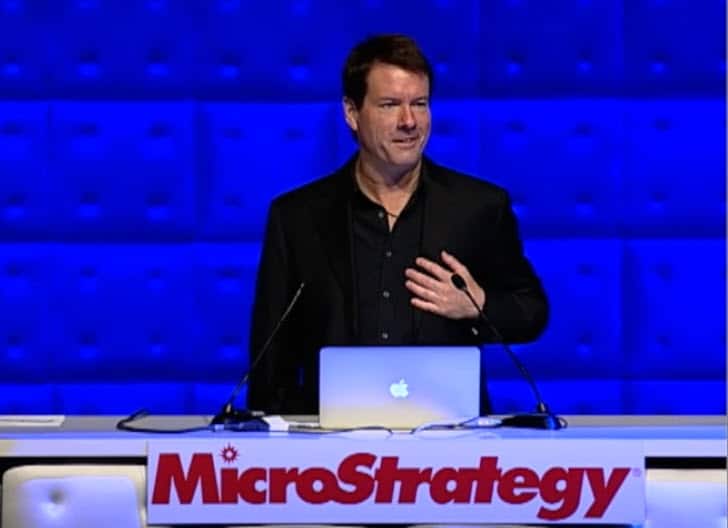

Chief Executive Officer of MicroStrategy, Michael Saylor stated that the financial market is “not quite ready” for Bitcoin Bonds. He believes that although Bitcoin-backed bonds will revolutionize the financial market, now is not the right time for the asset class.

Michael Saylor is a strong Bitcoin enthusiast, as indicated by MicroStrategy’s $5 billion worth of BTC holdings. His statement is coming after El Salvador announced the postponed launch of its BTC-backed volcano bonds.

“I’d love to see a day where people eventually sell Bitcoin-backed bonds like mortgage-backed securities,” he noted. This shows he still supports the idea of the Bitcoin bond but doesn’t agree with the timeframe of its introduction.

El Salvador Suspends Its Volcano Bitcoin Bond

While speaking about El Salvador’s Volcano bond, Saylor says it’s a hybrid sovereign debt instrument compared to a pure Bitcoin-treasury play. He added that although it has its credit risk, the bond does not in any way connect to the Bitcoin risk itself entirely.

As reported earlier, El Salvador was preparing to roll out its 10-year Bitcoin Bond, despite criticism across several quarters. According to the arrangement, the proceed from the bond will go into two projects, with 50% going to the much-talked-about “Bitcoin City” while the other 50% will be channeled towards more Bitcoin investment.

But Alejandro Zelaya, the country’s Finance Minister, postponed the launch, citing “unfavorable market conditions.

MacroStrategy Secures $205 Million Loan

MicroStrategy recently secured a $205 million loan from Silvergate Bank, through its subsidiary, MacroStrategy. The loan is collateralized by the company’s BTC holdings. Based on the agreement for the loan deal, MacroStrategy will use the loan to pay fees interest, take care of expenses relating to the loan, and buy more BTC.

Meanwhile, Saylor stated that getting the loan is the right decision for Macrostrategy’s shareholders. He stated that other options like leveraging decentralized finance (DeFi), loaning out BTC, and Bitcoin-backed bond issuance were considered before settling for the loan option.

Your capital is at risk.

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage