Join Our Telegram channel to stay up to date on breaking news coverage

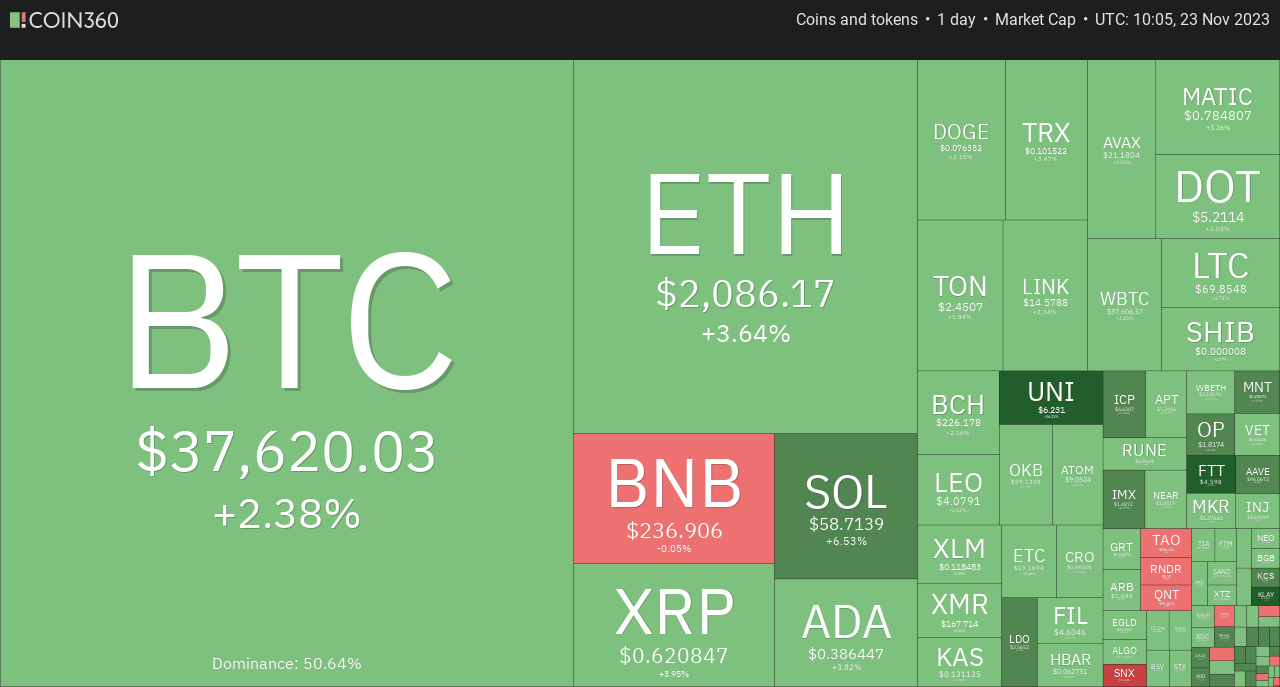

The global cryptocurrency market cap has reached $1.42 trillion, marking a notable increase of 2.55% over the last 24 hours. The market is back to brandishing its next cryptocurrency to explode.

Within the past 24 hours, the overall trading volume across the crypto sphere has experienced a decrease, totaling $55.03 billion. Notably, decentralized finance volume is $5.47 billion, accounting for 9.95% of the total crypto market’s 24-hour volume. Concurrently, stablecoins represent a significant portion of the trading activity, amounting to $48.69 billion or 88.49% of the entire crypto market volume in the last 24 hours.

Bitcoin currently dominates 51.50%, witnessing a slight decrease of 0.07% over the day. It gained consistent dominance over the last three days.

Asian markets remained largely steady on Thursday, maintaining the week’s accumulated gains as optimism builds around anticipated global interest rate reductions in the coming year. Simultaneously, oil prices dipped due to expectations of more minor output cuts by OPEC+.

Investors are closely monitoring Chinese policymakers for potential measures to bolster the sluggish property market, aligned with their broader objectives for economic growth.

In a day marked by subdued trading, MSCI’s broadest index of Asia-Pacific shares, excluding Japan (.MIAPJ0000PUS), registered a marginal 0.03% decline. Notably, Japan and the United States observed holidays.

On Thursday, China’s primary stock index (.CSI300) experienced a 0.16% drop. Interestingly, the real estate sub-index (.CSI931775) bounced back from earlier losses to secure a 2.11% gain.

Next Cryptocurrency To Explode

Reports from Bloomberg indicated that China has included Country Garden Holdings Co (2007. HK), weighed down by debts, on a preliminary list of 50 developers eligible for various financing assistance.

Simultaneously, a prominent wealth manager, heavily invested in the property sector, disclosed potential insolvency, citing liabilities amounting to $64 billion.

1. SpongeBob (SPONGE)

SpongeBob (SPONGE) could be performing better today. It experienced a price decline, settling at $0.00026988 today, with a 24-hour trading volume of $794,190. This reveals a 4.53% decrease in the past 24 hours and a more substantial 34.34% decline over the week. Sponge’s market cap data is currently unavailable due to the undisclosed supply of SPONGE tokens.

The highest price point recorded for SpongeBob (SPONGE) stands at $0.00092768, registered on May 10, 2023, about seven months ago. In contrast, the current price exhibits a 70.92% decrease from this all-time high. Conversely, the lowest price recorded for SPONGE was $0.00008794, noted around one month ago on Oct 14, 2023. The current price indicates a 206.78% increase from this all-time low.

Working in your 9-5 job waiting for the next #BullMarket 🧽🧽🔥🔥🚀🚀#Crypto #Web3 #MemeCoin #Alts pic.twitter.com/YDVwj7cWoc

— $SPONGE (@spongeoneth) November 20, 2023

Comparing SpongeBob’s performance against its counterparts, the cryptocurrency witnessed a 34.30% decrease in the past week. This positions SpongeBob (SPONGE) as an underperformer against the global cryptocurrency market, which saw a 2.80% increase, and in comparison to similar Ethereum Ecosystem cryptocurrencies, which saw an increase of 12.70%. Despite the recent fluctuations, the community sentiment remains bullish, with over 60% of users expressing positivity about SpongeBob (SPONGE) and its capacity to become the next cryptocurrency to explode soon.

2. Uniswap (UNI)

Uniswap commenced the day’s trading at over $6 and experienced a remarkable surge, surpassing several resistance barriers, notably breaching the long-standing $5.50 level. This particular level had been a persistent resistance for over three months, briefly broken last week without maintaining stability above it.

However, in the latest rally, Uniswap breached the $5.50 resistance and surged beyond $6, aiming to challenge the $6.50 barrier. Despite the momentum, it encountered substantial resistance at $6.30, resulting in a slight retracement from its peak.

This rapid surge follows a previous intraday session where Uniswap encountered a significant loss, dropping by over 6%. The exact catalyst for this sudden increase remains unknown. However, reports suggest that the ecosystem’s acceptance of a new token backed by uranium has ignited a buying frenzy for UNI and the new cryptocurrency.

Uranium308, the new asset, is yet to be listed on major exchanges, but traders have reported a considerable surge in its value.

1/ Uniswap v4 cuts gas on swapping and creating new pools ⛽

How?

Singleton, flash accounting, and & EIP 1153 🧵

— Uniswap Labs 🦄 (@Uniswap) November 21, 2023

Uniswap (UNI) holds a market capitalization of $4.64 billion, securing the 21st spot on CoinGecko rankings. The market cap is calculated by multiplying the token price by the circulating supply of UNI tokens, currently totaling 750 million tradable tokens.

In the last seven days, the asset exhibited a price surge of 11.70%, outperforming the global cryptocurrency market, which recorded a 2.70% increase. Furthermore, unlike similar Polygon Ecosystem cryptocurrencies, which saw no change, Uniswap has showcased more robust performance. The community sentiment remains bullish, with more than 82% of users expressing optimism about Uniswap (UNI) today. Despite its challenges, it is still fighting to be the next cryptocurrency to explode.

3. Lido DAO (LDO)

The Lido DAO token (LDO), known for its liquid staking capabilities, currently draws interest from prominent crypto asset management firms such as Amber Group and trading platforms like FalconX. This growing accumulation by institutional players, combined with positive on-chain metrics, propels the price of LDO’s upward trajectory.

On-chain intelligence data from Lookonchain indicates that wallet addresses associated with the Amber Group and FalconX have been withdrawing LDO tokens from Binance. Specifically, the wallet address 0x011D, linked to the Amber Group, initiated the withdrawal of 1.47 million LDO tokens valued at $3.6 million on Monday. Over the past three months, the firm has withdrawn 5.9 million LDO tokens, amounting to $14.5 million.

Simultaneously, the FalconX-affiliated address withdrew 1.26 million LDO tokens valued at $3.1 million on Monday alone, contributing to a total withdrawal of $12 million in LDO over the past week by the crypto trading platform.

The accumulation of LDO by institutional investors typically signals positive market sentiment as it reduces the circulating supply, consequently alleviating selling pressure on the token.

Various on-chain metrics such as trade volume, token supply on exchanges, and social dominance support the bullish case for LDO’s price. LDO’s trade volume has surged with its price, corroborating the ongoing rally in LDO’s value.

The social dominance metric measures the asset’s relevance and mentions across social media platforms like X (previously known as Twitter) compared to other assets. Notably, LDO’s social dominance peaked at nearly 0.2% on November 10 and has consistently remained above 0.027%, reinforcing the current price surge.

Further strengthening LDO’s price ascent is the decrease in LDO supply on exchange platforms, which dropped from 6.42% on November 1 to 5.54% early Monday. This diminishing supply on exchanges contributes significantly to LDO’s price surge by reducing potential selling pressures.

At the time of reporting, LDO is trading at $2.55, according to CoinMarketCap, marking a 9.18% increase for the day. LDO is likely the next cryptocurrency to explode among many.

4. Mina (MINA)

Mina Protocol (MINA) has also exhibited promising signs in recent trading, with its current price at $0.656770 and a 24-hour trading volume of $30.28 million. Over the last 24 hours, MINA has surged by 7.30%, showing a 2.16% increase in the past seven days. The market capitalization for the Mina Protocol is valued at $660.88 million, with a circulating supply of 1 Billion MINA tokens.

The highest price ever paid for Mina Protocol (MINA) tokens was $9.09, noted on Jun 01, 2021, marking an all-time high. The current price is approximately 92.77% lower than this record high. In contrast, the all-time low for MINA tokens stands at $0.351341, recorded around a month ago on Oct 11, 2023, illustrating an increase of 86.95% from this lowest recorded price.

While Mina Protocol has demonstrated a 2.20% price surge in the last seven days, it lags slightly behind the broader global cryptocurrency market, which has seen a 2.70% increase during the same period. However, compared to similar FTX Holdings cryptocurrencies, Mina Protocol has outperformed as these assets experienced a decline of 1.40% in the same timeframe.

Testworld Mission 2.0 Track 3 Update — Epoch 3 🔁

Last week, Network Performance Testing was paused in order to resolve issues relating to block production, memory use, and libp2p library.

Node operators are doing a great job discovering and reporting these bugs. Their hard…

— Mina Protocol (httpz) 🪶 (@MinaProtocol) November 22, 2023

Today, the market sentiment for Mina Protocol (MINA) is bullish, with more than 84% of users expressing positive sentiments about the token. This favorable community outlook coincides with the ongoing positive trajectory of Mina Protocol’s price, indicating growing confidence and optimism among investors.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage