Join Our Telegram channel to stay up to date on breaking news coverage

The blockchain industry is evolving with the rising popularity of Real-world Asset (RWA) tokenization, marking a significant shift in May. RWA tokenization outpaced the growth of established players like Ethereum (ETH) and Bitcoin (BTC).

Meanwhile, the market saw the introduction of new cryptocurrencies, listings, and presales, presenting enticing prospects for investors. This analysis consolidates these digital assets, outlining their characteristics, applications, and market performance histories.

New Cryptocurrency Releases, Listings, and Presales Today

RetaFi operates on the Polygon network and pioneers Liquid Staking Tokens (LSTs), drawing inspiration from traditional central banking systems. IntentX innovates as an OTC derivatives exchange specializing in perpetual futures trading. SOFA.org, a decentralized non-profit organization, drives the DeFi ecosystem forward.

Mega Dice has raised over $1.4 million and is rapidly approaching the $2 million milestone. Furthermore, a popular analyst recommends purchasing a specific cryptocurrency, forecasting a potential 150% surge in value.

1. RetaFi ($RTK)

RetaFi, built on the Polygon network, is a Liquid Staking Tokens (LSTs) project inspired by central banking systems. RetaFi offers a decentralized solution for asset management and liquidity provision, similar to how central banks manage the money supply. It supports staking and restaking services on Ethereum, BNB Chain, Solana, and Polygon.

Furthermore, RetaFi features a protocol leveraging advanced blockchain technology and smart contract infrastructure. This system governs key functions such as staking, restaking, reward distribution, and governance. Consequently, these elements ensure efficient operations across RetaFi’s network. The tokenization and staking mechanisms facilitate the conversion of staked assets into RCR or other RetaFi tokens, ensuring efficient staking operations.

Additionally, RetaFi integrates automated restaking strategies to maximize user rewards. These strategies reinvest staked assets across multiple pools or protocols, thereby optimizing returns. The validator network comprises nodes that validate transactions and maintain the network’s integrity. These validators are crucial for security and consensus mechanisms.

To enhance exchange rate accuracy and user benefits, RetaFi integrates Chainlink’s Oracle technology. This improves the reliability of exchange rate data for informed decision-making. Moreover, the ecosystem includes various decentralized applications (DApps) that offer financial services, liquidity pools, yield farming, and other DeFi functionalities. These DApps expand RetaFi’s utility and adoption.

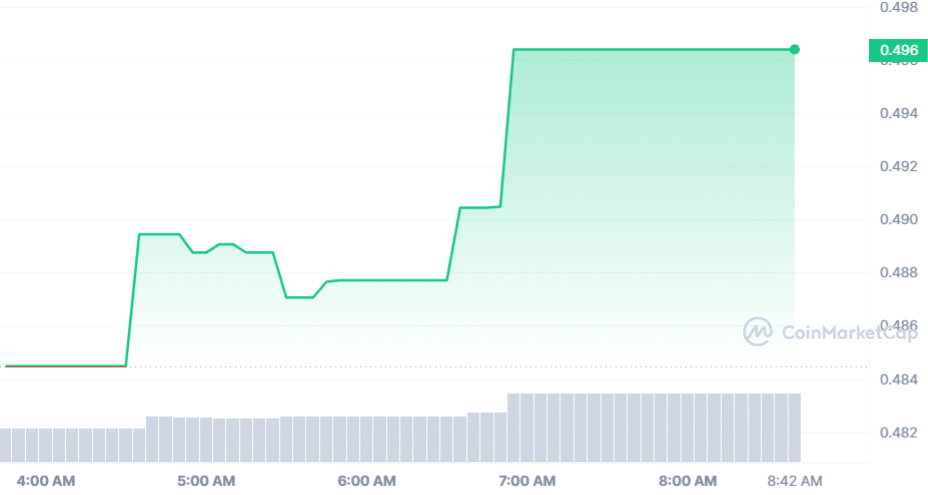

We would like to list $RTK on Coinmarketcap

— Retafi | Restaking Polygon (@retafi_com) June 4, 2024

The elements within RetaFi’s ecosystem interact seamlessly. Users stake assets on the platform and receive RCR tokens. These tokens can be restaked across multiple protocols for optimized rewards. Governance decisions made through the RCR token influence the protocol’s evolution. Meanwhile, the validator network ensures transaction security.

Furthermore, RetaFi offers integrated solutions. Chainlink’s decentralized oracle provides real-time exchange rates. The liquidity staking platform (LSD) optimizes capital efficiency. Additionally, cross-chain restaking protocols improve interoperability and staking management. Partnerships with Dynachain and Boom Arena enhance RetaFi’s ecosystem. These collaborations combine blockchain technology with wellness, finance, and gaming.

2. Mega Dice (DICE)

Mega Dice, a GameFi cryptocurrency venture operating on the Solana blockchain, has recently attracted attention for its successful fundraising efforts. It has raised over $1.4 million and is approaching the $2 million milestone. The project caters to gamers on its platform and holders of its DICE token by integrating gaming and cryptocurrency.

With the DICE token valued at $0.075, the presale phase has seen significant activity, with over 20 million tokens sold. Prospective investors are advised to consider participation before potential price adjustments occur.

Step into the wilderness with our #NewGame release #WildSurvivor by @ThePlayngo! 🦌

Test your survival skills and win BIG at Mega Dice Casino 😎

🔗 https://t.co/gzMSrtJhvz pic.twitter.com/3ZSfHxZvtL

— Mega Dice Casino (@megadice) June 8, 2024

Beyond fundraising, Mega Dice has introduced a Refer & Earn initiative. Users receive a percentage of their referred users’ spending as an incentive. In addition, the project has adopted a proactive airdrop strategy, distributing $2.25 million across three seasons.

The first season targets active players who wager a minimum of $5,000 within 21 days. It features a substantial $750,000 reward pool. Subsequent seasons expand on these incentives, providing an additional $1.5 million for sustained activity leading to the DICE token’s exchange listing.

Moreover, in addition to airdrops, token holders can earn rewards through staking. They receive daily payouts based on the casino’s profits. Mega Dice also provides NFTs for VIP players and offers a 25% referral commission to encourage further engagement and participation on the platform.

3. Intentx (INTX)

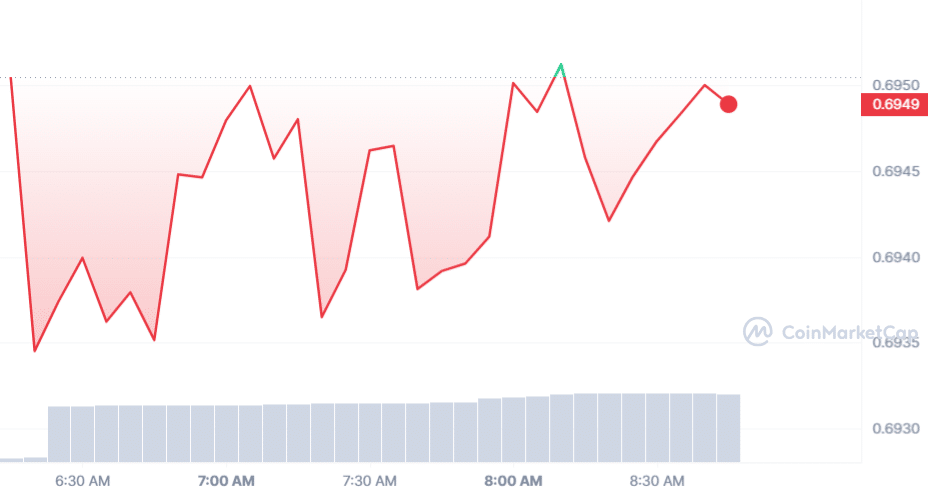

IntentX is an innovative OTC derivatives exchange focused on perpetual futures trading. By combining advanced technologies like cross-chain communication, account abstraction, and SYMMIO—a novel settlement layer—, IntentX addresses key challenges in on-chain derivatives. Consequently, this combination allows for omnichain deployment, lower fees, increased liquidity, improved capital efficiency, and better scalability.

IntentX offers traders a range of features. For instance, users can trade over 250 top cryptocurrency pairs with deep liquidity. The platform allows leverage of up to 60x on perpetual, enabling traders to amplify exposure or hedge risk. Trader incentives include “trade to earn” rewards in xINTX tokens. Moreover, the platform supports cross-margin accounts, efficiently managing all balances and positions. Sub-account support provides trading strategies, risk segregation, and performance tracking flexibility.

Importantly, IntentX ensures self-custody, meaning only the user controls their assets. It operates in a permissionless and trustless manner, with no KYC requirements. Furthermore, it cannot cease, blacklist, or freeze accounts or positions. This ensures the full security of blockchain technology. The user experience is streamlined with features like one-click trading, account abstraction, gas management, and integrated on/off-ramps.

IntentX has submitted our @Optimism Retro Funding Round 4: Onchain Builders application!🦾

As the Top Perp DEX on @base for the last 6 months, we are proud to contribute to the ecosystem growth and continue building the future of on-chain trading!📈 pic.twitter.com/SiijIBviNF

— IntentX (@IntentX_) June 6, 2024

IntentX’s Just-in-Time (JIT) liquidity architecture eliminates the need for up-front capital commitment by solvers. Thus, it provides deep liquidity and a wide range of asset pairs. This approach makes it roughly 100 times more capital-efficient than existing vAMM derivatives exchanges.

IntentX has formed strategic partnerships with Orbs, BeFi Labs, and Ethena Labs to enhance its offerings and scale effectively. Overall, IntentX’s combination of advanced technologies and strategic partnerships positions it as a formidable player in the on-chain derivatives trading landscape.

4. RCH Token (RCH)

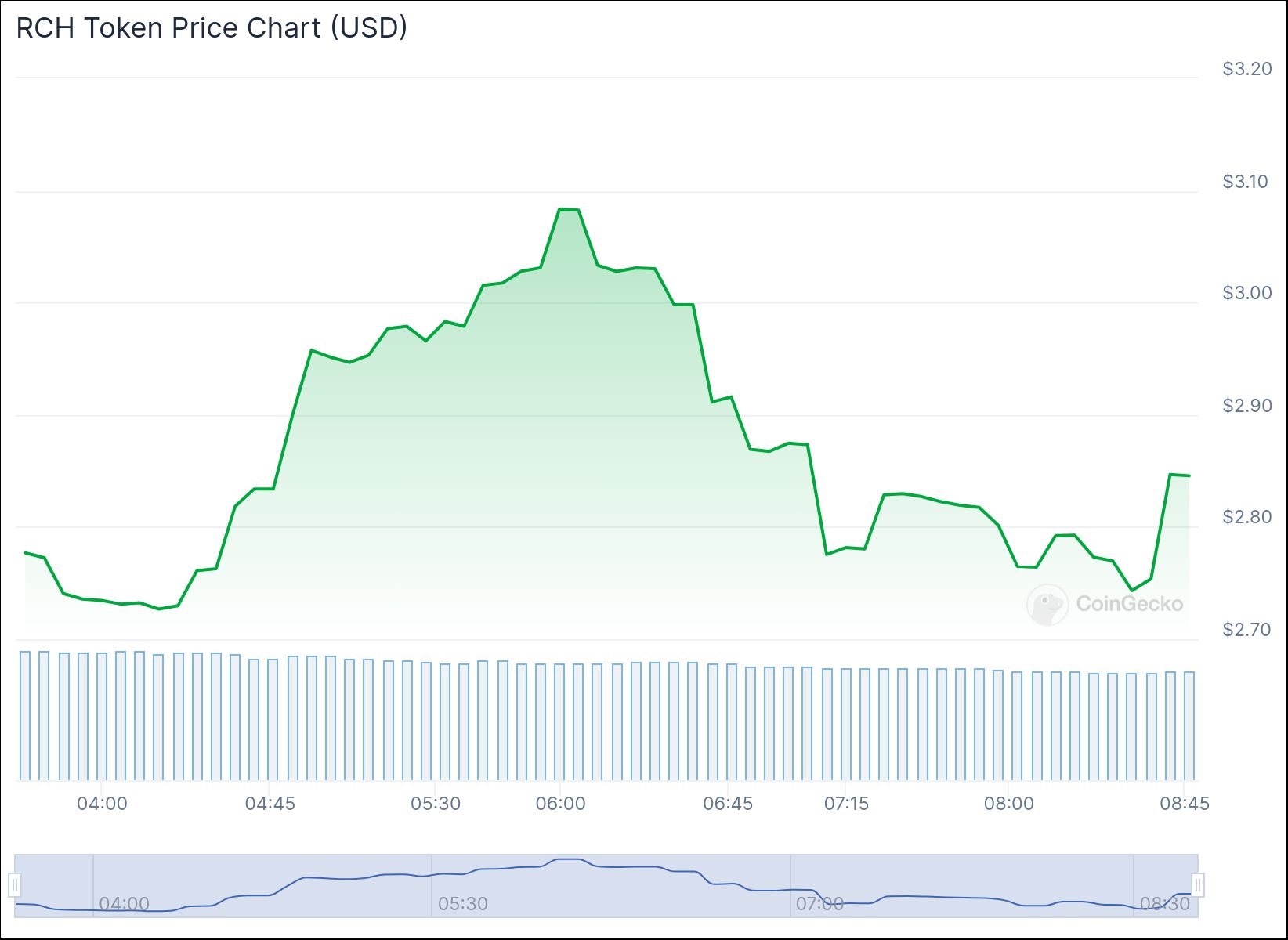

SOFA.org, a decentralized, non-profit organization, actively advances the DeFi ecosystem. It operates as a DAO, prioritizing the promotion of high DeFi standards, supporting quality projects, and advocating blockchain adoption in mainstream finance. The organization focuses on three key areas: education and tech Advancement, Research and innovation, and Industry Standards. The $SOFA governance token empowers community members to participate in decision-making, granting them voting rights on crucial proposals.

This approach fosters community ownership and enables direct platform development and management involvement. Backed by prominent founding members and project partners, SOFA.org aims to grow its protocol rapidly and Total Value Locked (TVL). The inaugural project centers on establishing a transparent, scalable, decentralized clearing solution for handling crypto-structured products on-chain.

Users can access a range of structured products via an open dApp, earning attractive yields with transactions automatically settled via standardized vaults and eliminating counterparty risks. Besides, users earn rewards solely through protocol usage through the $RCH utility token. Protocol earnings are recycled to burn $RCH tokens daily to align incentives, reducing total float and benefiting user-token holders over time.

$RCH serves as the core utility token within the SOFA ecosystem, actively rewarding users for transacting and contributing to its growth. With a total supply of 37 million tokens, a significant portion is pre-minted and locked in a Uniswap liquidity pool, with the remainder earmarked for airdrops to protocol users and supporters.

Its long-term deflationary design actively aims to appreciate token value alongside increasing transaction volumes. In a strategic move, SOFA.org has partnered with the Chainlink BUILD program to accelerate ecosystem growth and long-term adoption of its on-chain asset settlement framework. This partnership enhances access to Chainlink’s oracle services and technical support while incentivizing crypto-economic security through network fees and other benefits provided to the Chainlink community and service providers.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage