Join Our Telegram channel to stay up to date on breaking news coverage

NEO Price Analysis – July 29

Yesterday, NEO closed trading at $11.25, but the lowest recorded value of the coin was $10.81. NEO has gained some pace now and may move up soon to cross $12 again.

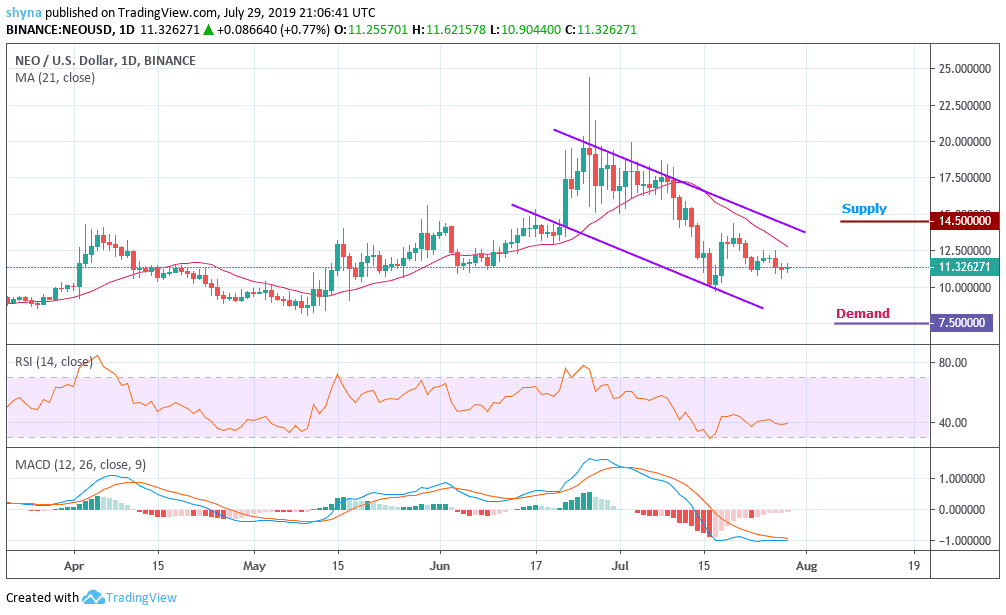

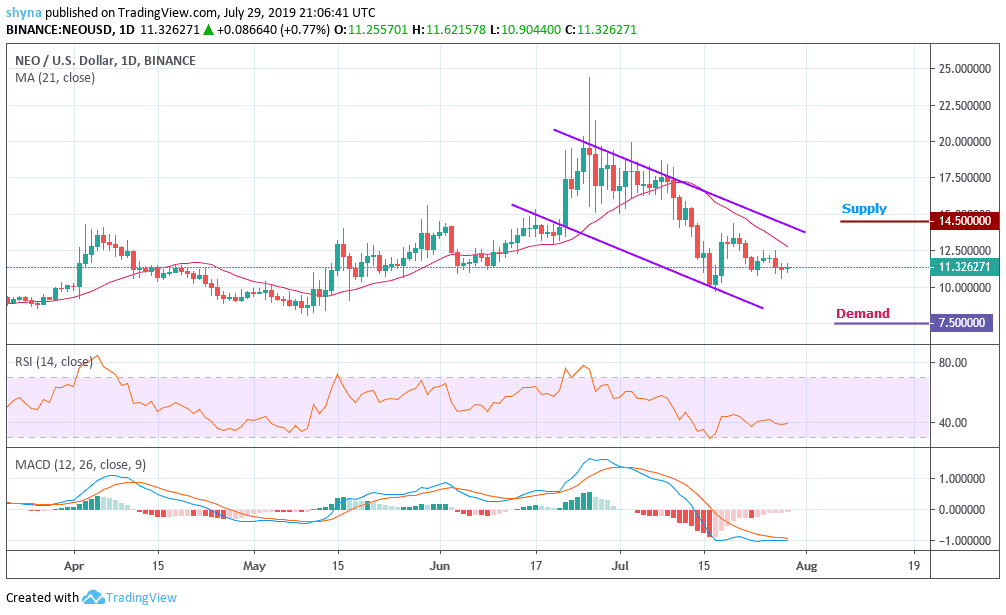

NEO/USD Market

Key Levels:

Resistance levels: $14.5, $15, $15.5

Support levels: $7.5, $7, $6.5

Since yesterday, NEO coin has maintained a steady trend except around midnight when the coin value fell drastically to as low as $10.5. The coin has recorded an uptrend of over 0.2% in the last one day rising from $11.28 to $11.31. It may also start moving up again in the near future.

NEO started the year trading at $7.55 and moved up to cross $18 in the last 30 days. The coin started this month trading at $16 and has not made much progress since then. It may likely move up to the supply levels of $14.5, $15 and $15.5 in the next few months if the firm is able to crack some key partnerships. Conversely, the price could fall below July 17 low to reach the demands at $7.5, $7 and $6.5 as RSI moves below level 40 and MACD on the negative side.

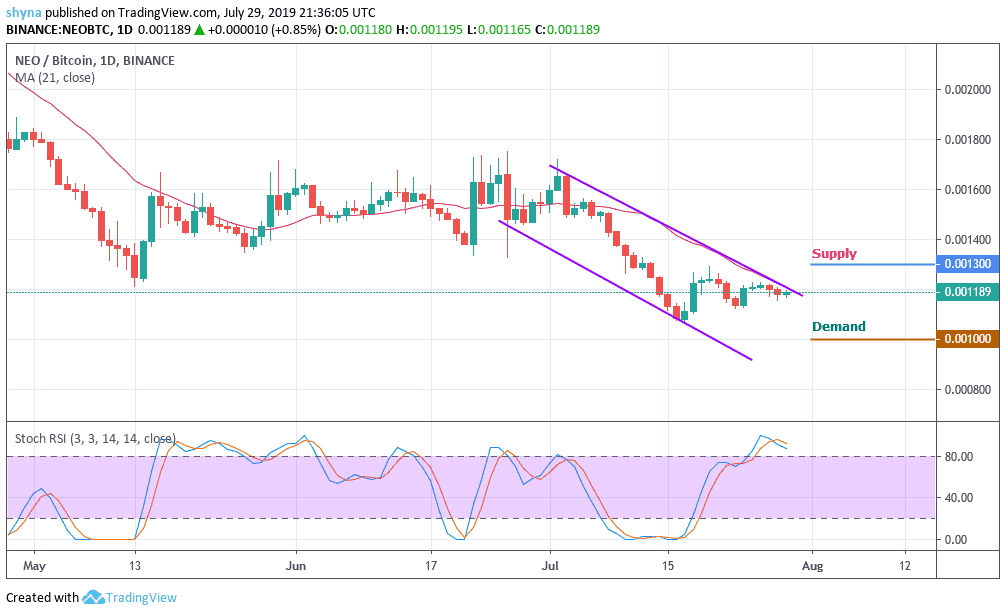

NEO/BTC Market

For the past few months, NEO performance has been very low due to a recurring bearish sentiment which has slipped the market to a monthly low at 1080SAT weeks back. While the price actions remain choppy, let’s be on the watch for the possible NEO’s direction.

For a positive spike, the 1300SAT and 1400SAT are the major supply levels for the token for now. Taking a look at the chart, we can see the NEO at its lowest. Therefore, a negative spike will retest important demand at the 1080SAT and 1030SAT before a possible slip to 1000SAT. Still, the NEO/BTC pair is bearish on a long–term. The stochastic RSI has already crossed to the overbought zone (above level 80). We may likely see a positive move if it remains above the mentioned level.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage