Join Our Telegram channel to stay up to date on breaking news coverage

Mike Novogratz, the billionaire and founder of cryptocurrency merchant banking firm Galaxy Digital, has cast doubt over the long-term stability of the United States stock market.

In the wake of widespread market rebounds from the coronavirus, the billionaire and Bitcoin bull has come out to bash traditional stock portfolios, touting alternative investment classes like Bitcoin and gold instead.

Cash is Trash, and Stocks are Misleading

Novogratz appeared on a recent episode of CNBC’s “Squawk on the Street” segment earlier this week, where he counseled investors to keep off traditional stocks and keep their wealth in digital assets.

He explained that while stocks have been rebounding from the coronavirus’s effects, there seems to be a more significant force at play here. “I think this is short covering. I think one or two more days and people will sell into it,” he opined, adding that Bitcoin will prove to be a better investment for these investors instead.

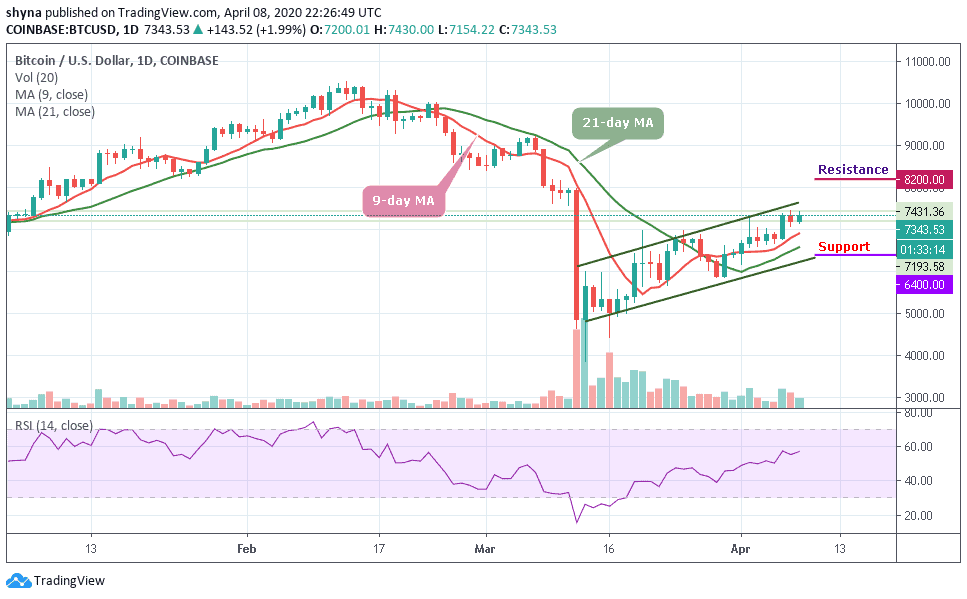

Of course, Bitcoin hasn’t been immune to the effects of the coronavirus. The top digital asset dropped to as low as $3,800 in the middle of last month, with the virus eroding just about all its gains from 2019. However, Bitcoin has clawed its way out of that hole and is currently trading comfortably over the $7,000 threshold.

Novogratz explained that he has a strong position in Bitcoin and is continually adding to it because the asset is an ideal long-term investment. He also bashed cash, pointing out that the government’s quantitative easing methods have made it less of a viable investment.

“Money is growing on trees right now. And I learned when I was a little kid that money really doesn’t grow on trees. And when you have a global, money-printing orgy going on… at one point that comes home to roost, and so I think hard assets are going to be a big buy,” he concluded.

Mike’s Big Bet on 2020

Novogratz has always been a significant Bitcoin bull. However, he’s placed particular emphasis on the asset’s prospects for 2020, as he believes this should be Bitcoin’s year. Last December, he announced some of his predictions for the year on Twitter, including Tom Hanks winning an Academy Award for his portrayal of Mr. Rogers and Bitcoin hitting $12,000 in value before 2020 ends.

Last month, he gave his opinions on the pandemic and its effect on the markets, explaining that while Bitcoin will continue to be volatile in the coming months, its macroeconomic backdrop is strong, and this should be Bitcoin’s year regardless.

He has also refined his prediction position in light of the asset’s rally at the beginning of the year. Earlier this month, he spoke with CNBC’s Closing Bell and predicted that the asset should double in value before October.

He even went one step further, explaining that he might give the asset up if it doesn’t hit $20,000 by the end of the year. Given that Bitcoin has started to surge and the halving is still upon us, there’s no telling how things might go. Despite the global pandemic, this really could still be Bitcoin’s year.

Join Our Telegram channel to stay up to date on breaking news coverage