Join Our Telegram channel to stay up to date on breaking news coverage

Software development company MicroStrategy plans a share offering to raise $750 million and said it will use some of the funds to buy more Bitcoin.

One of the biggest corporate Bitcoin holders, MicroStrategy, announced the plan to sell shares in a document submitted to the Securities and Exchange Commission on August 1. The funds will also be used for general business goals and working capital, it said.

TRENDING: MicroStrategy plans to sell up to $750 million of stock to possibly fund more #Bitcoin purchases.

— LunarCrush (@LunarCrush) August 2, 2023

“As with prior programs, we may use the proceeds for general corporate purposes, which include the purchase of Bitcoin as well as the repurchase or repayment of our outstanding debt,” said MicroStrategy Chief Financial Officer Andrew Kang in the company’s second quarter earnings call.

MicroStrategy recorded a net income of $22.2 million in the second quarter, compared with a $1.1 billion net loss a year earlier. At $120.4 million, total revenues were flat.

A large portion of the variance was brought on by a digital asset impairment loss in the quarter that was $24.1 million, as opposed to a massive $917.8 million loss the previous year.

More Bitcoin Investments

MicroStrategy founder and chairman Michael Saylor disclosed via X that the company had spent more than $14.4 million in July to purchase an additional 467 Bitcoins (BTC). With this latest acquisition, it held 152,800 BTC at the end of July 31 valued at almost $4.5 billion.

In July, @MicroStrategy acquired an additional 467 BTC for $14.4 million and now holds 152,800 BTC. Please join us at 5pm ET as we discuss our Q2 2023 financial results and answer questions about the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/SCHeBJ80TH

— Michael Saylor⚡️ (@saylor) August 1, 2023

“Our bitcoin holdings increased to 152,800 bitcoins as of July 31, 2023, with the addition in the second quarter of 12,333 bitcoins being the largest increase in a single quarter since Q2 2021,” CFO Kang revealed.

Kang said that the company used cash from operations to increase the amount of Bitcoin on its balance sheet. This was done against a “promising backdrop” of institutional interest, accounting transparency, and growing regulatory clarity for Bitcoin.

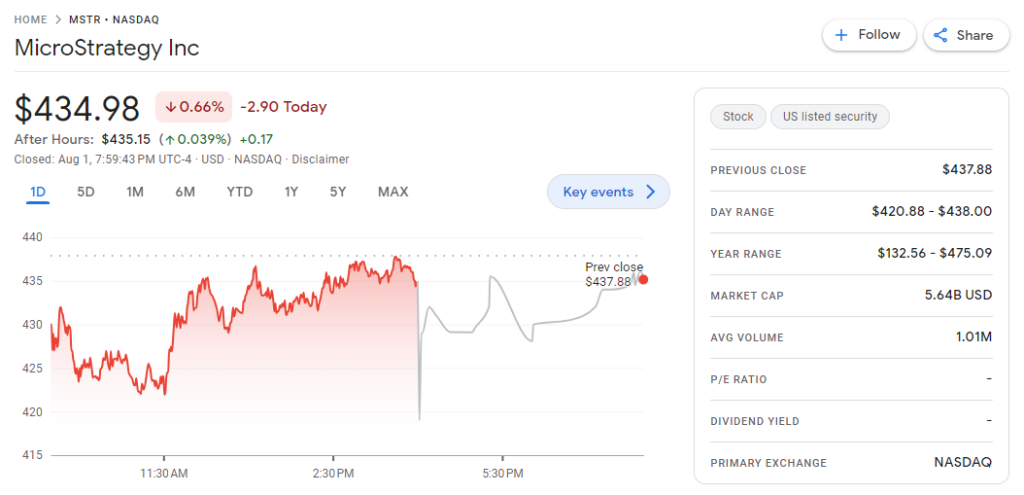

The business acquired most of its new digital gold by selling 1.08 million shares of stock for $333.5 million, or around $309 per share, through a deal with brokers Cowen and Canaccord Genuity. The shares surged to $434.98 at the quarter’s end, closing at $342.42.

Despite these lofty projections, the corporation reported that the carrying value of its Bitcoin was only $2.3 billion, meaning the asset’s original cost was less any depreciation, amortization, or impairment costs.

With an average carrying value per Bitcoin of $15,251, that figure represents cumulative impairment losses of $2.196 billion since MicroStrategy’s first purchase.

The company also reported that Bitcoin and MicroStrategy’s MSTR shares outperformed several other indexes and assets. While Bitcoin has increased by 145% since MSTR implemented its Bitcoin strategy in August 2020, MSTR has profited 254%.

The share price of MSTR was $145.02 a share on January 3, according to Google Finance. It has since jumped to $434.98 as of this writing. In July, New York-based investment firm Berenberg Capital published a bullish forecast for MicroStrategy.

Over 2023, the price of Bitcoin has progressively increased, rising 79% since the year’s beginning. In the second quarter, the cost of Bitcoin fluctuated between $25,000 and $30,700, with a substantial increase in mid-June following the SEC filing of numerous new spot Bitcoin exchange-traded funds.

Related Articles

- MicroStrategy Stock: The Harbinger of Bitcoin’s Imminent Major Impulse

- Saylor’s MicroStrategy Enjoys Share Price Bump As Bitcoin Halving Draws Closer

- When is it Time to Buy Bitcoin Again? YouTuber Steve Talks Specifics

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage