Join Our Telegram channel to stay up to date on breaking news coverage

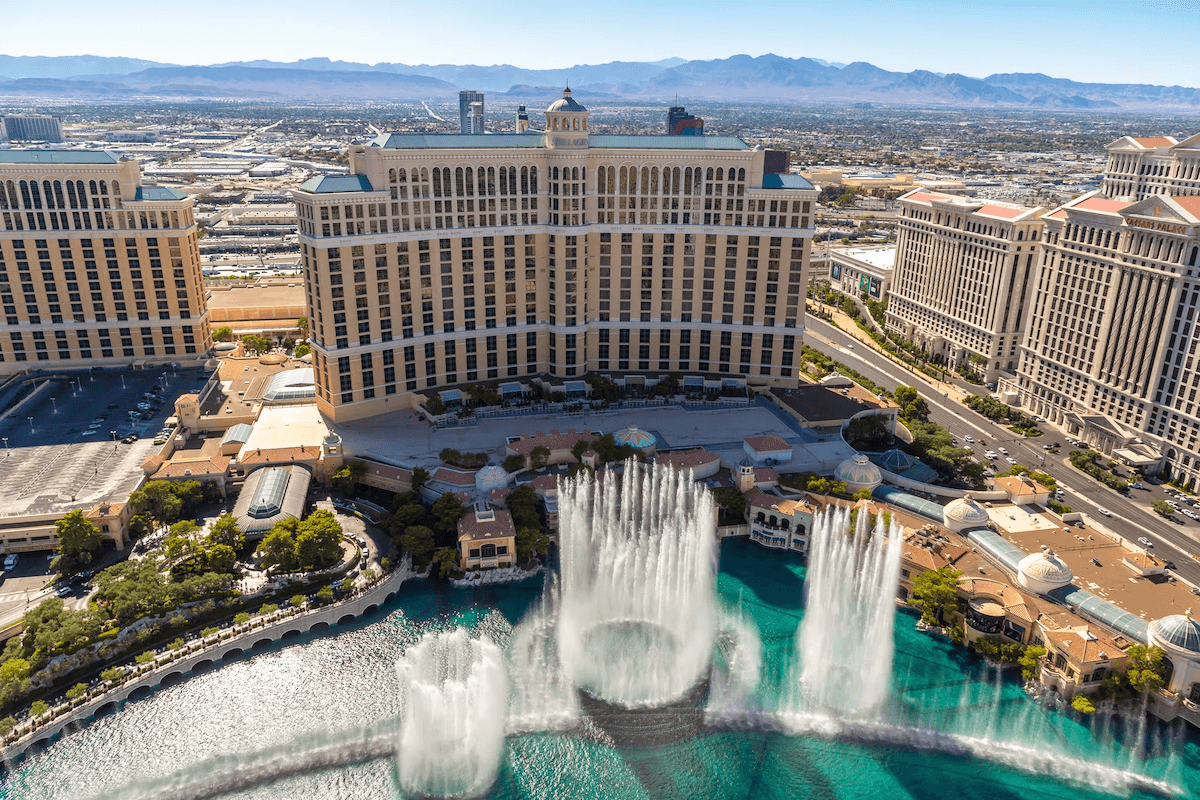

On April 25, 2025, the Nevada Gaming Commission (NGC) unanimously approved an $8.5 million settlement against MGM Resorts International, marking one of the largest AML-related enforcement actions in the state’s recent history. This move resolves allegations of systemic anti-money laundering (AML) failures across MGM’s flagship properties – MGM Grand and The Cosmopolitan of Las Vegas.

The settlement follows a broader investigation involving multiple illegal gambling networks and a pattern of insufficient due diligence by casino personnel over a multi-year period.

Notably, the commission’s ruling comes just weeks after a similar case concluded with Resorts World Las Vegas agreeing to pay a $10.5 million penalty for its own AML failures. Both cases are connected to former casino executive Scott Sibella, whose tenure at both companies has become a focal point for regulatory scrutiny.

Key Takeaways

- The NGC approved an $8.5 million fine against MGM Resorts for AML compliance failures.

- Issues involve illegal bookmakers Wayne Nix and Matt Bowyer, whose activities were flagged but not properly reported.

- MGM accepted responsibility and introduced an eight-point remediation plan, including expanded KYC procedures and transaction monitoring.

- The case reinforces Nevada’s tougher stance on AML enforcement and operator accountability.

- New leadership at the Nevada Gaming Control Board (NGCB) signals continued pressure for integrity and transparency in Strip operations.

Understanding the Case: What Went Wrong?

The crux of the case stems from MGM’s dealings with Wayne Nix, a former minor league baseball player turned unlicensed bookmaker, and Matt Bowyer, a high-volume sports betting operator with ties to major league insiders.

Between 2017 and 2020, Nix conducted numerous cash transactions at MGM properties – some exceeding $50,000 and delivered in paper bags or duffle bags. Compliance teams occasionally flagged these incidents but failed to consistently file Suspicious Activity Reports (SARs), especially when the cash didn’t arrive in small bills. These omissions occurred despite Nix’s known history with illicit betting operations and a guilty plea in 2022 for illegal gambling and tax fraud.

Meanwhile, Bowyer was believed to have handled more than $325 million in illegal bets, including wagers placed on behalf of Ippei Mizuhara, the disgraced former interpreter for MLB star Shohei Ohtani. MGM first identified Bowyer as a risk in 2015 and formally banned him in 2018, yet interactions with him persisted beyond that period.

According to reports, The Cosmopolitan (acquired by MGM in 2021) accepted over $900,000 in gambling proceeds from Nix after he had already been flagged. These funds were traced directly to Nix’s betting operation and later cited in the company’s non-prosecutorial agreement with the federal government.

MGM’s Admission and Remediation Strategy

Unlike Resorts World Las Vegas, which denied any wrongdoing in its settlement, MGM Resorts took a different route – openly accepting fault. John McManus, MGM’s chief legal officer, told the NGC that the company “did not put up obstacles” and chose to cooperate with federal and state authorities from the outset.

As part of its response, MGM unveiled a detailed eight-step remediation plan designed to correct structural gaps in its AML protocols:

- Enhanced Interdepartmental Coordination: Bridging compliance and credit departments to improve internal monitoring.

- Top 25 Customer Oversight: Requiring enhanced due diligence for the highest cash players.

- Transaction Threshold Reform: Mandatory reporting of any cash transaction over $100,000, regardless of denomination or source.

- Increased Compliance Funding: Boosting AML-related expenditures by over $1 million annually.

AML Training Expansion: More frequent and specialized education for front-line staff and management. - New Transaction Monitoring Software: Deploying technology to flag anomalous patterns in real time.

- Regular Internal Audits: Scheduled compliance reviews and risk assessments across all properties.

- Policy Standardization Across Acquired Assets: Ensuring properties like The Cosmopolitan adhere to MGM’s corporate compliance standards.

Stephen Martino, MGM’s chief compliance officer, described these reforms as “critical investments” in restoring regulatory trust and maintaining long-term operational integrity.

What the NGC Said and Why It Matters

Commissioners did not mince words. Brian Krolicki, a member of the NGC, described the situation as “unacceptable” and warned the Strip’s major operators that “this is a clarion call for the industry.” He stressed that the commission’s tolerance for even minor lapses in AML enforcement had evaporated.

The broader message was clear: operators, especially those serving VIP clients and handling large volumes of cash, must operate under conditions of total transparency. Failing to do so invites harsh consequences.

The fine also reaffirms Nevada’s global reputation as a top-tier gaming regulator. With increasing federal scrutiny and the continued integration of digital payment systems into casino ecosystems, states like Nevada are taking a more proactive role in enforcement.

Sibella Fallout and Broader Legal Ramifications

The ghost of Scott Sibella loomed large throughout the hearing. Sibella, who previously led MGM Grand and later served as president at Resorts World Las Vegas, has been a central figure in both enforcement actions. In 2024, he was sentenced to probation after pleading guilty to federal charges related to failing to report suspicious financial activity.

His downfall served as both a cautionary tale and a catalyst for reform across the Strip. As Sibella awaits further legal restrictions from gaming regulators, other key figures connected to the illegal bookmakers – particularly Wayne Nix and Matt Bowyer – are still awaiting sentencing. Bowyer is due for sentencing in October 2025, while Nix’s proceedings remain pending without a confirmed date.

A Changing Guard in Nevada Regulation

Coinciding with the case, Governor Joe Lombardo appointed Mike Dreitzer as chairman of the Nevada Gaming Control Board. A seasoned executive with decades of experience in casino tech and regulatory affairs, Dreitzer’s appointment signals continuity – but also reform.

He has pledged to prioritize tech-driven compliance tools, increased inter-agency cooperation, and public trust restoration. Given the mounting attention on AML vulnerabilities, Dreitzer’s leadership will be instrumental in setting expectations for operators heading into 2026.

Final Thoughts

The $8.5 million fine against MGM is more than just a punitive measure – it’s a line in the sand. As regulators ramp up enforcement and the public grows more aware of the ties between illicit gambling and organized crime, casino operators can no longer afford to rely on outdated AML frameworks.

For MGM, the penalty, while steep, is survivable. However, reputational risks and increased regulatory oversight will linger. With new compliance plans in motion and a warning sent to the entire Strip, the pressure is on to meet the rising standards of modern casino governance.

Join Our Telegram channel to stay up to date on breaking news coverage